SNDL Stock News: Sundial Growers sinks to 52-week low prices as cannabis stocks continue sell off

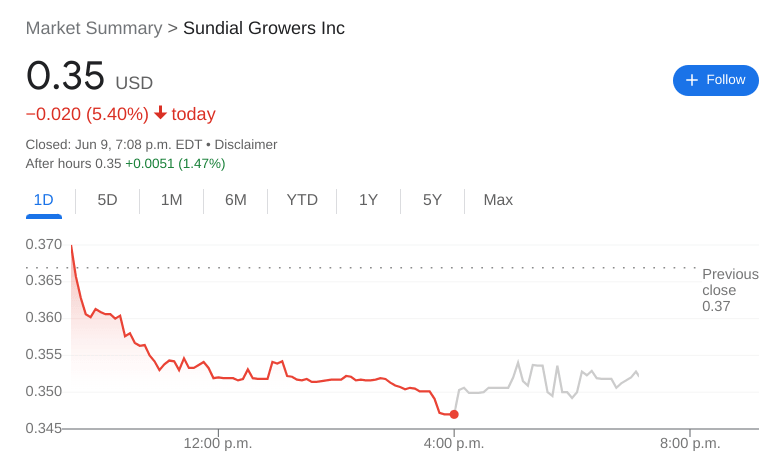

- NASDAQ:SNDL fell by 5.40% during Thursday’s trading session.

- More analyst coverage hits the cannabis sector on Thursday.

- Sundial remains in jeopardy of delisting despite its health balance sheet.

NASDAQ:SNDL continued its downward descent on Thursday as the stock dipped to a 52-week low price. Shares of SNDL dropped by a further 5.40% and closed the trading session at $0.35. The stock continues to drop like a stone as investors remain bearish on the cannabis sector in general. Little news of US federal legalization from the Senate vote has led to most stocks in the sector selling off considerably this year.

Ahead of the key CPI report on Friday, all three major indices closed lower for the second straight day. The Dow Jones sank by 638 basis points, the S&P 500 fell by 2.38%, and the NASDAQ plummeted by 2.75% during the session.

Stay up to speed with hot stocks' news!

Interestingly, just a day after it downgraded the stock from Buy to Hold, Zacks Investment Research once again raised the stock back up to a Buy rating with a $0.50 price target. It seems one more bearish session was enough to push the stock back to a Buy. ATB Capital Markets, which provided a Buy rating for Sundial earlier this month, just put out an Underperform rating for Aurora Cannabis (NASDAQ:ACB) with a price target of $3.00 per share.

Sundial stock forecast

Sundial’s status as a stock listed on the NASDAQ exchange continues to be in jeopardy as shares fall further below $1.00. There just seems to be little appetite for cannabis stocks in this market environment, even though Sundial has a healthy balance sheet with no debt. If the stock continues downward, Sundial will likely be forced to undergo a reverse stock split if it wishes to stay listed on the NASDAQ.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet