Pound Sterling reclaims 1.3400 on soft US PCE inflation

- The Pound Sterling bounces back strongly above 1.3400 against the US Dollar after soft US PCE inflation data.

- Investors will focus on a slew of US labor market data released next week.

- The BoE is expected to cut interest rates once in the last quarter of the year.

The Pound Sterling (GBP) recovers sharply above the round-level resistance of 1.3400 against the US Dollar (USD) in Friday’s North American session. The GBP/USD pair gains strength after the release of the United States (US) Personal Consumption Expenditure Price Index (PCE) data for August, which showed that price pressures grew at a slower-than expected pace.

US annual headline PCE inflation rose by 2.2%, slower than the consensus of 2.3% and the prior release of 2.5%. In the same period, the US core PCE index, the Federal Reserve’s (Fed) preferred inflation gauge, grew expectedly by 2.7% but faster than the prior release of 2.6%. The month-on-month headline and core PCE inflation rose by 0.1%.

A slowdown in the inflation data is unlikely to cement market expectations for the Fed to cut interest rates by 50 basis points (bps) again in November as officials were already confident that price pressures will return to the bank’s target of 2%. Meanwhile, policymakers have become more vigilant about labor market risks. Last week, the Fed started the policy-easing cycle with a larger-than-usual interest rate cut of 50 basis points (bps) to 4.75%-5.00%, which signaled that officials would do whatever it takes to revive labor market strength.

Daily digest market movers: Pound Sterling retraces intraday losses against US Dollar

- The Pound Sterling performs weakly against its major peers, except the Asia-Pacific currencies, on Friday. The British currency remains uncertain due to the absence of top-tier United Kingdom (UK) economic events.

- There isn’t any top-tier UK economic data this week or the next one. Therefore, the GBP will be influenced by market expectations for the Bank of England’s (BoE) monetary policy action for the remainder of the year.

- Financial market participants expect that the BoE will lower interest rates once in any of the two policy meetings remaining this year. The BoE pivoted to policy normalization with a 25-bps interest rate cut in August to 5%, but left rates unchanged in its last week’s meeting.

- On Tuesday, BoE Governor Andrew Bailey said in an interview with the Kent Messenger newspaper that "the path for interest rates will be downwards, gradually,” Reuters reports. Bailey’s comments suggest that he is confident about inflation sustainably returning to the bank’s target of 2%. He didn’t provide a specific neutral rate but assured that they will not return to historic lows as seen in times of pandemic.

British Pound PRICE Today

The table below shows the percentage change of the British Pound (GBP) against listed major currencies today. The British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.10% | -0.04% | -1.54% | 0.03% | -0.46% | -0.44% | -0.61% | |

| EUR | 0.10% | 0.06% | -1.47% | 0.09% | -0.34% | -0.36% | -0.48% | |

| GBP | 0.04% | -0.06% | -1.51% | 0.04% | -0.42% | -0.40% | -0.55% | |

| JPY | 1.54% | 1.47% | 1.51% | 1.58% | 1.11% | 1.12% | 1.00% | |

| CAD | -0.03% | -0.09% | -0.04% | -1.58% | -0.50% | -0.47% | -0.61% | |

| AUD | 0.46% | 0.34% | 0.42% | -1.11% | 0.50% | 0.03% | -0.14% | |

| NZD | 0.44% | 0.36% | 0.40% | -1.12% | 0.47% | -0.03% | -0.15% | |

| CHF | 0.61% | 0.48% | 0.55% | -1.00% | 0.61% | 0.14% | 0.15% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

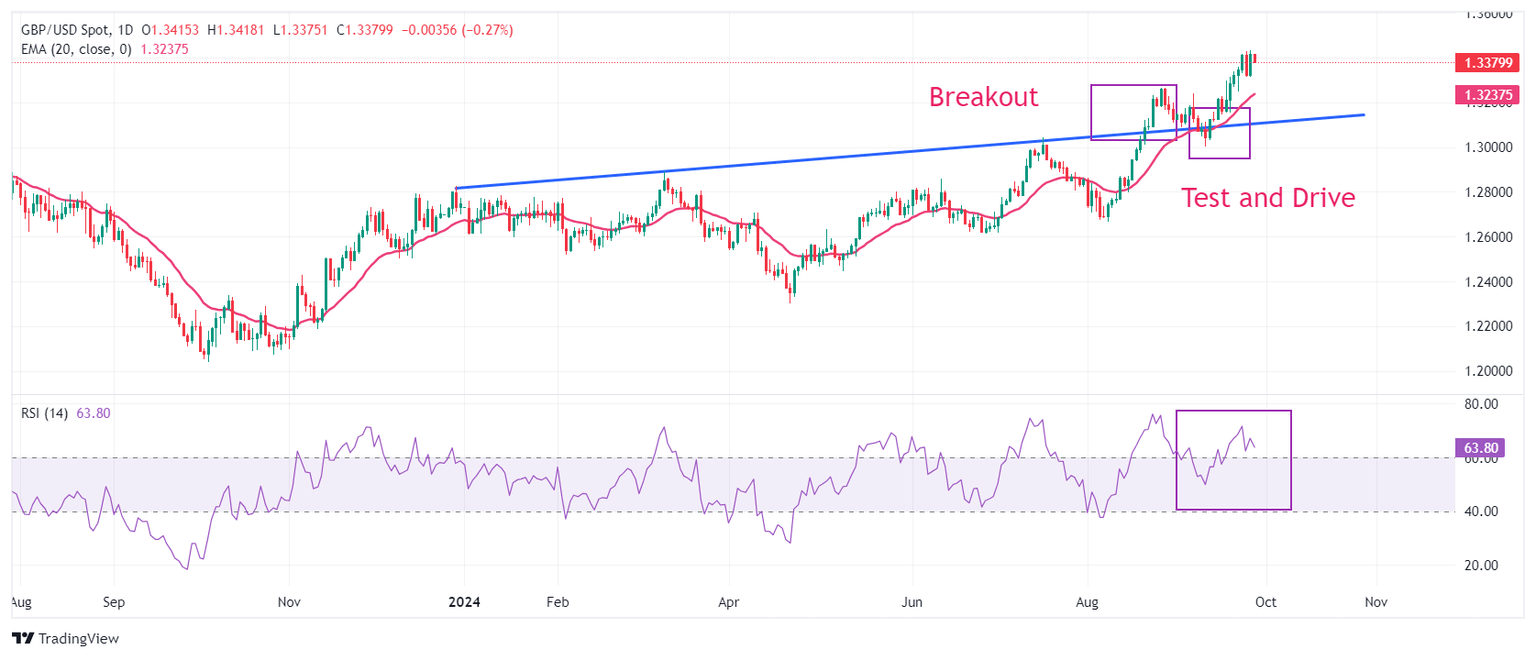

Technical Analysis: Pound Sterling jumps back above 1.3400

The Pound Sterling recovers above the key resistance of 1.3400 against the US Dollar in North American trading hours. The GBP/USD pair bunces back to near its fresh more-than-two-year high above 1.3430. The near-term outlook of the Cable remains firm as the 20-day Exponential Moving Average (EMA) near 1.3235 is sloping higher.

Earlier in September, the Cable strengthened after recovering from a corrective move to near the trendline plotted from the December 28, 2023, high of 1.2828, from where it delivered a sharp increase after a breakout on August 21.

The 14-day Relative Strength Index (RSI) tilts down but remains above 60.00, suggesting an active bullish momentum.

Looking up, the Cable will face resistance near the psychological level of 1.3500. On the downside, the 20-day EMA near 1.3235 will be the key support for Pound Sterling bulls.

Economic Indicator

Consumer Price Index ex Food & Energy (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as the Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The CPI Ex Food & Energy excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally speaking, a high reading is bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Wed Sep 11, 2024 12:30

Frequency: Monthly

Actual: 3.2%

Consensus: 3.2%

Previous: 3.2%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.