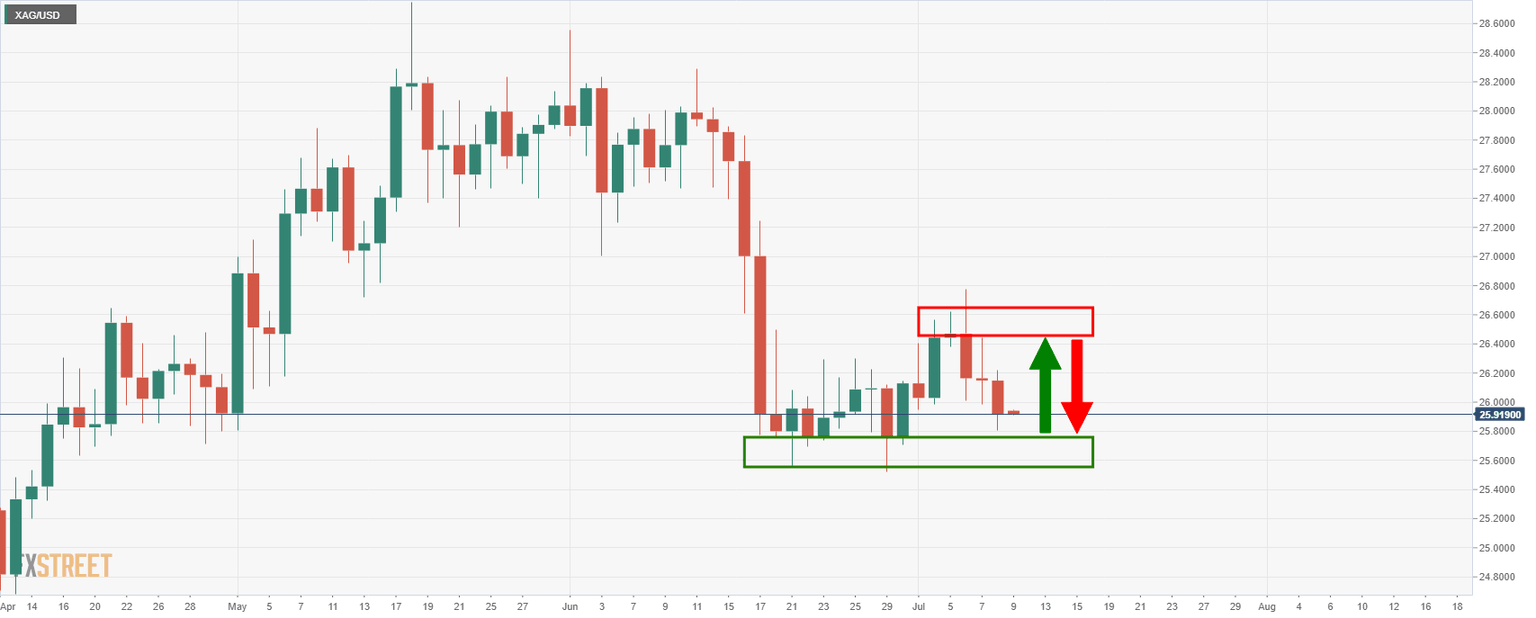

Silver bears take on bullish commitments at critical structure

- The price of silver is in the hands of the bears below 1 July business.

- Bulls will need to commit at this juncture or face a squeeze to the downside.

Silver has been rejected to the upside and is taking on the bull's commitments at a familiar area on the daily charts.

The following analysis illustrates both a bullish and bearish scenario.

Daily charts

The price has recovered to a 38.2% Fibonacci retracement area which had a confluence of the 20 EMA:

Consequently, the price has struggled to maintain the bid and has sunk back to test the bull’s commitments in the daily support structure in today’s lows.

Should they hold, then there is the likelihood of a retest of the highs and a deeper 50% mean reversion correction of the June sell-off near 26.91.

Meanwhile, there is the case for the downside also as the price has actually broken structure on the July 1 daily candle:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.