RBA Lowe: Inflation is way too high, needs to come down

The Reserve Bank of Australia's governor Philip Lowe said inflation is way too high and that it needs to come down.

Key comments

The current monetary policy stance is restrictive.

Government fiscal policy is broadly neutral.

There is a risk RBA hasn't done enough with rates.

It is not our objective to send the economy into recession.

Will no longer have lunch meetings before SOMP.

If CPI expectations anchored, can stay on narrow path.

If wage outcomes stay reasonable, could see a fairly soft landing.

New wage agreements this year higher, bit lower next year.If we are wrong about the wage-price spiral, the costs will be quite significant.

The Q4 inflation result demonstrated solid domestic demand.We're still unsure how far rates can go.

Rates have not yet reached their peak.

AUD/USD update

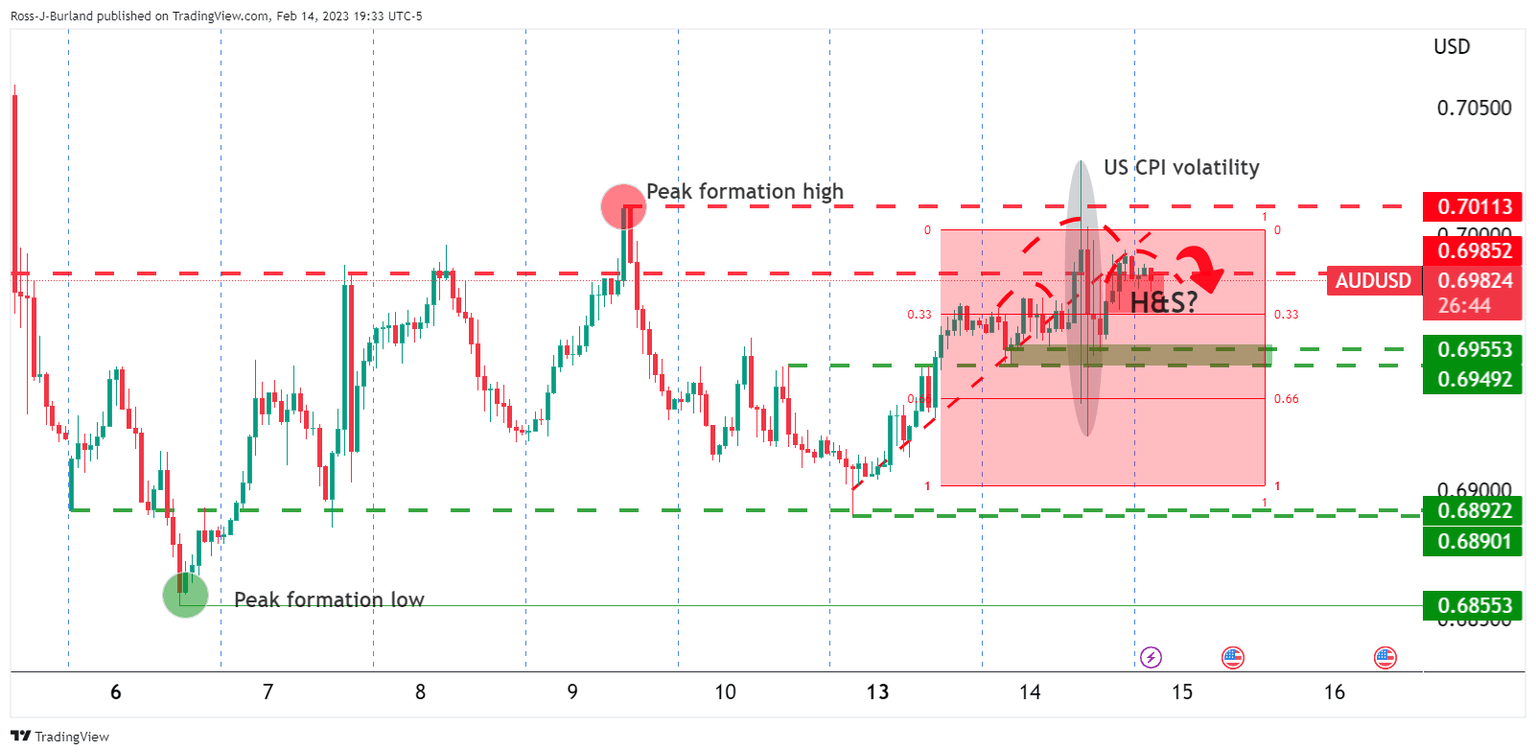

AUD/USD Price Analysis: Bears are dominating the bias with eyes on break of 0.6900

The price remains in a bearish prospect so long as it stays below the 'head' of the H&S formation:

About RBA's Lowe

Philip Lowe replaced Glenn Stevens as governor of Australia’s central bank. Lowe was the Deputy Governor of the Reserve Bank of Australia, a position he held since February 2012.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.