Prolonged accumulation pays off: Impinj (PI) on track for record-breaking rally [Video]

![Prolonged accumulation pays off: Impinj (PI) on track for record-breaking rally [Video]](https://editorial.fxstreet.com/images/Markets/Equities/SP500/wall_street_nyse4-637299025173341169_XtraLarge.jpg)

Impinj, Inc (PI) a Seattle-based provider of RFID solutions, offers products for various industries such as retail, healthcare, and food and beverage. The company’s product line includes reader chips, tag chips, fixed readers, and antennas. The company offers passive UHF RFID chips, RFID readers, reader chips, antennas and software applications for RFID systems. PI is listed on NASDAQ.

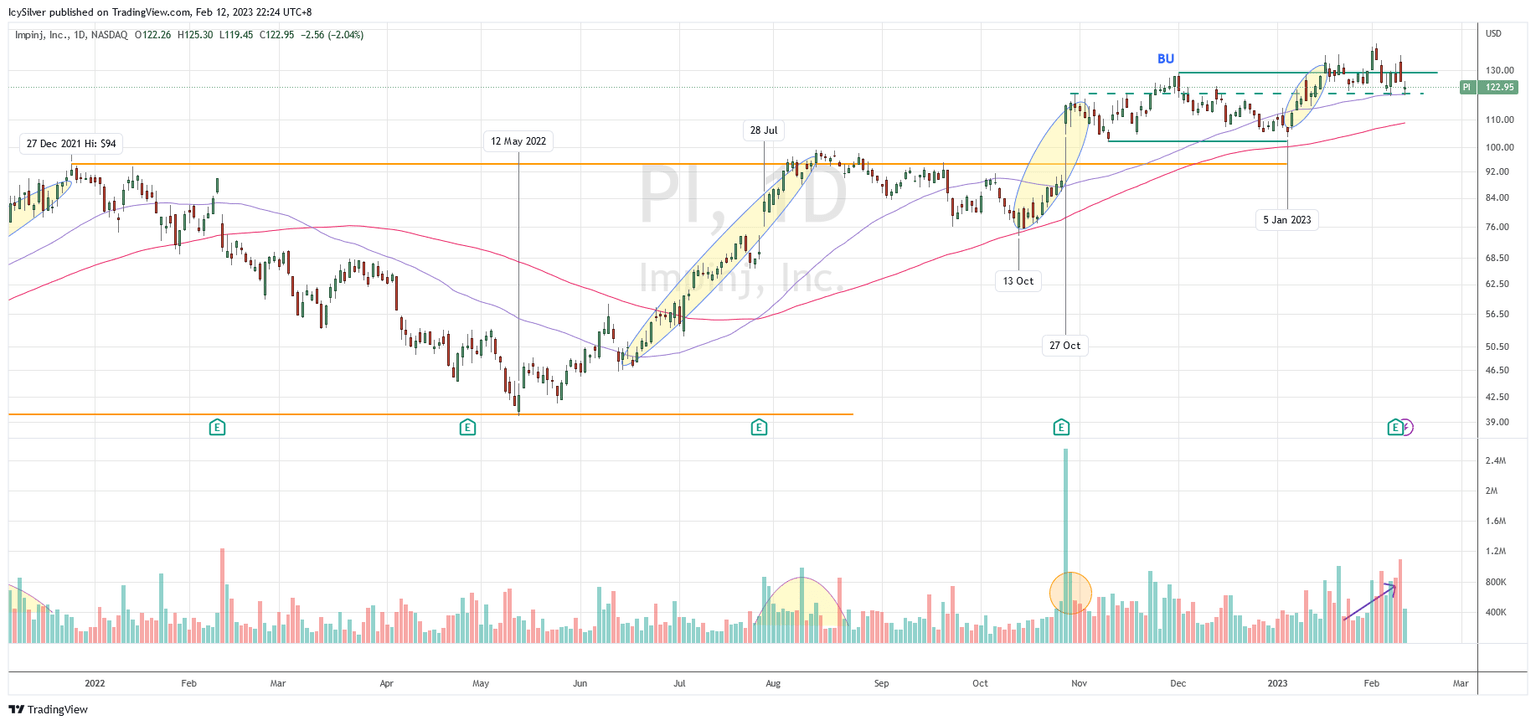

PI price has been consolidating in a big range between $40 and $80 since 2021. On 27 Dec 2021, the price hit a high of $94 before retracing. It slowly drifted down to test the support of $40 over several months until 12 May 2022. The price quickly bounced up from the support and rallied. In fact, the Wyckoff sign of strength (SOS) rally started in mid June 2022 to attempt a breakout of $94. Consistency of high volume together with wide spread bars and gap up price action suggests presence of demand.

The reaction from the August breakout was a shallow pull back and grind down to around $73.50. The price continued on with another SOS rally and gap up on 27 Oct with earning results as catalyst.

The price then ranges between $102 and $130 in a Wyckoff back up (BU) phase. The SOS rally that began on 5 Jan 2023 attempted to break the resistance of $130 but was unsuccessful. Nevertheless, the price was able to stay committed above $92-$100 support area. The increase of volume together with the volatility suggests presence of supply with more testing and short-term weakness ahead.

Bias

Bullish. According to the Wyckoff method, PI is preparing to break out of the BU and begin a mark up phase rally after the back up action in the trading range 120–140 is completed.

If the price breaks below $120, it is likely to consolidate further and range between the support of $102 and $120.

PI was discussed in detail in my weekly live group coaching on 24 Jan 2023 before the market opened. The recent increase of volatility in the market after a climatic run up suggested more testing and consolidation ahead as discussed in the video below.

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.