Pound Sterling recovers strongly as monthly US core PCE Inflation declines

- The Pound Sterling rebounds sharply against the US Dollar as monthly US core PCE inflation turns out softer than expected.

- Annual US core PCE Inflation grew in line with estimates of 2.8%.

- UK business optimism improves due to cooling inflationary pressures and expectations for BoE rate cuts.

The Pound Sterling (GBP) recovers intraday losses and jumps to 1.2750 in Friday’s American session. The GBP/USD rises as monthly United States core Personal Consumption Expenditure Price Index (PCE) data for April misses estimates. The underlying inflation grew at a slower pace of 0.2% from the estimates and the prior release of 0.3%.

Annually, the core PCE inflation data, which is the Federal Reserve’s (Fed) preferred inflation measure, grew steadily by 2.8%. The scenario of annual core PCE data coming in line with expectations is less likely to move the Fed towards rate cuts in September. Fed policymakers have said they want to see inflation declining for months before considering a policy-normalization move.

Meanwhile, soft monthly inflation reading has weighed heavily on the US Dollar. The US Dollar Index (DXY), which tracks the Greenback's value against six major currencies, slumps to near 104.40.

Daily digest market movers: Pound Sterling revives losses as US Dollar weakens

- The Pound Sterling rises to 1.2750 against the US Dollar (USD). The Cable rebounds as the US Dollar extends its downside after the release of soft monthly US core inflation reading.

- The US Dollar's appeal was already downbeat due to the downwardly revised US Q1 Gross Domestic Product (GDP) data. The US Bureau of Economic Analysis (BEA) reported that the economy expanded at a slower pace of 1.3% due to lower consumer spending compared with the preliminary estimate of 1.6%.

- Downwardly revised GDP estimates weighed on the US Dollar, and market speculation about the Fed lowering interest rates in September edged up slightly above 50%. Fed rate-cut prospects will be meaningfully influenced by the core PCE inflation data.

- Meanwhile, Fed policymakers continue to emphasize keeping interest rates at their current levels until they get sufficient evidence that inflation will sustainably return to the desired rate of 2%. On Thursday, Dallas Federal Reserve Bank President Lorie Logan said inflation is on course to return to 2% but the path appears to be slower and bumpier than expected at the beginning of the year, Reuters reports. Logan also said it is too early to consider rate cuts.

- On the United Kingdom (UK) front, the outlook for the economy has improved after a survey by Lloyds Bank showed that easing price pressures and firm expectations for the Bank of England (BoE) starting to reduce interest rates sooner have pushed business optimism to its highest since November 2015.

- Due to the absence of top-tier UK economic data, investors look for developments in upcoming elections. Exit polls show that the Labour Party will come into power after almost 15 years of conservative-led governments.

- The Pound Sterling could remain slightly volatile due to market expectations for elections but its impact on the monetary policy is expected to be slim. The outlook for the UK economy could change if the Labour Party comes into power, but their fiscal plans are expected to remain conservative to avoid any upside risk to price pressures.

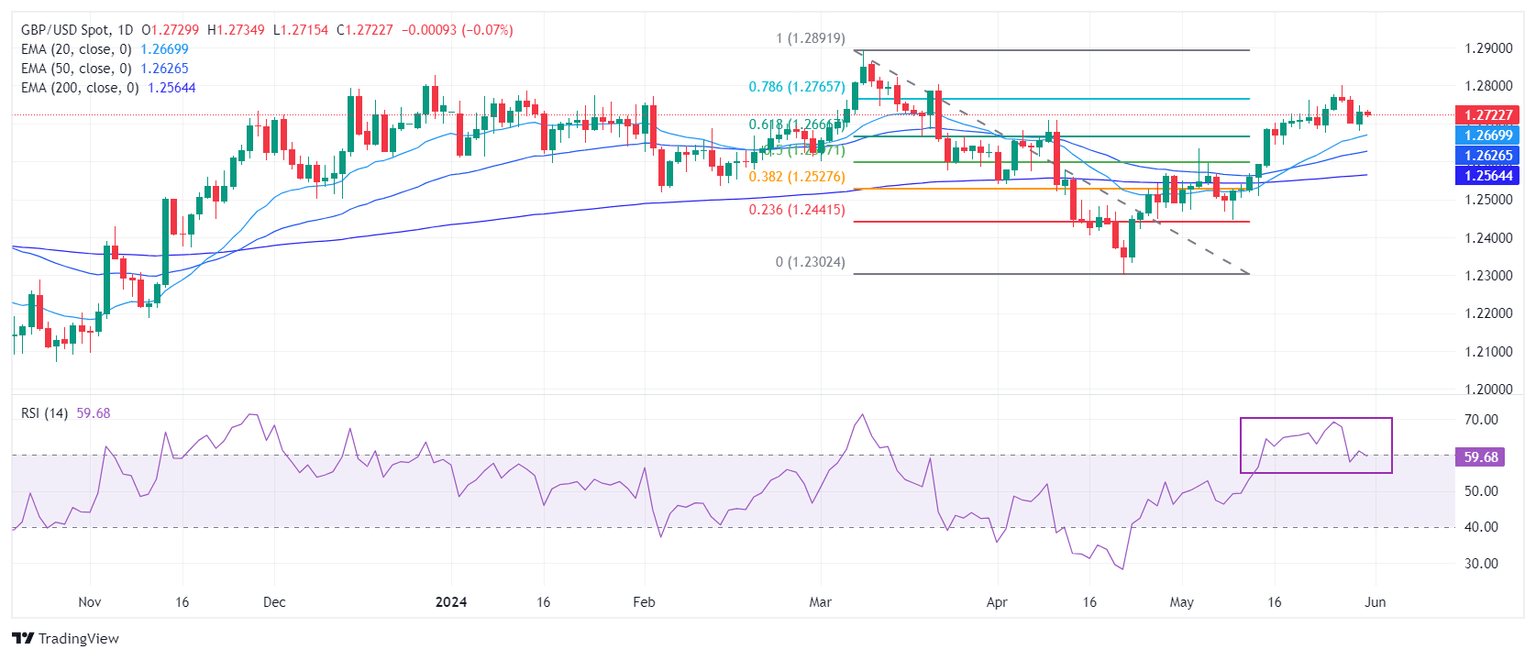

Technical Analysis: Pound Sterling aims to recapture 78.6% Fibo retracement near 1.27

The Pound Sterling revives intraday losses made against the US Dollar after the release of the US core PCE Price Index data for April. The near-term outlook of the GBP/USD pair remains upbeat as it holds above at 1.2670, the 61.8% Fibonacci retracement support (plotted from the March 8 high of 1.2900 to the April 22 low at 1.2300). The asset is expected to extend upside towards 78.6% Fibo retracement near 1.2770.

The Cable is expected to remain in the bullish trajectory as all short-to-long-term Exponential Moving Averages (EMAs) are sloping higher, suggesting a strong uptrend.

The 14-period Relative Strength Index (RSI) has slipped into the 40.00-60.00 range, suggesting that the momentum, which was leaned toward the upside has faded for now.

(This story was corrected on May 31 at 06:32 GMT to say that the core PCE Price Index is the Federal Reserve's preferred inflation measure, not tool.)

Economic Indicator

Core Personal Consumption Expenditures - Price Index (YoY)

The Core Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The PCE Price Index is also the Federal Reserve’s (Fed) preferred gauge of inflation. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The core reading excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures." Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Last release: Fri May 31, 2024 12:30

Frequency: Monthly

Actual: 2.8%

Consensus: 2.8%

Previous: 2.8%

Source: US Bureau of Economic Analysis

After publishing the GDP report, the US Bureau of Economic Analysis releases the Personal Consumption Expenditures (PCE) Price Index data alongside the monthly changes in Personal Spending and Personal Income. FOMC policymakers use the annual Core PCE Price Index, which excludes volatile food and energy prices, as their primary gauge of inflation. A stronger-than-expected reading could help the USD outperform its rivals as it would hint at a possible hawkish shift in the Fed’s forward guidance and vice versa.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.