S&P 500 opens flat as investors take a step back ahead of NFP

- Wall Street's main indexes post modest gains on Thursday.

- Financial shares rise as US T-bond yields stage a rebound.

- Energy stocks decline as crude oil prices go into consolidation.

Major equity indexes in the US opened near Wednesday's closing levels as investors seem to be reluctant to take large positions while waiting for Friday's labour market report. As of writing, the S&P 500 Index was unchanged on the day at 4,167, the Dow Jones Industrial Average was rising 0.1% at 34.265 and the Nasdaq Composite was down 0.1% at 13,485.

Supported by a modest rebound witnessed in the US Treasury bond yields on Thursday, the rate-sensitive Financials Index is up 0.5% after the opening bell.

On the other hand, the Energy Index is losing 0.7% as the worst-performing major sector in the early trade as crude oil prices struggle to gain traction after closing in the red on Wednesday.

Earlier in the day, the US Department of Labor reported that the weekly Initial Jobless Claims declined to 498,000 in the week ending May 1. This reading came in better than the market expectation of 540,000 but failed to trigger a significant market reaction ahead of Friday's Nonfarm Payrolls (NFP) data.,

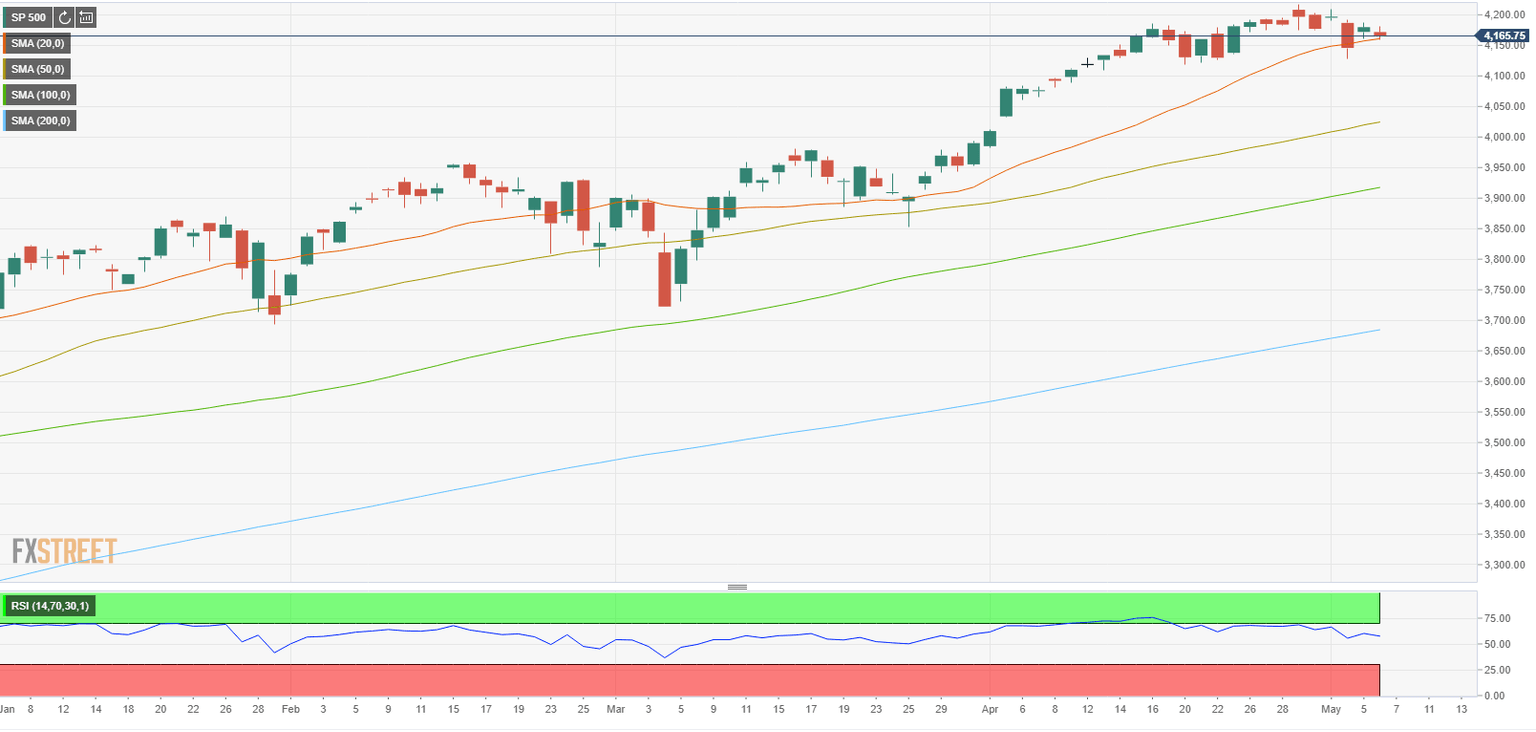

S&P 500 chart (daily)

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.