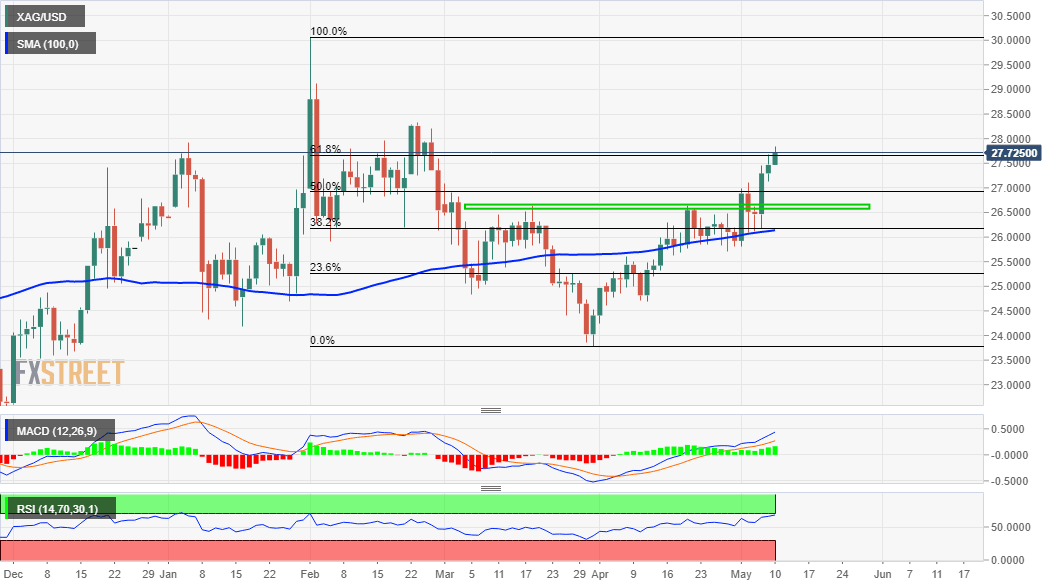

Silver Price Analysis: XAG/USD holds steady near 61.8% Fibo. level, over two-month tops

- Silver added to last week’s strong gains and gained traction for the third straight session.

- The technical set-up favours bullish traders and supports prospects for additional gains.

- Sustained weakness below the $27.00 mark is needed to negate the constructive outlook.

Silver gained positive traction for the third consecutive session and climbed to the highest level since February 25 during the early part of the trading action on Monday. The commodity now seems to have entered a bullish consolidation phase and was last seen trading around the $27.65-70 region.

The mentioned area marks the 61.8% Fibonacci level of the $30.07-$23.78 downfall. This is followed by the $28.00 round-figure mark, which if cleared decisively will be seen as a fresh trigger for bullish traders and pave the way for an extension of the recent rally from YTD lows touched in March.

Meanwhile, technical indicators on the daily chart have been scaling higher in the bullish territory and are still far from being in the overbought zone. This comes on the back of the recent break through the $26.60-50 strong resistance zone and supports prospects for additional near-term gains.

That said, slightly overstretched RSI (14) on the 4-hour chart held bulls from placing aggressive bets and capped the upside, at least for now. Nevertheless, the XAG/USD seems poised to surpass the $28.00 round-figure mark and aim to test the next relevant hurdle near the $28.80-85 supply zone.

The momentum could further get extended and allow bullish traders to aim back to reclaim the $29.00 level for the first time since early February.

On the flip side, immediate support is now pegged near the $27.40-35 region. Any subsequent dip might now be seen as an opportunity to initiate fresh bullish positions and remain limited near the $27.00 mark. The latter coincides with the 50% Fibo. level and should act as a key pivotal point.

XAG/USD daily chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.