Rivian Earnings Preview: What to expect from RIVN stock earnings on Thursday

- RIVN stock is set to open higher on Monday as markets stage a recovery.

- Rivian to release earnings on Thursday.

- RIVN fell below $50 for the first time since IPO this week.

Rivian (RIVN) should see some form of recovery on Wednesday when the market opens as equity indices are pointing to a pretty big rally if the gains in Europe are anything to go by. There does not appear to be anything dramatic behind the gains in Europe this morning. Some comfort was taken from the news of joint bond issuance by the EU on Tuesday, and news of civilian ceasefire evacuations going ahead as planned has helped markets this morning. That and of course nothing can go down in a straight line forever. Expect this rally to be short-lived as growing stagflation problems will present particular problems for equity investors and hit high growth stocks such as Rivian especially hard.

Rivian Stock News

While we should rally on Wednesday, Thursday will also bring some key news for investors. Rivian will release its earnings after the close on Thursday. The last set of earnings was poorly received and we feel this set may also prove challenging. Any commentary around rising costs or delivery delays will likely be punished. Rivian stock took a hammering last week as it announced price hikes, and Tesla boss Elon Musk poked fun at its margins via his tool of choice, Twitter.

The stock tanked before Rivian CEO RJ Scaringe quickly backtracked as order cancellations mounted following the price hike. This is a serious problem for Rivian. Raw materials are in short supply, and costs are skyrocketing due to the Ukraine conflict. This will be a problem for most EV makers.

This week a report from Morgan Stanley said rising commodity costs had already added $1,000 to the cost of electric vehicles. It is not just Rivian then that will feel the pressure on margins. We also note on Tuesday that Barclays more or less halved its price target for Rivian.

Rivian is to release Q4 earnings after the close. Earnings per share are expected to come in at -$1.97, while revenue is estimated to be $60.03 million. We feel these will be hard numbers to live up to, especially on the revenue side. Outlook and deliveries will be the more important metric.

Rivian Stock Forecast

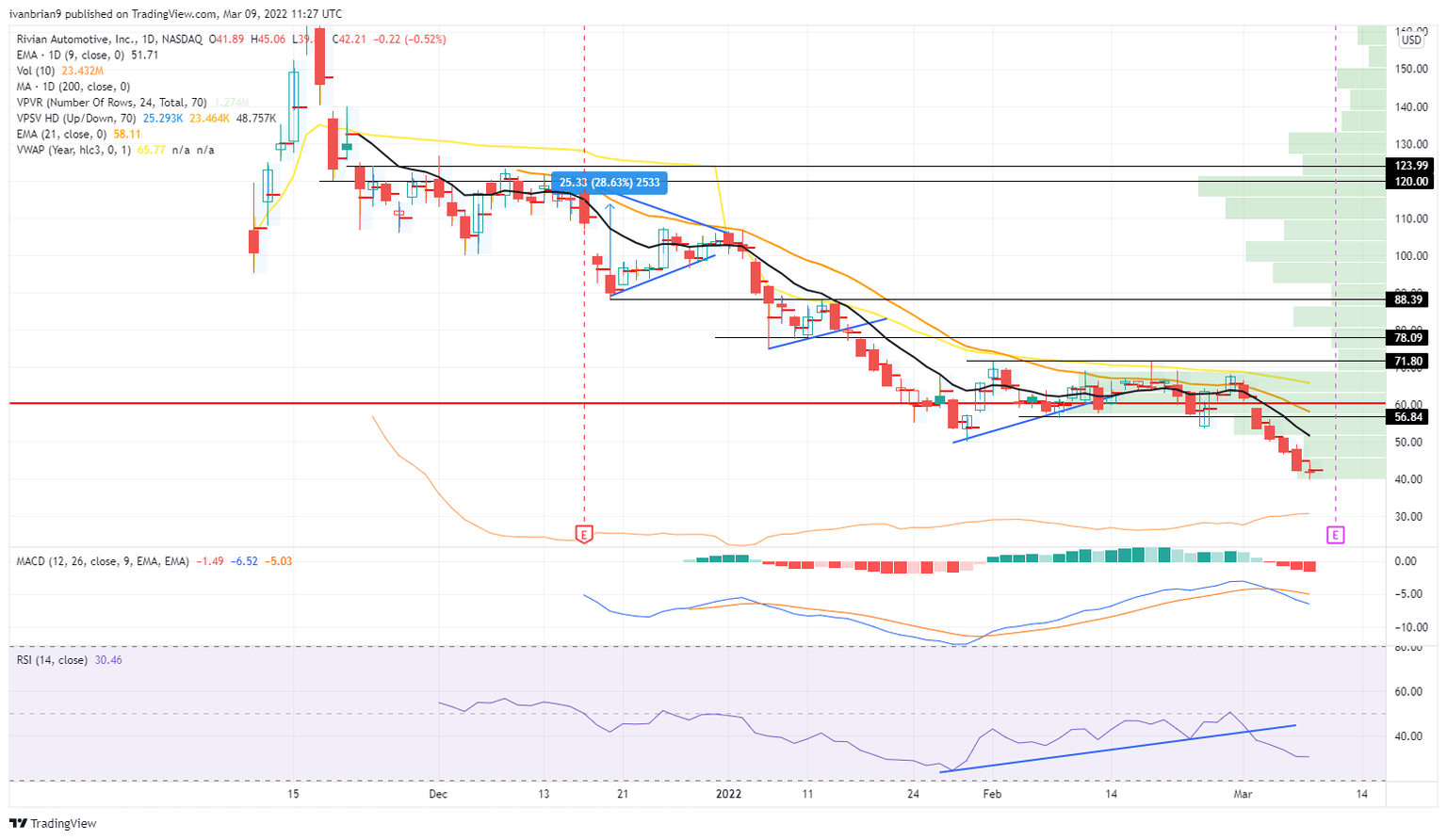

$56.84 remains the key short-term resistance. Getting above there brings Rivian stock back into a high-volume zone and so could get some stability from that. Above $71.80, Rivian stock turns bullish on the chart, but at the moment we have a declining Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) confirming the weakness in the stock. A brief rally is due on Wednesday, but earnings will provide more clarity. The risk-reward is pointing to further losses.

Rivian (RIVN) chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.