S&P 500 Futures Price Analysis: Eye 4,000 amid bullish technical setup

- S&P 500 futures look north amid bull cross on the 4H chart.

- Reflation trades to continue favoring riskier assets.

- The RSI holds firmer just beneath the overbought region.

S&P 500 futures are flirting with record highs just above the 3,900 level, as the bulls continue to benefit from the US stimulus optimism induced renewed reflation trade prospects.

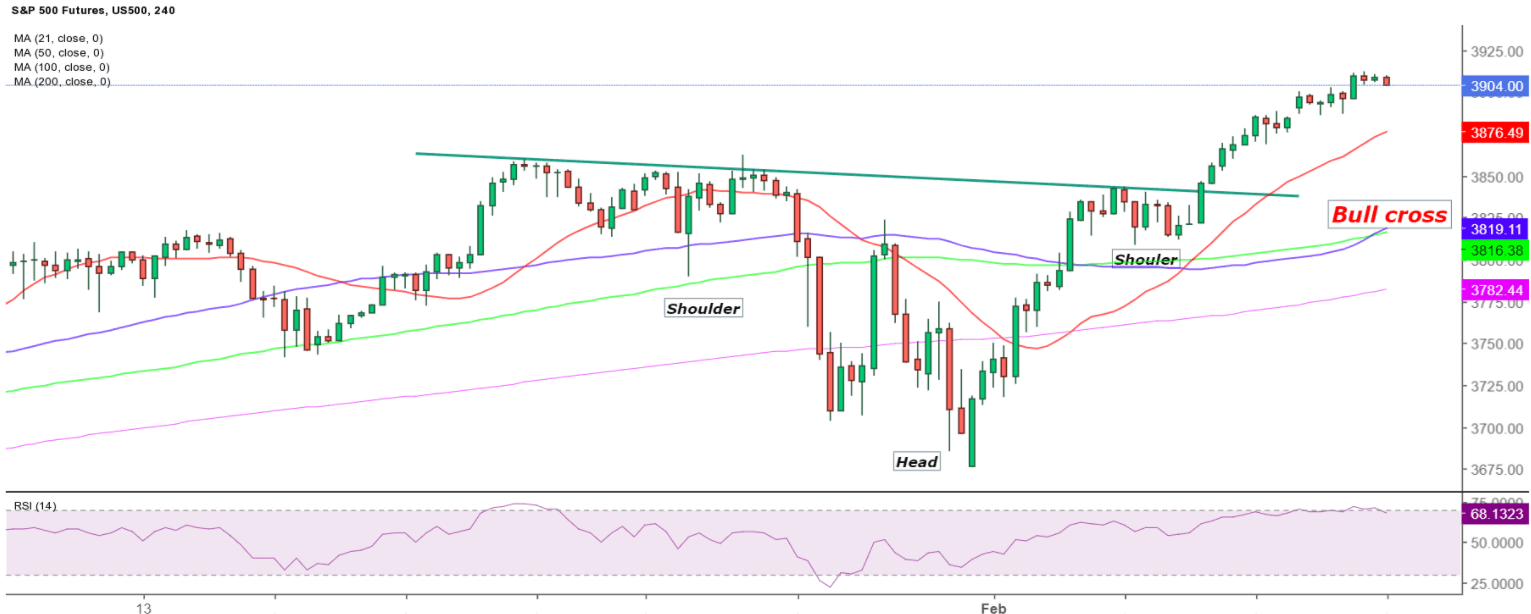

The bulls extended the rally following the inverse head-and-shoulders breakout on the four-hour chart spotted last Thursday.

The measured target is placed at 4,010, with the bullish crossover confirmed earlier today to provide that extra zest to the buyers to refresh record highs. The 50-simple moving average (SMA) pierced the 100-SMA from below, validating the bullish formation on the said time frame.

Ahead of that, the psychological 3,950 level could offer some resistance on S&P 500 futures’ upward journey.

Looking at the hourly chart, the futures tied to the S&P 500 index have confirmed a death cross earlier in the Asian session.

The 50-hourly moving average (HMA) pierced through the 200-HMA from above, suggesting that there is further scope to the downside.

In contrast, any corrective pullbacks could meet strong support at bullish 21-SMA at 3,876. Further south, the pattern neckline resistance now support around 3,840 could challenge the bearish commitments.

All in all, the path of least resistance appears to the upside, further supported by the Relative Strength Index (RSI), which holds firmer just below the overbought region, near 68.00.

S&P 500 Futures: Four-hour chart

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.