S&P 500 Futures Price Analysis: Teasing bull flag on 1H, further upside likely

- &P 500 Futures poised for a fresh leg higher amid USD weakness.

- Technical set up favors bulls in the near-term, looks to test 3300.

- A stack of healthy support levels to limit the downside ahead of US data.

S&P 500 futures, the fear gauge, is consolidating the latest advance to 3270 region in the European session this Friday, as the US dollar licks its wounds ahead of the US data and stimulus talks.

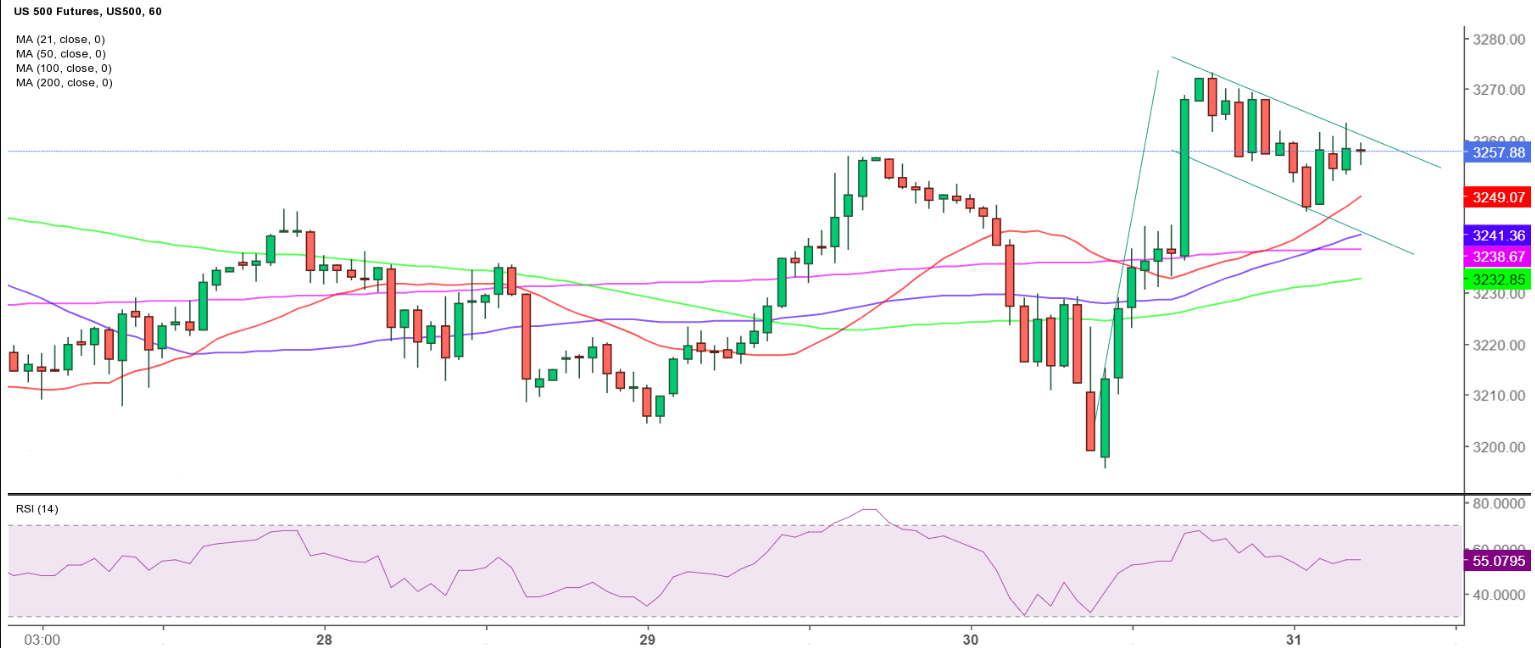

From a near-term technical perspective, the price is on the verge of a bull flag breakout on the hourly, teasing the falling trendline resistance at 3260.

Should the pattern get confirmed, the bulls will target the 3300 level en route the pattern beyond 3350. The hourly Relative Strength Index (RSI) remains bullish around 55 levels, suggesting an additional upside in the coming hours.

Meanwhile, the upward-pointing 21-hourly Simple Moving Average (HMA) at 3249 will likely guard the downside.

A breach of the latter will call for a test of powerful support around 3240, the confluence of the falling trendline support, 50 and 200-HMAs.

Further south, the horizontal 100-HMA at 3232 will be the level to beat for the bears.

The S&P 500 futures briefly managed to regain the latter, although faced rejection just below the horizontal 50-HMA at 3224.50.

The bulls need a convincing break above a cluster of resistance levels seen around 3225 to validate the pattern. That supply zone is the confluence of the bearish 100-HMA and falling trendline resistance.

The next upside target is the horizontal 200-HMA of 3232 en route 3250. The hourly Relative Strength Index (RSI) has turned bullish above 50.00, suggesting that the further upside looks likely ahead of the Fed.

To the downside, the daily low could be retested on a failure to take out the 3225 zone, with sellers then aiming for the falling trendline support at 3200.

S&P 500 Futures: Hourly chart

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.