RIVN Stock News: Rivian shares climb on 2021 production report, analyst upgrade

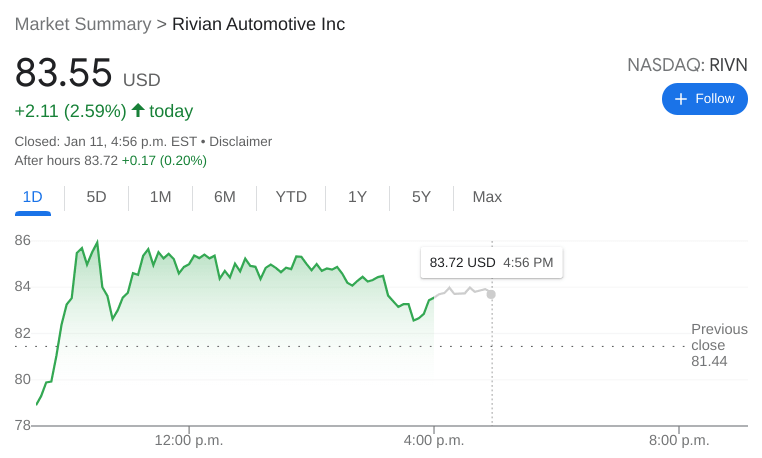

- NASDAQ:RIVN gained 2.59% during Tuesday’s trading session.

- A Redburn analyst provides a healthy upgrade for Rivian’s stock.

- Rivian submits its 2021 production report to the SEC.

NASDAQ:RIVN is experiencing early growing pains of a newly public company in 2022 as the stock seemingly takes two steps forward and one step back. After news of the company’s COO departing in December amidst the ramping up of production, the company received some positive news on Tuesday that caught the attention of investors. Shares of Rivian gained 2.59% and closed the trading session at $83.55. It was a bullish day for the EV sector as growth stocks managed to claw back some of their losses. Shares of Lucid (NASDAQ:LCID), Tesla (NASDAQ:TSLA), and Nio (NYSE:NIO) were all riding higher during Tuesday’s session.

Stay up to speed with hot stocks' news!

Another Wall Street analyst has initiated coverage of Rivian, and like his peers he has provided a healthy boost to Rivian’s stock price. Redburn began coverage of Rivian on Tuesday with a buy rating and a generous price target of $141. In comparison, the same firm initiated coverage of Rivian rival Lucid with a neutral rating and a price target that is below its current stock value. Rivian has received several bullish targets and reports from Wall Street analysts, but thus far the stock has yet to prove any of these predictions true in the short-term.

RIVIAN stock forecast

Another piece of news that had investors buying back into Rivian on Tuesday was that the company officially filed its 2021 production figures with the SEC. According to the filing, Rivian managed to produce 1,015 vehicles and deliver 920 of them to its customers. The number is more than initially thought for Rivian so this can only be seen as good news. With a new factory being built in Georgia, Rivian should see its production capacity increase several times over the next few years.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet