Silver Price Analysis: Making lower lows in the short-term

- Silver is declining steadily on the intraday charts suggesting a short-term bear trend bias at work.

- The precious metal is currently pulling back up to resistance from the bottom of a mini-range.

- It will probably roll-over and begin descending again as the pattern of lower lows continues.

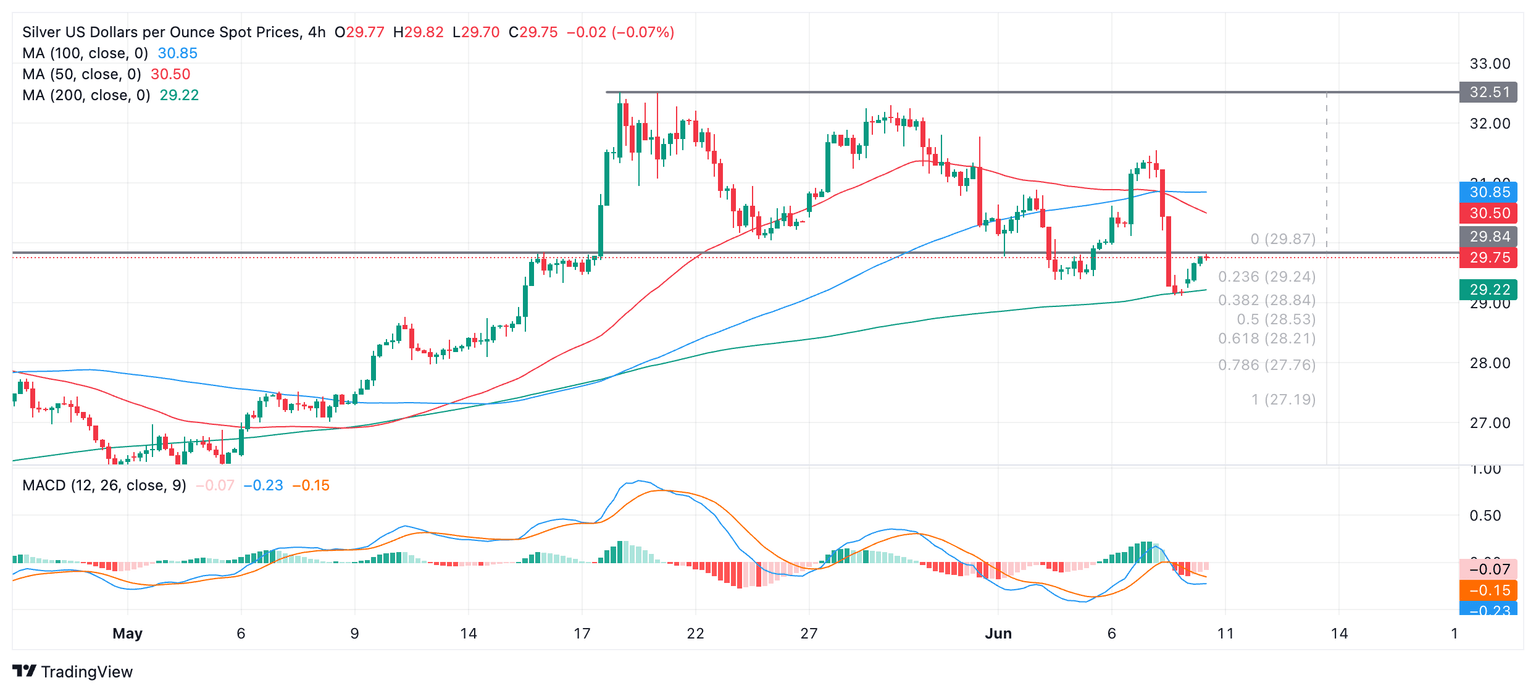

Silver (XAG/USD) is in a step decline on the four-hour chart after piercing below the bottom of a mini-range it formed after peaking in mid-May.

The precious metal fell to a new low at $29.12, at the level of the 200 Simple Moving Average (SMA) following the release of market-moving data on Friday.

Silver 4-hour Chart

It has since pulled back up to resistance from the floor of the range. On balance Silver looks bearish in the short-term and the price will probably roll-over and continue down.

A break below $29.12 (June 7 low) would confirm a lower low and probably a move down to an initial target at $28.21. This is the 0.618 Fibonacci ratio of the height of the range extrapolated lower, the normal method for establishing targets after breakouts from ranges. Further bearishness could see Silver even reach as low as $27.19, the 100% extrapolation of the height of the range lower.

Alternatively a move above the $31.55 lower high would bring the bearish short-term bias into doubt and suggest the possibility of a recovery back up to the range high at $32.51.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.