SPDR S&P 500 ETF Trust (SPY) Forecast: Markets move higher as risk reduces

- S&P 500 benefits on Monday from risk appetites increasing.

- SPY rallies as markets price in a soft landing for the US economy.

- SPY's position was also helped by buybacks and CTA funds.

The S&P 500 (SPY) kept up its recovery rally on Monday as the index closed 0.7% higher in a broad-based advance. The tech and growth sectors were the standout performers, while energy lagged. Oil prices fell on the news of more Chinese lockdowns. This and a move lower for yields helped the Nasdaq to lead the day on Monday. The recent gain has confused some investors who had bought into the macroeconomic background.

Certainly fears of the Ukraine conflict spilling out in NATO spooked markets as did fears for the US economy, but a combination of factors served to reverse the rally. First, oil prices collapsed sharply from highs seen at the start of the Russia-Ukraine conflict. Second, Fed Chair Jerome Powell spoke bullishly about prospects for the US economy and how it could handle a rate hiking cycle. Finally, investors had over-positioned themselves, so when the expected decline did not continue, they suddenly found themselves underweight equities. This was added to by strong corporate buybacks now that earnings season blackouts had ended.

SPY Stock News

Monday was most notable for the meme stock return. GME surged 25%, AMC 44% and HYMC over 80%. The risk was back in a big way as retail investors piled back into equities. Tesla is far from a meme stock, but it does hold a massive retail following. It announced a stock split dividend on Monday that resulted in an 8% surge for TSLA by the close. Retail investors were big participants in that move too, but now that the rally has gained strength this may just be the time to fade it. Or certainly, this may be the time to exercise caution.

We take note of the increasingly hawkish predictions for the next Fed meeting in May. The Chicago Mercantile Exchange's (CME) Fed Watch tool is a benchmark for monitoring market probabilities of Fed interest rate decisions. Note below how the indicator is signaling a 73% chance of a 75-100 basis point rate at the next Fed meeting. For comparison, one month ago the probability for a 75-100 basis point base rate was a mere 15%. That implies a 50 basis point hike is a given and 75 basis points is on the table. Equity markets, especially high-growth stocks, will not react well if that plays out as predicted.

SPY Stock Forecast

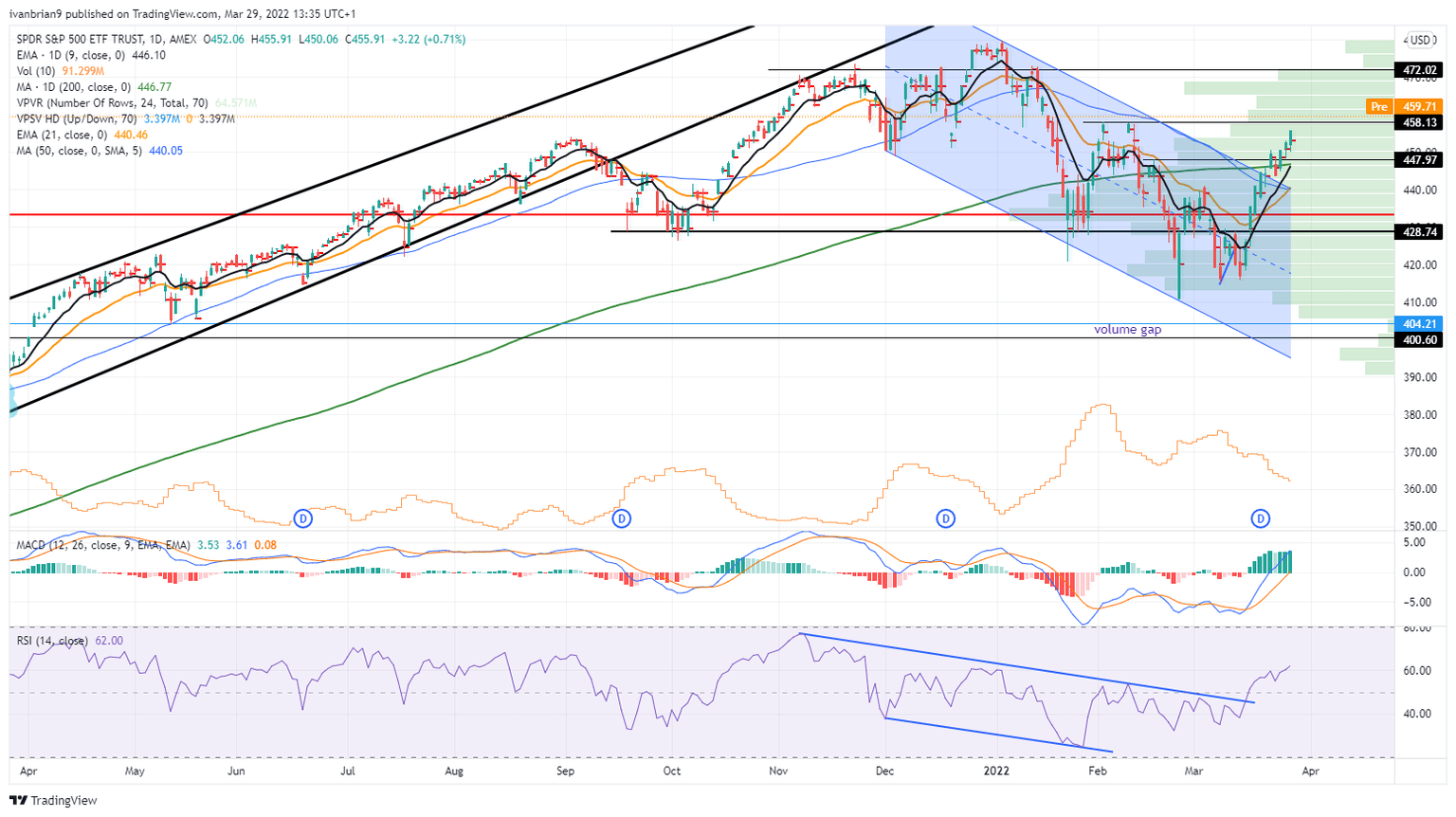

A huge level is incoming at $458 that foreshadows huge resistance. The double top from February was a perfect bearish signal. Now we have a near-perfect complete retracement. Will bears return to defend the level? A break above will see technical all-time highs likely. Failure and the first support is at $446 from the 200-day moving average.

SPY chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.