Pound Sterling reclaims three-year high against USD after Israel-Iran ceasefire

- The Pound Sterling soars above 1.3600 against the US Dollar as a ceasefire between Israel and Iran has reduced safe-haven demand.

- Better-than-expected UK flash PMI data for June has supported the Pound Sterling.

- Several Fed Governors have vowed to cut interest rates in July to support the US labor market.

The Pound Sterling (GBP) extends its Monday’s upside move to near 1.3630 against the US Dollar (USD) during European trading hours on Tuesday. The GBP/USD pair strengthens as a global risk rally driven by the ceasefire between Israel and Iran has dampened demand for safe-haven assets such as the US Dollar.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, falls sharply to near 98.13 on Tuesday from a fresh two-week high of around 99.40 posted the previous day.

During European trading hours, Iranian state media confirmed a truce with Israel, stating that “a ceasefire came into effect between Iran and Israel following four waves of Iranian attacks on Israeli-occupied territories”, Reuters reported. The confirmation form Tehran for a truce with Israel came after United States (US)President Donald Trump stated in a post on Truth.Social that a ceasefire between two Middle East nations has become effective now and urged them not to violate the same. “The ceasefire is now in effect. Please do not violate it!" Trump wrote.

On late Monday, US President Trump stated in a post on Truth.Social that both Israel and Iran have agreed to a “Complete and Total CEASEFIRE”.

Signs of easing Middle East tensions have sent Oil prices down almost 15% from its recent highs, in a big relief for Oil-importing nations.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.28% | -0.72% | -0.84% | -0.15% | -0.82% | -0.99% | -0.30% | |

| EUR | 0.28% | -0.48% | -0.59% | 0.12% | -0.55% | -1.14% | -0.01% | |

| GBP | 0.72% | 0.48% | -0.12% | 0.61% | -0.06% | -0.66% | 0.33% | |

| JPY | 0.84% | 0.59% | 0.12% | 0.71% | -0.01% | -0.18% | 0.43% | |

| CAD | 0.15% | -0.12% | -0.61% | -0.71% | -0.68% | -1.27% | -0.29% | |

| AUD | 0.82% | 0.55% | 0.06% | 0.01% | 0.68% | -0.60% | 0.39% | |

| NZD | 0.99% | 1.14% | 0.66% | 0.18% | 1.27% | 0.60% | 1.00% | |

| CHF | 0.30% | 0.00% | -0.33% | -0.43% | 0.29% | -0.39% | -1.00% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Daily digest market movers: Pound Sterling rises ahead of BoE Bailey's testimony

- The Pound Sterling outperforms its major peers on Tuesday, except for Asia-Pacific currencies, receiving support from upbeat preliminary United Kingdom (UK) S&P Global Purchasing Managers’ Index (PMI) data for June released on Monday and the Bank of England’s (BoE) “gradual and calibrated” monetary easing guidance.

- The PMI report showed that overall business activity grew at a faster-than-projected pace. The service sector activity rose steadily, while factory activity declined but at a slower-than-expected pace. The report also showed that new business volumes returned to growth after contracting for six straight months. However, firms cut jobs due to rising staffing costs after the increase in employers’ contribution to social security schemes.

- Last week, the BoE kept interest rates steady at 4.25%, as expected, and kept its gradual monetary expansion guidance. The UK central bank also warned of higher energy prices and downside risks to the labor market.

- During European trading hours, BoE Monetary Policy Committee (MPC) member Megan Greene also stated that a "careful and gradual approach to removing monetary policy restrictiveness continues to be warranted". Greene warned of upside risks to inflation and downside growth risks.

- For fresh cues on the monetary policy outlook, investors await BoE Governor Andrew Bailey's testimony before the Lords Economic Affairs Committee and speech from Deputy Governor Dave Ramsden during the day.

- In the US region, flash private sector PMI data for June came in stronger than projected. The Services PMI, which gauges activities in the services sector, came in higher at 53.1, compared to estimates of 52.9. The Manufacturing PMI steadied at 52.0, faster than expectations of 51.0. According to the PMI report, the sentiment of factory owners has increased on hopes of greater benefits from new trade policies imposed by US President Trump.

- On the monetary front, a sudden change in Federal Reserve (Fed) officials’ stance on the monetary policy outlook has weighed on bond yields and the US Dollar. On Tuesday, Fed Governor Michelle Bowman joined Governor Christopher Waller and argued in favor of reducing interest rates as early as July.

- “[I am] open to cutting rates as soon as the July FOMC meeting if inflation pressures stay contained,” Bowman said and warned of “signs of softness emerging in the labor market”. On Friday, Christopher Waller said that the Fed “should not wait for the job market to crash in order to cut rates."

Technical Analysis: Pound Sterling aims to stabilize above 1.3600

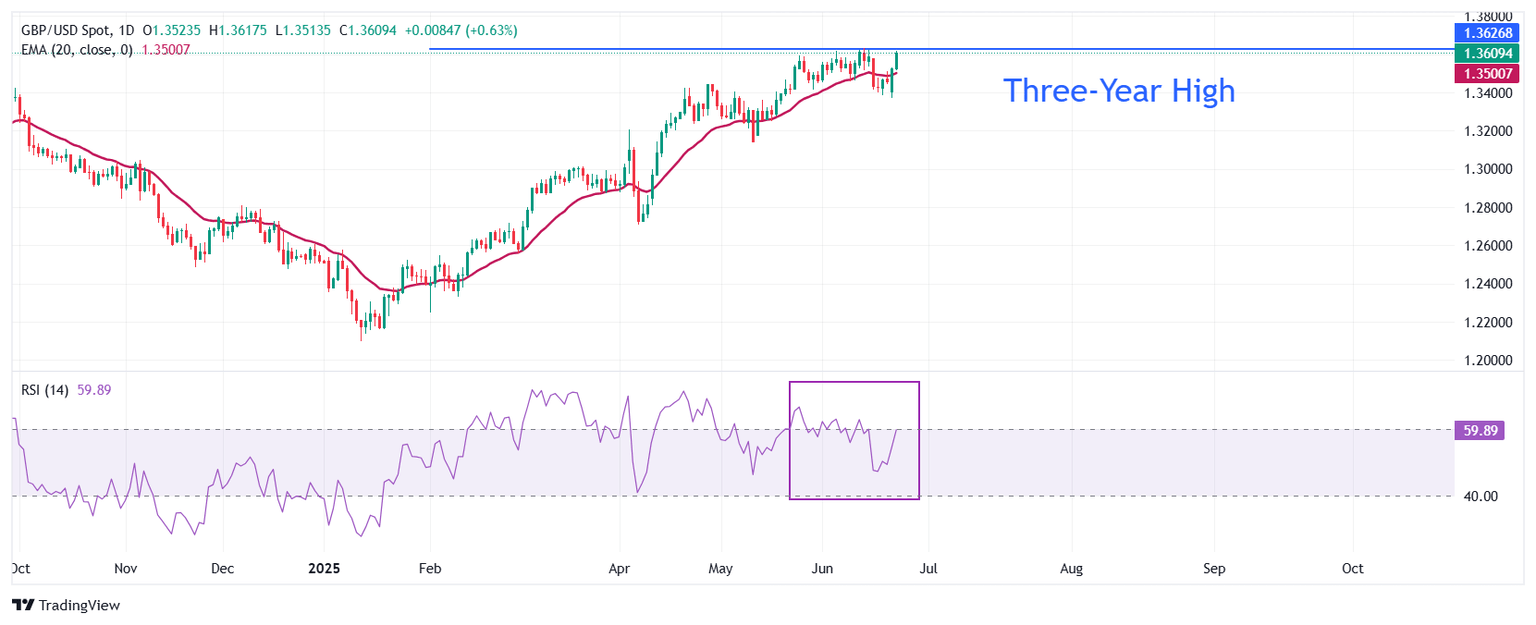

The Pound Sterling reclaims the three-year high of 1.3630 on Tuesday posted on June 13. The near-term trend of the GBP/USD pair turns bullish as it returns above the 20-day Exponential Moving Average (EMA), which is around 1.3500.

The 14-day Relative Strength Index (RSI) rebounds to near 60.00. A fresh bullish momentum would emerge if the RSI breaks above that level.

Looking down, the May 16 low around 1.3250 will act as a key support zone. On the upside, the 13 January 2022 high around 1.3750 will act as a key barrier.

(This story was corrected at 08:42 GMT to say in the title that Pound Sterling gains ahead of BoE Bailey's testimony and not BoE Powell's testimony.)

Economic Indicator

BoE's Governor Bailey speech

Andrew Bailey is the Bank of England's Governor. He took office on March 16th, 2020, at the end of Mark Carney's term. Bailey was serving as the Chief Executive of the Financial Conduct Authority before being designated. This British central banker was also the Deputy Governor of the Bank of England from April 2013 to July 2016 and the Chief Cashier of the Bank of England from January 2004 until April 2011.

Read more.Next release: Tue Jun 24, 2025 14:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Bank of England

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.