Silver Price Analysis: XAG/USD falls after clashing at $24.00, weighed by technical factors, strong USD

- Silver prices dropped after testing weekly highs of $24.00, impacted by rising US bond yields.

- Bullish momentum was curbed by the strong US Dollar and significant resistance at the $24.00 area, according to technical indicators.

- Downward bias confirmed by bearish Relative Strength Index (RSI) and three-day Rate of Change (RoC).

Silver price dropped after testing weekly highs of $24.00, and retraces weighed due to elevated US bond yields, strong US Dollar (USD), and technical indicators. The XAG/USD exchanges hands at around $23.40s after hitting a weekly high of $24.05.

XAG/USD Price Analysis: Technical outlook

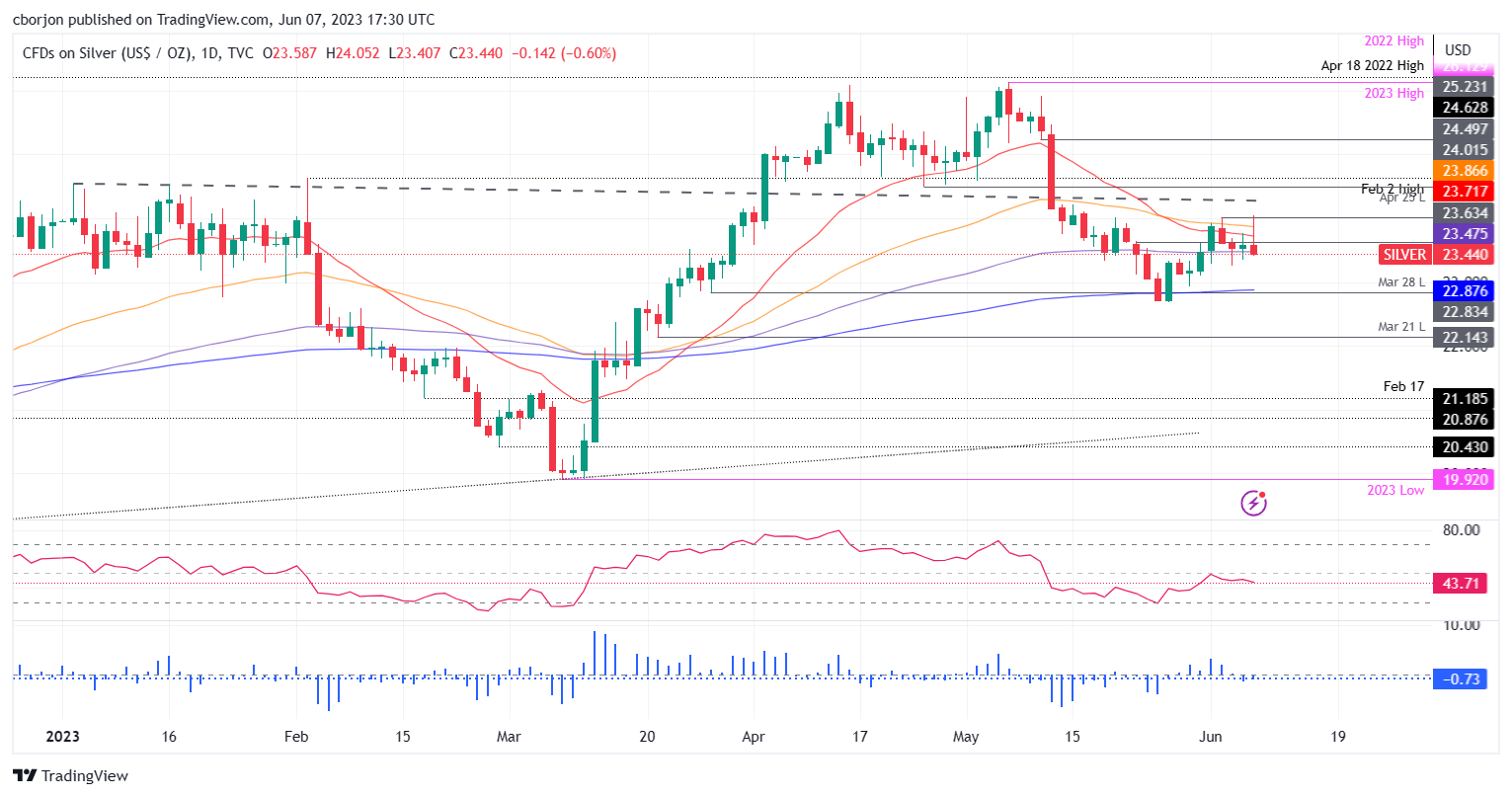

XAG/USD remains neutral-to-downward biased, unable to break decisively above the $24.00 mark area. Technical indicators, like the 50- and 20-day Exponential Moving Averages (EMAs) confluence at $23.71-$23.87, dragged Silver’s spot price lower.

Furthermore, the Relative Strength Index (RSI) indicator and the three-day Rate of Change (RoC) portray that sellers are in charge, both at bearish territory warrant downward action.

Therefore, the XAG/USD first support would be the current week’s low at $23.25, which, once cleared, the white metal could extend its losses toward the $23.00 figure. If XAG/USD slides further will challenge the 200-day EMA at $22.87.

Otherwise, the XAG/USD resistance area would be the abovementioned confluence of the 20/50-day EMAs, at around $23.71-$23.87, which, once breached, could spark a test of $24.00. if XAG/USD clears that area, the next supply zone would be the $25.00 mark.

XAG/USD Price Action – Daily chart

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.