Silver Price Forecast: XAG/USD stays in tight range near $31 in countdown to US Inflation

- Silver price’s upside remains capped near $31.00 with a focus on the US Inflation.

- The US Dollar remains on the backfoot amid firm Fed rate-cut bets.

- Fed Powell sees cracks in US labor market strength.

Silver price (XAG/USD) consolidates in a tight range for the last four trading sessions. The upside in the Silver price remains limited to around $31.00 as investors await the United States (US) Consumer Price Index (CPI) data for June, which will be published at 12:30 GMT.

The inflation data will significantly influence market speculation for Federal Reserve (Fed) rate cuts this year. According to the CME FedWatch tool, traders expect that the central bank will choose the September meeting as the earliest point for pivoting to policy normalization. The tool also shows that there will be two rate cuts instead of one as signaled by officials in the latest dot plot.

Meanwhile, the US CPI report is expected to show that the core consumer inflation, which strips off volatile food and energy prices, grew steadily, while annual headline figure declined to 3.1% from May’s reading of 3.3%.

Market expectations for Fed rate cuts strengthened on widening cracks in the US labor market due to the maintenance of a restrictive interest rate stance. In the semi-annual Congressional testimony, Fed Chair Jerome Powell admitted that the economy is no longer overheated, with cooling job market conditions. He added that the labor market has moderated to where it was before pandemic-era.

Firm rate-cut speculation weighs on the US Dollar (USD). The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, appears to be vulnerable near a four-week low around 104.85

Silver technical analysis

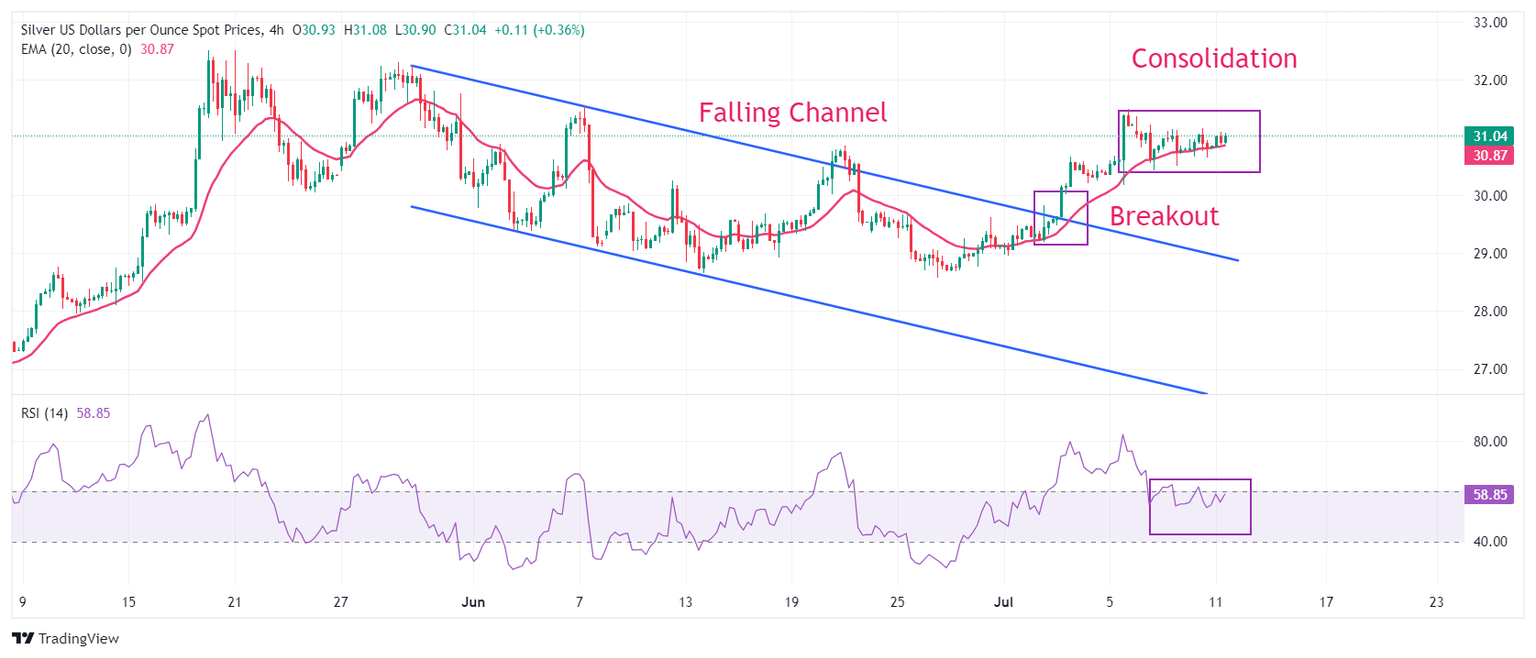

Silver price trades sideways in a narrow range around $31.00, suggesting a sharp volatility contraction. The overall trend remains bullish as it has turned sideways after a decisive breakout of the Bullish Flag chart formation on a four-hour timeframe. The asset trades close to the 20-period Exponential Moving Average (EMA) near $31.00, suggesting indecisiveness ahead of US inflation data.

The 14-period Relative Strength Index (RSI) hovers near 60.00. A decisive break above the same would push the momentum toward the upside.

Silver four-hour chart

Economic Indicator

Consumer Price Index (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as The Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier.The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Thu Jul 11, 2024 12:30

Frequency: Monthly

Consensus: 3.1%

Previous: 3.3%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.