Silver Price Analysis: Bears taking over and test bullish commitments at key support

- Silver bears are taking the lead into the critical days ahead for the week.

- Bears are testing the bullish commitments around a critical support structure.

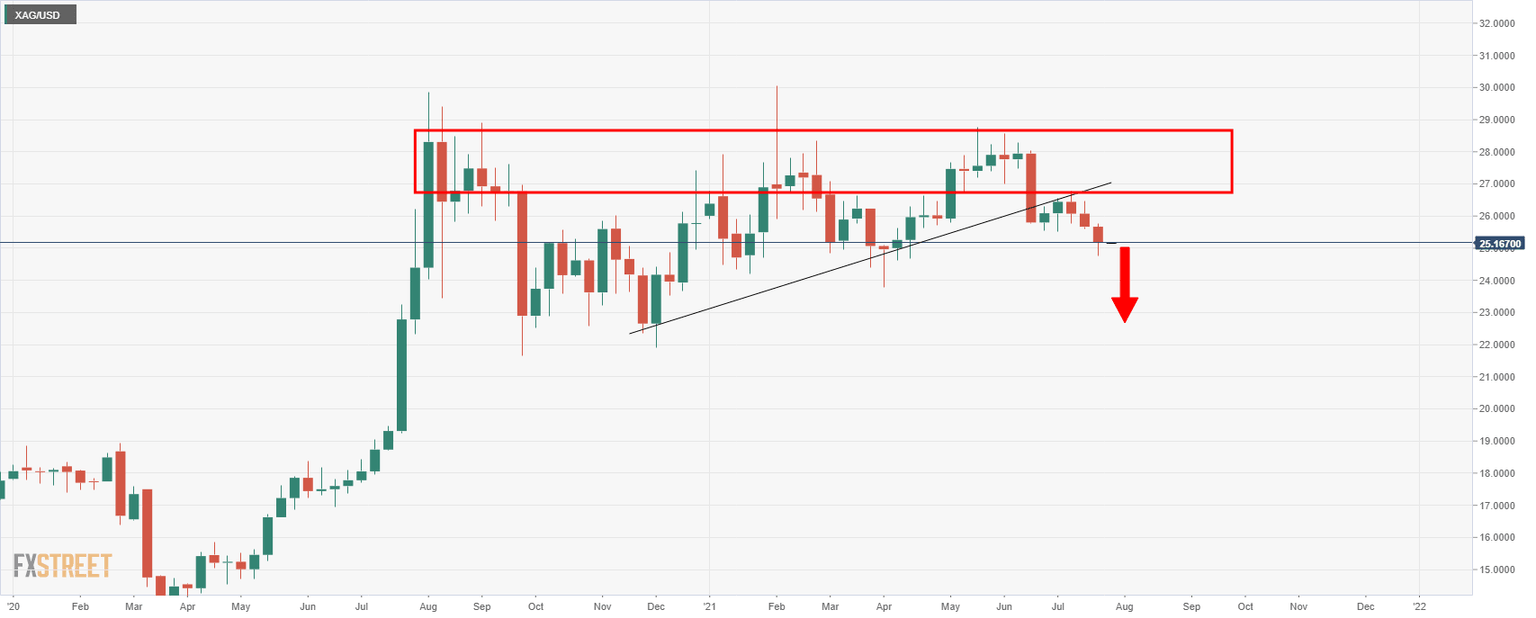

As per the prior analysis, Silver Price Analysis: Bears on the prowl, the market remains within a bearish as the week progresses towards the showdown event in the Federal Open market Committee meeting.

Prior analysis

According to the weekly chart, silver’s bullish trend could well have met its apex and be set for a significant downturn in the coming weeks ahead.

The price has dropped below the dynamic weekly support line and from a daily perspective, the price is below the June-July support between 25.75 and 25.52.

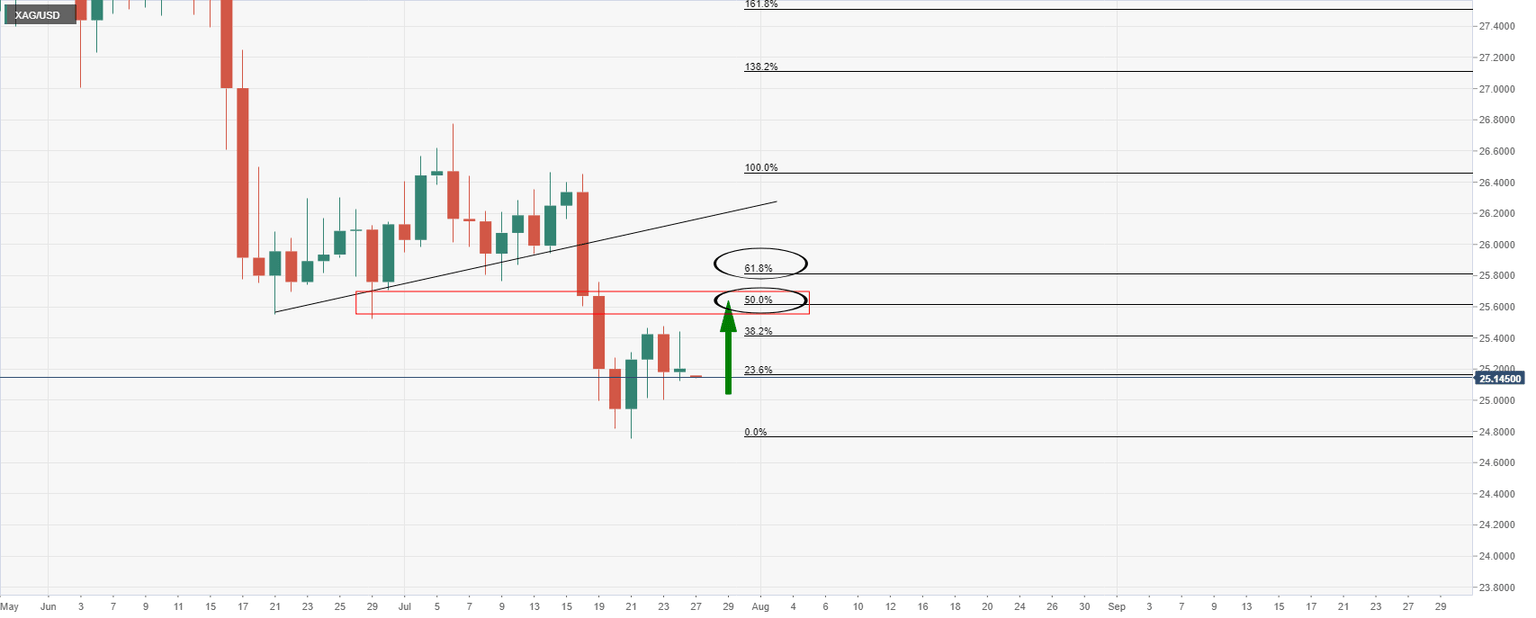

The price has made over a 38.2% Fibonacci retracement and is pressured lower from there which opens prospects of a downside continuation for the days ahead.

However, a bullish start to the week could test the 4-hour 20 EMA that guards 25.31 resistance.

If the bears step in there or below, then the downside extension to test the 24.50s initially and the 24.30s thereafter will be on the cards.

Live market analysis

The price is being rejected by the 38.2% Fibonacci at this stage and is showing signs that there is no way above it, for now.

This leaves the bears in good stead for the sessions ahead.

However, on the other hand, the price action took out the 21 July highs in the 25.30s and has subsequently tainted the prospects of a bearish H&S on the 4-hour chart given the higher RHS’s high:

Nevertheless, the head of the formation’s high is still intact and therefore bears are still in play.

A break of the neckline near 25.10 and the prior lows 25.12 for the sessions should be monitored by the bears.

A subsequent retest of this area vs the counter trendline support could offer an optimal entry point to target a downside extension and to test the 24.50s initially and the 24.30s thereafter.

On the flip side, however, a stronger correction will see the 50% mean reversion at 25.60 of the daily bearish impulse that meets prior daily lows ahead of the 61.8% Fibo in 25.83.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.