Pound Sterling gains further against USD as US Retail Sales decline faster-than-expected

- The Pound Sterling extends its upside to near 1.2600 aagainst the US Dollar after weak US Retail Sales data for January.

- A delay in imposition of reciprocal tariffs by US President Trump has weighed on the US Dollar.

- Investors await the UK labor market and inflation data for fresh cues on BoE’s policy outlook next week.

The Pound Sterling (GBP) posts a fresh eight-week high around 1.2600 against the US Dollar (USD) in Friday’s North American session. The GBP/USD pair strengthens as the US Dollar slumps after the release of the United States (US) Retail Sales data for January.

The Census Bureau reported that Retail Sales, a key measure of consumer spending, declined at a faster-than-expected pace of 0.9% on month after expanding by 0.7% in December, upwardly revised from 0.4%. On the year, the consumer spending measure rose by 4.2%, slower than the 4.4% expansion in December, upwardly revised from 3.9%.

Weak Retail Sales data is likely to force traders to make fresh Federal Reserve (Fed) dovish bets. Currently, the Fed is expected to keep interest rates steady in the next three policy meetings, according to the CME FedWatch tool. While there is an almost 50% chance that the Fed can cut interest rates in the July meeting.

After poor Retail Sales data, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, extends its downside to near 106.75, the lowest level seen in almost four weeks.

The US Dollar was already underperforming since President Donald Trump directed the Commerce Department and trade representatives to devise a plan to match tariffs on each product with every country.

President Trump said in the Oval Office on Thursday, "I've decided for purposes of fairness that I will charge a reciprocal tariff." Trump added, "It's fair to all, no other country can complain." The President further added that tariffs will “level the playing field for all US companies.”

This scenario weighed heavily on the US Dollar, as market participants anticipated that Trump would impose reciprocal tariffs immediately. These assumptions were based on his tweet at Truth Social, “Three great weeks, perhaps the best ever, but today is the big one: reciprocal tariffs!!! Make America great again!!!", which came in early North American trading hours on Thursday.

Daily digest market movers: Pound Sterling trades distinctively with peers ahead of UK employment and inflation data

- The Pound Sterling exhibits a mixed performance against its major peers on Friday. The British currency struggles as investors shift focus to the labor market data for the three months ending December and the Consumer Price Index (CPI) data for January, which will be released on Tuesday and Wednesday, respectively. Both economic indicators will influence market speculation about whether the Bank of England (BoE) will reduce interest rates again in the March meeting. The BoE cut its key borrowing rates by 25 basis points (bps) to 4.5% on February 6.

- The British currency has been performing cautiously as investors are concerned about the United Kingdom's (UK) economic outlook despite upbeat Gross Domestic Product (GDP) data for December and the last quarter of the previous year.

- In the latest monetary policy meeting, the BoE halved its GDP forecasts for the year to 0.75%, which was a big blow for Chancellor of the Exchequer Rachel Reeves, who has been promising to lift economic growth. The BoE stated that higher global tariffs would slow down their growth rate.

- The UK Office for National Statistics (ONS) reported on Thursday that the economy surprisingly expanded by 0.1% in the fourth quarter of 2024, while economists projected it to have contracted at a similar pace. In December, the GDP growth rate was robust at 0.4%.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.30% | -0.37% | -0.38% | -0.18% | -0.56% | -0.73% | -0.43% | |

| EUR | 0.30% | -0.07% | -0.10% | 0.11% | -0.26% | -0.43% | -0.13% | |

| GBP | 0.37% | 0.07% | 0.00% | 0.18% | -0.19% | -0.36% | -0.05% | |

| JPY | 0.38% | 0.10% | 0.00% | 0.18% | -0.20% | -0.36% | -0.06% | |

| CAD | 0.18% | -0.11% | -0.18% | -0.18% | -0.40% | -0.53% | -0.24% | |

| AUD | 0.56% | 0.26% | 0.19% | 0.20% | 0.40% | -0.17% | 0.13% | |

| NZD | 0.73% | 0.43% | 0.36% | 0.36% | 0.53% | 0.17% | 0.30% | |

| CHF | 0.43% | 0.13% | 0.05% | 0.06% | 0.24% | -0.13% | -0.30% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

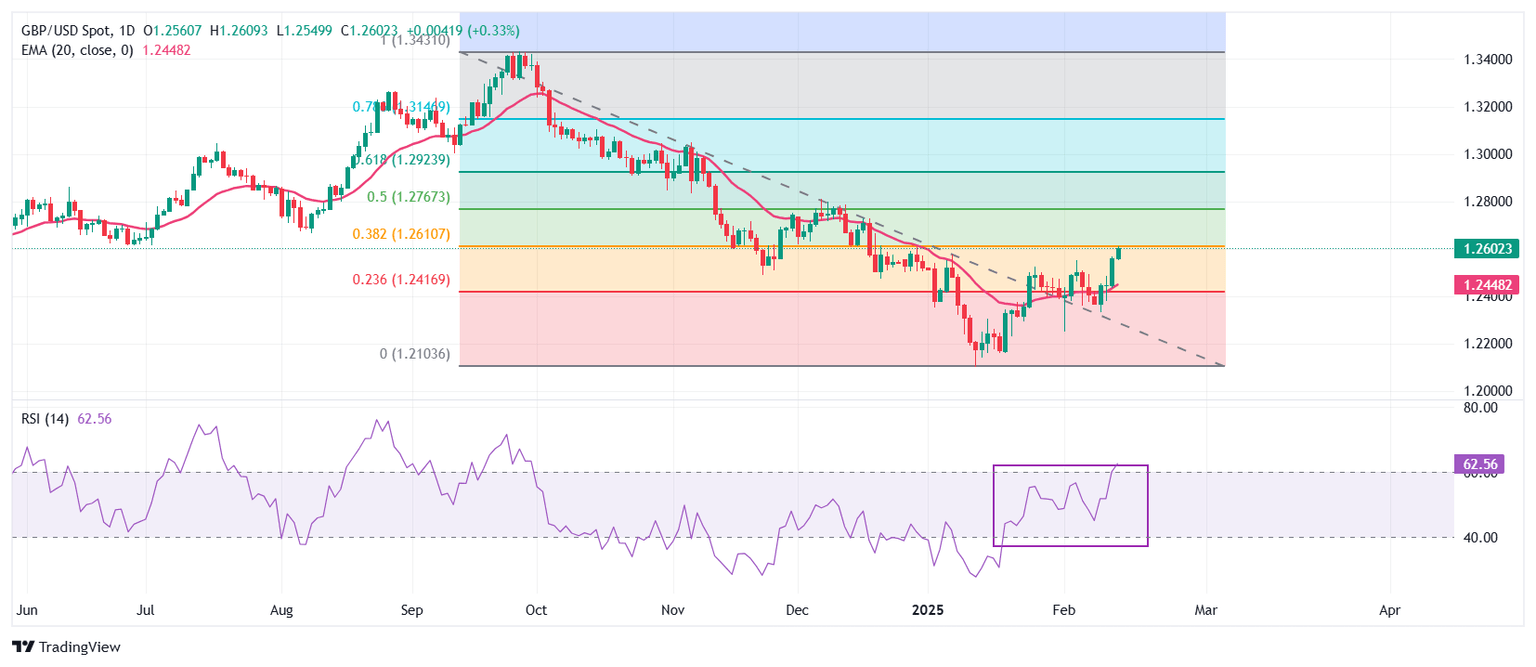

Technical Analysis: Pound Sterling jumps to near 1.2600

The Pound Sterling refreshes eight-week high around 1.2600 against the US Dollar in North American trading hours on Friday. The GBP/USD pair strengthened after breaking above the February 5 high of 1.2550. The outlook of the Cable has turned bullish as the 20-day Exponential Moving Average (EMA) starts sloping higher, which stands around 1.2448.

The 14-day Relative Strength Index (RSI) advances to near 60.00. A bullish momentum would activate if the RSI (14) sustains above that level.

Looking down, the February 3 low of 1.2250 will act as a key support zone for the pair. On the upside, the 50% Fibonacci retracement at 1.2767 will act as a key resistance zone.

Economic Indicator

Retail Sales (MoM)

The Retail Sales data, released by the US Census Bureau on a monthly basis, measures the value in total receipts of retail and food stores in the United States. Monthly percent changes reflect the rate of changes in such sales. A stratified random sampling method is used to select approximately 4,800 retail and food services firms whose sales are then weighted and benchmarked to represent the complete universe of over three million retail and food services firms across the country. The data is adjusted for seasonal variations as well as holiday and trading-day differences, but not for price changes. Retail Sales data is widely followed as an indicator of consumer spending, which is a major driver of the US economy. Generally, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Fri Feb 14, 2025 13:30

Frequency: Monthly

Actual: -0.9%

Consensus: -0.1%

Previous: 0.4%

Source: US Census Bureau

Retail Sales data published by the US Census Bureau is a leading indicator that gives important information about consumer spending, which has a significant impact on the GDP. Although strong sales figures are likely to boost the USD, external factors, such as weather conditions, could distort the data and paint a misleading picture. In addition to the headline data, changes in the Retail Sales Control Group could trigger a market reaction as it is used to prepare the estimates of Personal Consumption Expenditures for most goods.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.