S&P 500 Update: Nasdaq suffers yield failure, S&P flat, Dow breaks another record

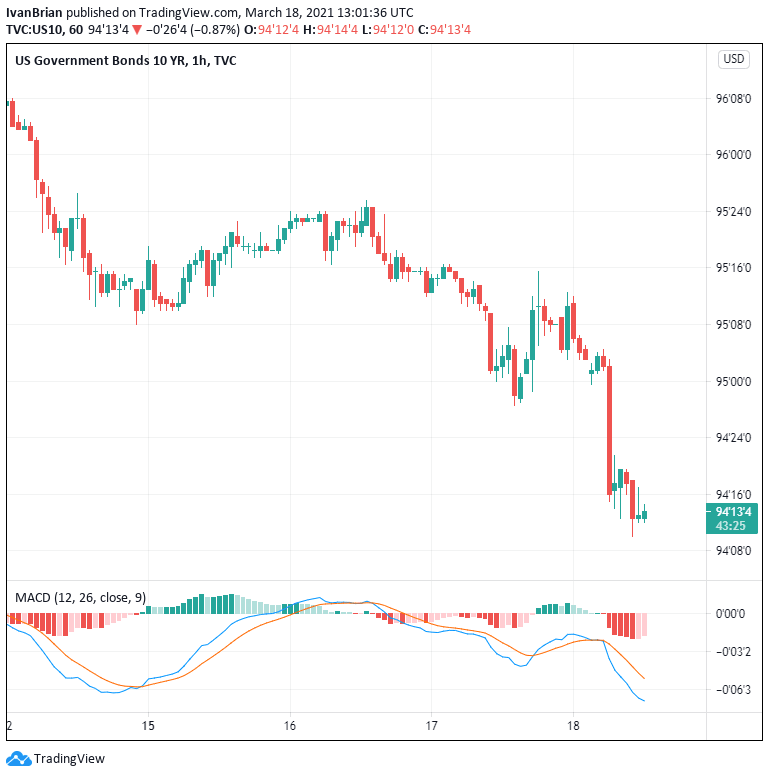

Update 1600 GMT 1400 EST: The Nasdaq continued to suffer from yield failure on Thursday as the 10 year played havoc with high growth valuations. The broader market fared slightly better with the Dow positive and setting yet another record high while the S&P was flat. The US 10 year yield has remained steady at 1.73%.

Sectors: Financials, as ever performed well in a rising yield environment with Healthcare the only other positive sector. Tech and Energy suffered as higher yields and lower oil prices fed into equities.

Selected Stocks: SNDL +1.4%, BABA +2%, Bank of America +5%, Weibo +9%, Citenzens Financial +5% , ZOM -4%, CCIV -2%, GME -1.3%, RBLX -4%, Dollar General -6%, Tesla -3%.

Here is what you need to know on Thursday, March 18:

The Fed rides to the unlimited support of equity markets on Wednesday, pledging to keep zero rates until 2023 at least. The Fed does see inflation spiking but anticipates no need for interest rate rises. This, despite US growth forecasts being revised up, and hitting 40-year highs. If this all seems like deja vu well the term "irrational exuberance" should send a shiver down traders spines. In response, equity markets did what only they could do in the face of unlimited free money printing, go and set more record highs. Volumes are starting to slow as the rally continues, never a great sign. This morning the bond market has decided it's going to play chicken with the Fed. The US 10 Year has made a big move with the yield now hitting 1.73%.

The Dollar has not taken the Fed doves well but is recovering slightly on Thursday on the back of the US10 Year. EUR/USD is at 1.1932. Oil is continuing to give up ground as US reserves grow, $64.06 for WTI.

European markets are mixed with Eurostoxx flat, Dax up 0.9% and FTSE down 0.4%.

US futures are pulling back from Wednesday's record highs with the Nasdaq down 1.6%, S&P down 0.6%, and Dow Jones down 0.1%.

Stay up to speed with hot stocks' news!

S&P 500 News

US Federal Reserve makes no change to interest rates as expected but commits to no change until 2023.

Bank of England makes no change to interest rates and no change to its bond-buying program.

US Jobless claims 770k versus 700k expected.

US Philly Fed Index 51.8 versus 23.3 expected.

Bank of Japan likely to allow bond yields to rise and let interest rate yield band higher.

Morgan Stanley says the EU may not have a summer economic boost as slow vaccinations and new variants bite.

Accenture beat estimates and raises outlook. Up 5% in pre-market.

AZN: Norway hospital makes finding that caused blood clots.

AZN: EMA is to release findings on AZN vaccine today.

Dollar General missed estimates, guidance disappoints, down 5% in pre-market.

Signet Jewellers beats estimates, shares up 7% in pre-market.

Boeing and Airbus: Air China to buy 18 Airbus jets.

Alphabet GOOGL: Blocking cookies is a source of concern for the US Justice Dept according to Reuters.

Nikola: Hanwha corp is to sell up to 50% of its stake in Nikola according to Reuters.

Nokia: forecasts margins rising in 2023.

Petco: beats estimates in first results release since going public. Shares up 3% in pre-market.

Coherent: New player in the market as Lumentum faces competition from IIVI in the battle to buy Coherent.

Williams-Sonoma beats, shares up 12% in pre-market.

Sundial Growers reported mixed earnings after the close on Wednesday. Conference call today. Shares up 5% pre-market. See more.

Upstart Holdings: beats on earnings, shares up 39% in pre-market.

Luminor Technologies announces partnership with SAIC Motor, shares up 12% in pre-market.

AMC says by Friday 98% of its theatres will be open, 99% by March 26. Shares up 4% in pre-market.

Ups and Downs

Comcast: JPMorgan raises price target.

Pepsi: Guggenheim reiterates buy rating.

Carnival: UBS upgrades to buy

Economic Releases

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637516696555204434.png&w=1536&q=95)