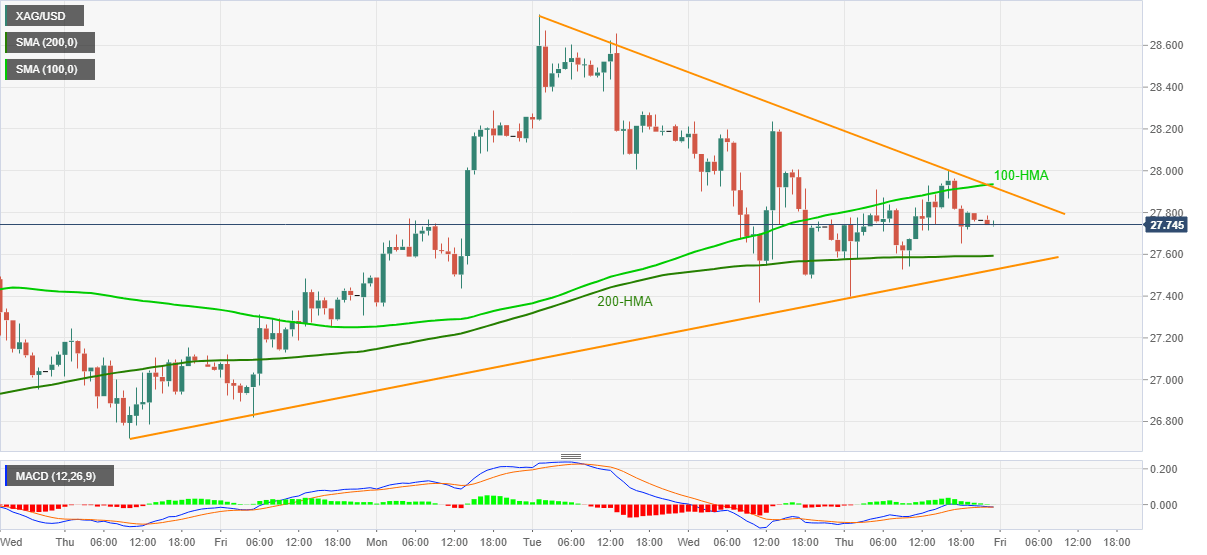

Silver Price Analysis: XAG/USD remains inside a choppy range below $28.00

- Silver struggles for a clear direction inside a short-term symmetrical triangle.

- Key HMAs, sluggish MACD add filters to the commodity’s moves.

Silver seesaws around $27.70-75 during Friday’s Asian session. The white metal jumped to $28.00 the previous day before closing Thursday with minimal gains inside a one-week-old symmetrical triangle.

Not only the triangle formation but 100 and 200-HMAs also challenge the bullion’s immediate moves amid sluggish MACD.

Hence, silver traders should look for opportunities once the quote breaks the $27.50–$28.00 range.

Given the recent run-up in precious metal prices, mainly led by the US dollar weakness, odds of the metal’s upside break of $28.00 are higher, which in turn could quickly recall the $28.30 resistance on the chart.

However, any further upside past $28.30 needs to cross the monthly high of $28.75 before targeting the $29.00 and the yearly peak surrounding $30.00.

On the flip side, a sustained trading below $27.50 could take a rest near $27.10 before battling the $26.60-75 support zone comprising March-April highs and the previous week’s low.

Silver hourly chart

Trend: Sideways

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.