Pound Sterling outperforms US Dollar as Trump tariffs fuel US recession risks

- The Pound Sterling jumps to near 1.3200 against the US Dollar as higher-than-anticipated Trump’s tariffss have prompted risks of a US recession.

- President Trump imposed 10% tariffs on the UK, the lowest level across all trading partners.

- The UK is unlikely to retaliate against US tariffs.

The Pound Sterling (GBP) surges to near 1.3200 against the US Dollar (USD) during the North American trading hours on Thursday, the highest level seen in almost six months. The GBP/USD pair soars as the US Dollar plummets after US President Donald Trump unveils worse-than-expected tariffs for his trading partners. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, nosedives to near 101.35.

US President Trump announced a 10% baseline duty on all products entering the US and additional specific levies on the majority of its trading allies, which have followed threats of countermeasures by their leaders. Market participants expect that the full-scale implementation of tariffs will lead the US economy to a recession. Such a scenario underpins the need for more interest rate cuts from the Federal Reserve (Fed) despite knowing that higher levies have also stoked worries about persistent inflation.

US Council of Economic Advisers Chair Stephen Miran also agreed to expectations that Trump’s protectionist policies could lead to “short-term bumps” in the economy, as per his interview with Fox Business. However, he clarified that the president is focused on “long-term economic transition” and improvement in the “durability, sustainability, and fairness” of the American economy with respect to the rest of the world.

On the economic data front, the US ISM Services PMI data for March has come in weaker-than-expected. The Services PMI came in significantly lower at 50.8 compared to estimates of 53.0 and the prior release of 53.5.

Daily digest market movers: Pound Sterling gains against US Dollar

- The Pound Sterling exhibits a different performance with each of its major peers on Thursday. The outlook of the British currency appears to be healthier as United States (US) President Donald Trump has imposed lower tariffs on the United Kingdom (UK). Trump slapped a 10% levy on Britain, which was the minimal figure seen in the reciprocal tariff chart.

- The lower tariffs by Trump on the UK don’t indicate that the impact on the economic outlook will be limited. UK firms would face tough competition in the global market from businesses of those nations that have attracted fat import duties from the US. Higher tariffs on those companies will make their products less competitive in the US, forcing them to offer lower prices globally.

- Contrary to other leaders who are preparing for countermeasures against Trump’s tariffs, the UK is unlikely to retaliate. Before tariffs were revealed, UK Prime Minister Keir Starmer said, “I really do think it is not sensible to say the first response should be to jump into trade war with the US as government braces itself for the announcement of widespread taxes on imports," according to BBC News. However, he didn’t rule out that the administration has been actively preparing for all “eventualities” ahead of President Trump's announcement of “planned tariffs”.

- Meanwhile, revised UK S&P Global/CIPS Composite and Services PMI data for March has come in weaker-than-preliminary estimates. The Composite and Services PMI fell to 51.5 and 52.5, respectively.

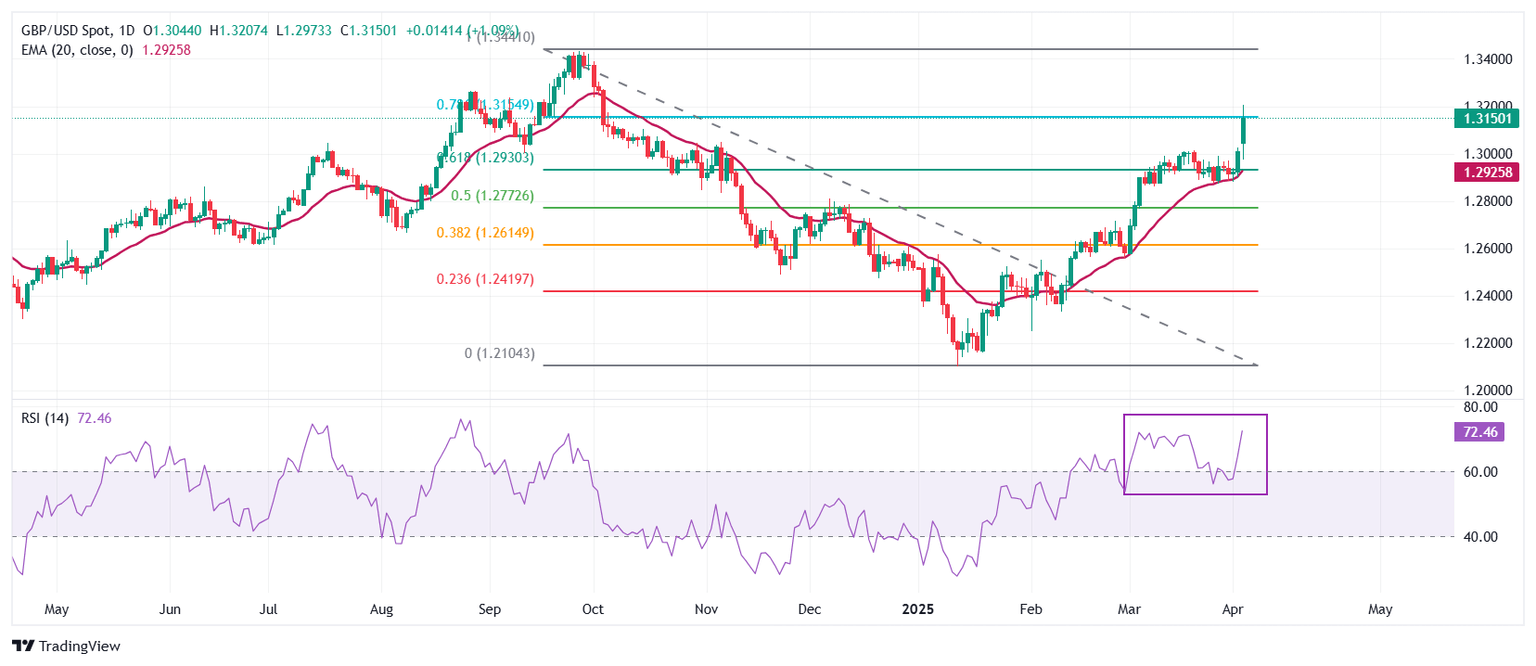

Technical Analysis: Pound Sterling approaches 1.3400

The Pound Sterling rallies to near 1.3175 against the US Dollar after building base around the 61.8% Fibonacci retracement, plotted from late-September high to mid-January low, near 1.2930. The upward-sloping 20-day Exponential Moving Average (EMA) near 1.2922 suggests the near-term outlook is bullish.

The 14-day Relative Strength Index (RSI) jumps around 70.00 after cooling down to near 60.00, indicating that the bullish momentum has resumed.

Looking down, the 61.8% Fibonacci retracement at 1.2930 will act as a key support zone for the pair. On the upside, the September 26 high of 1.3434 will act as a key resistance zone.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

BRANDED CONTENT

Finding the right broker for your trading strategy is essential, especially when specific features make all the difference. Explore our selection of top brokers, each offering unique advantages to match your needs.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.