Pound Sterling slumps further against US Dollar, US NFP under spotlight

- The Pound Sterling slides to near 1.3160 against the US Dollar as traders pare Fed’s interest-rate cut bets.

- Economists expect the BoE to cut interest rates next week.

- Investors await the US Nonfarm Payrolls and ISM Manufacturing PMI reports for July.

The Pound Sterling (GBP) refreshes almost 11-week low at around 1.3160 against the US Dollar (USD) during the European trading session on Friday. The GBP/USD faces selling pressure as the US Dollar extends its upside, with traders paring bets supporting interest rate cuts by the Federal Reserve (Fed) in the September policy meeting.

During the press time, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, posts a fresh two-month high around 100.15.

According to the CME FedWatch tool, the probability for the Fed to cut interest rates in the September meeting has fallen to 39.2% from the 58.4% seen a week ago.

A slew of factors have contributed to this quick retracement of expectations that the Fed will lower rates in September. First, recent economic data , including the stronger-than-expected United States (US) Q2 Gross Domestic Product (GDP) growth and June’s sticky core Personal Consumption Expenditure Price Index (PCE). Second, signals from Fed Chair Jerome Powell, who suggested that there is no rush for interest rate cuts

On Wednesday, the Fed left interest rates steady in the current range of 4.25%-4.50% for the fifth straight meeting. Jerome Powell hinted that monetary policy adjustments are currently inappropriate as “tariffs have exerted pressure on some goods”.

Daily digest market movers: Pound Sterling trades lower against its peers

- The Pound Sterling weakens against its peers on Friday, with investors shifting their focus to the Bank of England’s (BoE) monetary policy decision, which will be announced on Thursday.

- Market experts are predicting that the BoE will reduce interest rates by 25 basis points (bps) to 4% and will signal a pause as price pressures remain well-above the 2% target. “A one-and-done cut next week looks likely as the inflation is expected to hold above the BoE’s target of 2% through 2026 and 2027,” economists at Pantheon Macroeconomics said, Reuters reports.

- In June, the United Kingdom (UK) headline Consumer Price Index (CPI) came in at 3.6% on year, higher than expectations and the prior release of 3.4%.

- In Friday’s session, the GBP/USD pair will be influenced by US Nonfarm Payrolls (NFP) and the ISM Manufacturing Purchasing Managers’ Index (PMI) data for July, which will be published during North American trading hours.

- The US NFP data could significantly influence market expectations for the Fed’s monetary policy outlook. Economists expect the US economy to have added 110K fresh workers, lower than the 147K jobs created in June. The Unemployment Rate is seen ticking up to 4.2% from 4.1%.

- In the press conference on Wednesday, Jerome Powell stated that “downside risks to the labour market are certainly apparent”, however, until now labor-related indicators have shown broadly stable jobs market within a cooling trend.

- Meanwhile, the ISM Manufacturing PMI is expected to come in slightly higher at 49.5 from 49.0 in June, suggesting that activity in ther US factory sector continued to decline but at a moderate pace.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the weakest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.08% | 0.30% | -0.26% | 0.12% | 0.04% | 0.57% | 0.44% | |

| EUR | -0.08% | 0.32% | -0.33% | 0.10% | 0.09% | 0.34% | 0.42% | |

| GBP | -0.30% | -0.32% | -0.59% | -0.22% | -0.24% | 0.23% | 0.12% | |

| JPY | 0.26% | 0.33% | 0.59% | 0.36% | 0.31% | 0.70% | 0.70% | |

| CAD | -0.12% | -0.10% | 0.22% | -0.36% | -0.09% | 0.45% | 0.34% | |

| AUD | -0.04% | -0.09% | 0.24% | -0.31% | 0.09% | 0.47% | 0.47% | |

| NZD | -0.57% | -0.34% | -0.23% | -0.70% | -0.45% | -0.47% | -0.01% | |

| CHF | -0.44% | -0.42% | -0.12% | -0.70% | -0.34% | -0.47% | 0.00% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

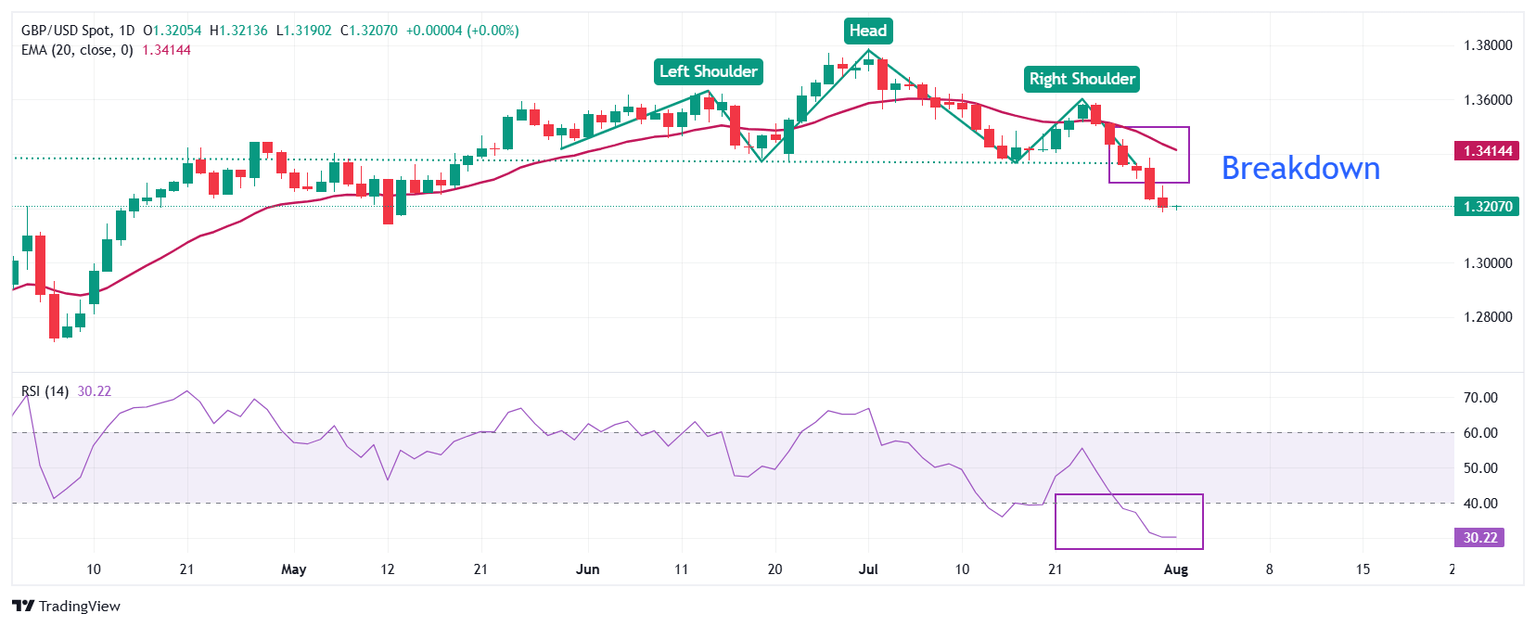

Technical Analysis: Pound Sterling weakens on H&S breakdown

The Pound Sterling slumps to near 1.3160 against the US Dollar on Friday. The outlook of the GBP/USD pair has turned bearish as it has broken down below the neckline of a Head and Shoulders (H&S) chart pattern.

The downward-sloping 20-day Exponential Moving Average (EMA), near 1.3414, also suggests that the near-term trend is bearish.

The 14-day Relative Strength Index (RSI) oscillates well below 40.00, almost at oversold levels, indicating that a bearish momentum is intact.

Looking down, the May 12 low of 1.3140 will act as a key support zone. On the upside, the July 30 high near 1.3385 will act as a key barrier.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Next release: Fri Aug 01, 2025 12:30

Frequency: Monthly

Consensus: 110K

Previous: 147K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.