Pound Sterling drops against US Dollar ahead of US employment, PMI data

- The Pound Sterling trades broadly stable against its peers after BoE members' speeches before the Treasury Committee.

- BoE Governor Bailey hints at high doubts over the pace of interest rate cuts.

- Investors await key US ADP Employment and ISM Services PMI data for August.

The Pound Sterling (GBP) ticks down to near 1.3435 against the US Dollar (USD) during the European trading session on Thursday. The GBP/USD pair faces a slight selling pressure as the US Dollar stabilizes after a corrective move on Wednesday.

At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, ticks up to near 98.25.

The Greenback fell sharply on Wednesday after the release of the US JOLTS Job Openings data for July, which missed estimates. Fresh jobs posted by US employers came in at 7.18 million, lower than expectations of 7.4 million, and the prior reading of 7.35 million. Weak US job openings data intensified expectations supporting interest rate cuts by the Federal Reserve (Fed) for the upcoming September monetary policy meeting.

According to the CME FedWatch tool, the probability for the Fed to cut interest rates in September has increased to 97.6% from 92% seen before the US JOLTS Job Openings data release.

On a broader note, the outlook of the US Dollar is uncertain amid doubts surrounding the future of tariffs imposed by US President Donald Trump since his return to the White House. Trump announced on Tuesday that he will push the tariff case to the Supreme Court immediately after the appeals court ruled against a majority of additional imports. A panel of judges called tariffs “illegal” and accused Trump of improperly invoking the emergency law.

Pound Sterling trades broadly stable, Bailey signals uncertainty over interest rate outlook

- The Pound Sterling trades calmly against its major peers on Thursday as the Bank of England (BoE) officials delivered mixed remarks on the monetary policy outlook before the House of Commons’ Treasury Committee the previous day.

- BoE Governor Andrew Bailey signaled significant uncertainty on the pace of interest rate cuts in the near term, citing risks to both inflation and the labor market. “I think path for rates will continue to be downwards, but there is considerably more doubt on how fast we can cut rates,” Bailey said. He added that “I'm more concerned about downside job risks than Monetary Policy Committee (MPC) members who voted to keep rates on hold”.

- Speaking at the hearing of the Treasury Committee, BoE Deputy Governor Clare Lombardelli and BoE monetary policymaker Megan Greene reiterated a hawkish guidance on the interest rate outlook, citing upside inflation risks. Lombardelli warned that further monetary policy expansion could derail the central bank’s goal of bringing inflation sustainably down to the 2% target. Investors should note that both BoE officials supported holding interest rates steady in the policy meeting in August.

- On the contrary, BoE MPC member Alan Taylor argued in favor of reducing interest rates at a faster pace, citing that the recent increase in inflation is unlikely to be persistent. Taylor favored a bigger 50 basis point (bp) interest rate reduction in the August meeting and revised his vote to a 25 bps decline to get a majority vote.

- Regarding surging UK gilt yields, BoE Governor Bailey said that the situation seems to be global, not specific to the United Kingdom (UK), as the government has not raised a significant debt.

- In Thursday’s session, investors will focus on the US ADP Employment Change and the US ISM Services PMI data for August, which will be published during North American trading hours.

- The ADP is expected to show that new 65K workers were added by the US private sector in August, significantly lower than 104K in July. Meanwhile, the US ISM Services PMI is expected to come in at 51.0, higher than the prior release of 50.1.

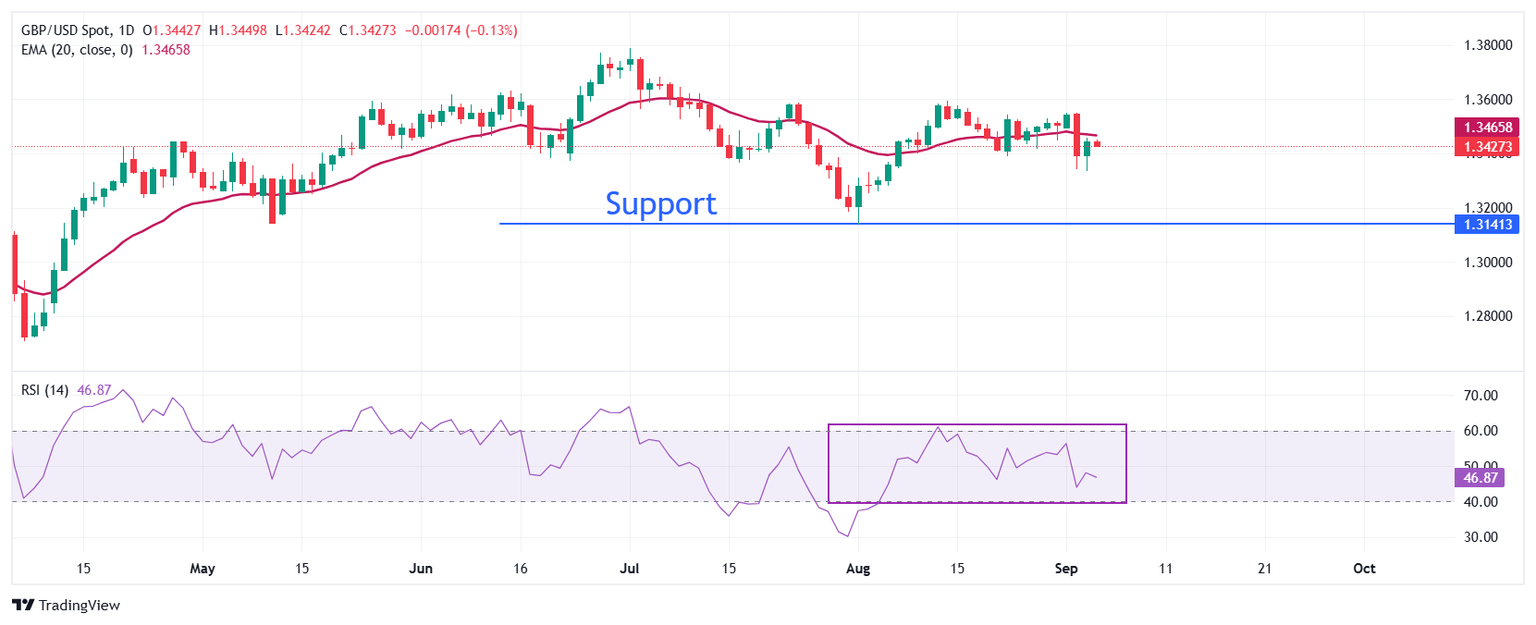

Technical Analysis: Pound Sterling stays below 20-day EMA

The Pound Sterling ticks down to near 1.3435 against the US Dollar on Thursday. The near-term trend of the GBP/USD pair has turned bearish as it trades below the 20-day Exponential Moving Average (EMA), which is around 1.3463.

The 14-day Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range, indicating a sideways trend.

Looking down, the August 1 low of 1.3140 will act as a key support zone. On the upside, the August 14 high near 1.3600 will act as a key barrier.

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.