Pound Sterling trades with caution as US inflation takes centre stage

- The Pound Sterling wobbles around 1.3430 against the US Dollar ahead of the US-UK CPI data for June

- Investors expect US inflation to have accelerated, while the UK CPI is estimated to have risen steadily.

- Market sentiment remains jittery as trade tensions between the US and the EU persist.

The Pound Sterling (GBP) trades cautiously against the US Dollar (USD) near a three-week low around 1.3430 on Tuesday. Investors brace for significant volatility in the GBP/USD pair as the United States (US) Consumer Price Index (CPI) data for June is scheduled to be published at 12:30 GMT.

Ahead of the US inflation data, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades marginally lower from the three-week high around 98.00.

Investors will pay attention to the US CPI data, as it will provide clarity about the impact of tariffs imposed by President Donald Trump on inflation . Federal Reserve (Fed) officials have been arguing in favor of keeping interest rates at their current levels until they get clarity about how much Trump’s tariff policies will impact prices, and the CPI release could offer some insights on the matter.

Still, considering the timing of the announcement of reciprocal tariffs by US President Trump for 22 nations, notably Japan, South Korea, the European Union (EU), and its North American peers, the impact of tariffs will be majorly seen in August CPI figures.

According to the estimates, the US headline inflation rose to 2.7% on year from 2.4% in May. The core CPI – which strips off volatile food and energy items – is expected to have grown by 3%, faster than the prior release of 2.8%. On month, both headline and the core CPI are seen rising by 0.3%.

Daily digest market movers: Investors await UK CPI and employment data

- The Pound Sterling trades broadly calm against its peers on Tuesday. The British currency is expected to trade sideways as investors await the release of the United Kingdom (UK) Consumer Price Index (CPI) data for June and the labor market data for the three-months ending May, which are scheduled for Wednesday and Thursday, respectively.

- Economists expect the UK CPI to have grown at a steady 3.4%, a scenario that generally should prompt the Bank of England (BoE) to hold interest rates steady as inflation is still above the 2% target. However, traders are pricing in a 25-basis point (bps) interest rate reduction by the UK central bank in the August policy meeting amid growing labor market and trade war risks.

- UK employers have slowed down their hiring plans to offset the impact of an increase in the employers’ contributions to social security schemes, which became effective in April. In the Autumn Statement, Chancellor of the Exchequer Rachel Reeves raised employers’ contribution to National Insurance (NI) from 13.8% to 15%.

- Meanwhile, the Office for National Statistics (ONS) is expected to show that the ILO Unemployment Rate steady at 4.6%, remaining at the highest level since the three-months ending in August 2021.

- On the global front, investors seek clarity on trade talks between the US and the European Union (EU). US President Trump confirmed on Monday that Washington is still in talks with Brussels to secure a trade pact before the August 1 deadline, despite having announced 30% tariffs on imports from the EU over the weekend. Signs of intensifying trade tensions between the US and the EU would be unfavorable for riskier assets, given the high volume of business between both economies.

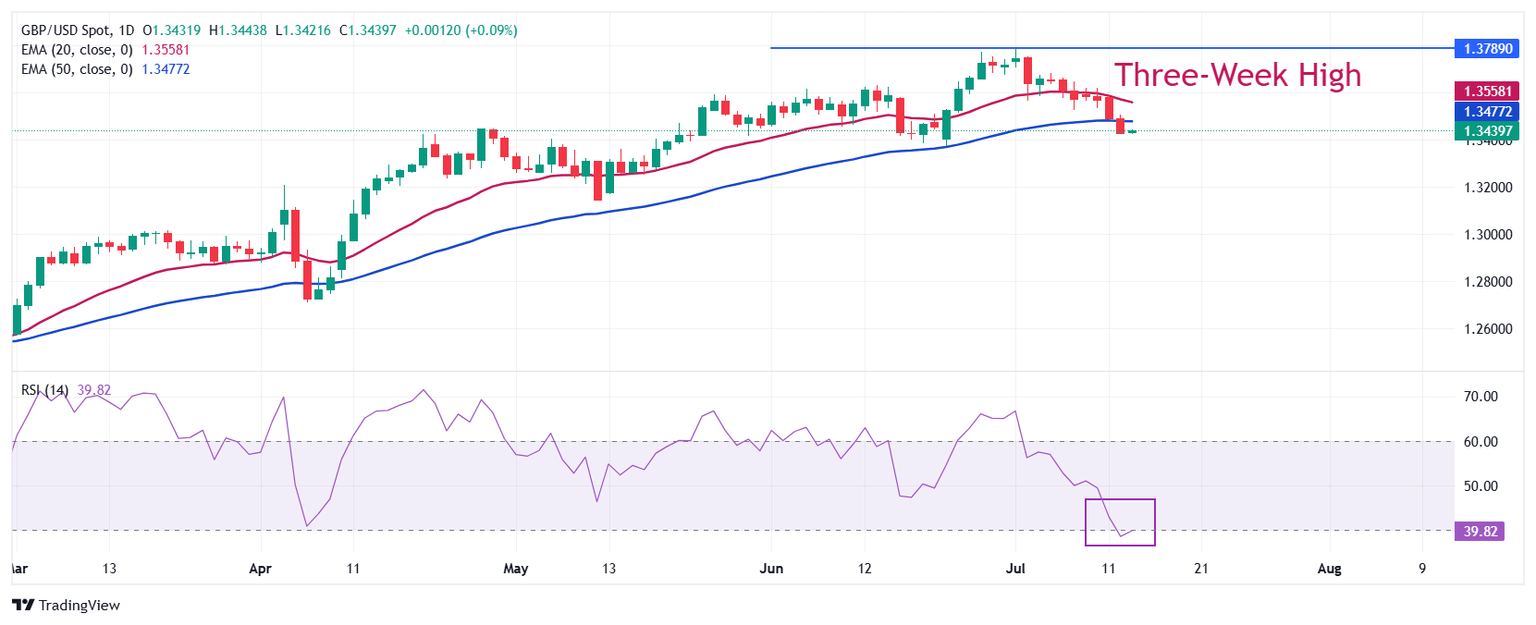

Technical Analysis: Pound Sterling sees downside below 1.3400

The Pound Sterling trades close to a three-week low around 1.3430 against the US Dollar. The near-term trend of the GBP/USD pair has turned bearish as it stabilizes below the 20-day and 50-day Exponential Moving Averages (EMAs), which trade around 1.3558 and 1.3477, respectively.

The 14-day Relative Strength Index (RSI) falls below 40.00. A fresh bearish momentum would emerge if the RSI stays below the same.

Looking down, the June 23 low of 1.3370 will act as a key support zone. On the upside, the three-and-a-half-year high around 1.3800 will act as a key barrier.

Economic Indicator

Core Consumer Price Index (YoY)

The United Kingdom (UK) Core Consumer Price Index (CPI), released by the Office for National Statistics on a monthly basis, is a measure of consumer price inflation – the rate at which the prices of goods and services bought by households rise or fall – produced to international standards. The YoY reading compares prices in the reference month to a year earlier. Core CPI excludes the volatile components of food, energy, alcohol and tobacco. The Core CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as bullish for the Pound Sterling (GBP), while a low reading is seen as bearish.

Read more.Next release: Wed Jul 16, 2025 06:00

Frequency: Monthly

Consensus: 3.5%

Previous: 3.5%

Source: Office for National Statistics

The Bank of England is tasked with keeping inflation, as measured by the headline Consumer Price Index (CPI) at around 2%, giving the monthly release its importance. An increase in inflation implies a quicker and sooner increase of interest rates or the reduction of bond-buying by the BOE, which means squeezing the supply of pounds. Conversely, a drop in the pace of price rises indicates looser monetary policy. A higher-than-expected result tends to be GBP bullish.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.