Silver Price Analysis: XAG/USD holds recovery gains above $25.00

- Silver snaps four-day losing streak, wavers around intraday high off-late.

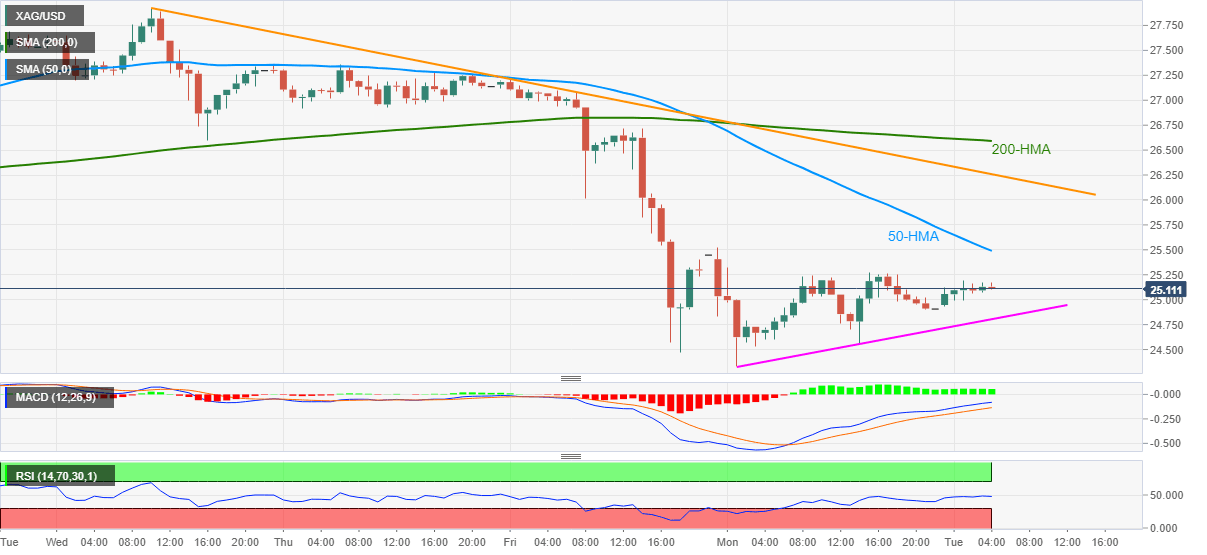

- Bullish MACD, gradual bounce off $24.33 favor buyers eyeing 50-HMA.

- One-week-old resistance line, 200-HMA add to the upside filters.

Silver consolidates recent losses around $25.12, up 0.64% intraday, while heading into the European session on Tuesday. In doing so, the white metal rises for the first time in the last five days.

It should also be noted that the recovery moves are gradual and in the pattern, backed by the bullish MACD, which in turn suggests further upside to the 50-HMA level near $25.50.

However, the commodity’s further rise past-$25.50 will be challenged by a descending resistance line from last Wednesday, near $26.25, ahead of an area comprising 200-HMA and January 06 low surrounding $26.60.

Meanwhile, a downside break of the immediate support line, at $24.80 now, will aim for the $24.00 threshold with the recent low around $24.35-30 likely acting as an intermediate halt.

If at all silver bears refrain from stepping back from $24.00, multiple lows marked during the early December around $23.55 and October bottom close to $22.60 will be in focus.

Silver hourly chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.