Silver Price Analysis: XAG/USD rallies further beyond $27.00 mark, highest since late February

- Silver gained strong positive traction on Thursday and surged past the $27.00 mark.

- The technical set-up favours bullish traders and supports prospects for further gains.

- Only a sustained break below the $26.00 mark will negate the near-term positive bias.

Silver caught some aggressive bids during the early North American session and surged to the highest level since February 26. The commodity was last seen trading around the $27.15-20 region, up around 2.5% for the day.

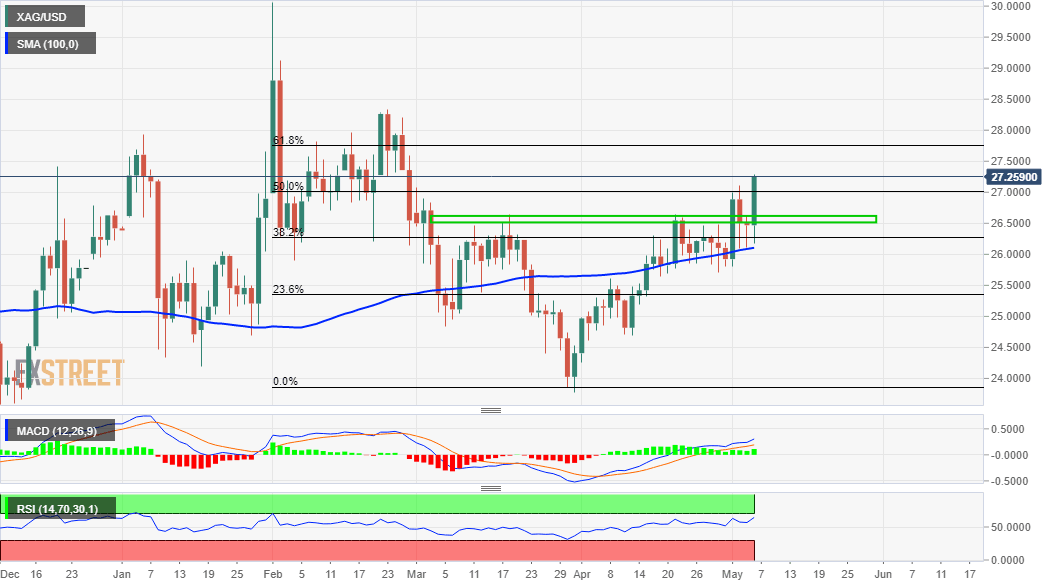

Given that the intra-week slide attracted dip-buying near the $26.00 mark, acceptance above the 50% Fibonacci level of the $30.07-$23.78 downfall might be seen as a fresh trigger for bullish traders. A subsequent strength beyond the $27.00 mark adds credence to the positive outlook and might have already set the stage for further gains.

The constructive set-up is reinforced by the fact that technical indicators on the daily chart have been gaining positive traction and are still far from being in the overbought territory. Hence, some follow-through strength towards the 61.8% Fibo. level, around the $$27.65-70 region, en-route the $28.00 mark, now looks a distinct possibility.

On the flip side, any meaningful pullback might now find decent support and bought into near the $26.60-50 congestion zone. This, in turn, should continue to help limit the downside near the $26.00 mark. The latter coincides with the 38.2% Fibo. level, which if broken decisively will negate the bullish bias and prompt some technical selling.

XAG/USD daily chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.