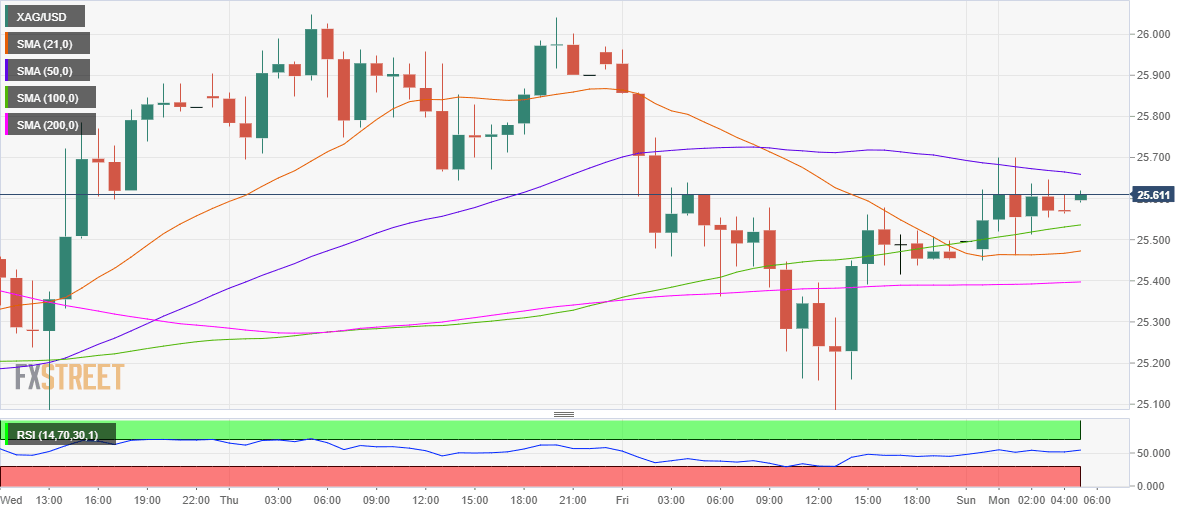

Silver Price Analysis: XAG/USD gathers pace for a break above 50-HMA

- Silver awaits range breakout while capped between 50 and 200-HMAs.

- Hourly RSI remains bullish, backing the upside bias.

- $1865 will offer strong resistance if XAU/USD bounces further.

Silver (XAG/USD) has entered into a phase of consolidation above $25.50, having recovered from Friday’s sharp drop to the $25 mark.

The bulls are looking for a strong catalyst to break through the crucial 50-hourly moving average (HMA) resistance at $25.66.

Meanwhile, 100-HMA at $25.50 offers immediate support to the bright metal. The hourly Relative Strength Index (RSI) trades flat just above the midline, keeping the buyers hopeful in the near-term.

Acceptance above 50-HMA could call for a test of the $26 mark and beyond. While the 21-HMA support at $25.46 will be put at risk should the 100-HMA give way.

The 200-HMA is seen as the next relevant cushion for the XAG bulls.

Silver Price Chart: Hourly

Silver: Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.