Pound Sterling weakens as stubborn US inflation improves safe-haven demand

The Pound Sterling (GBP) witnesses an intense sell-off in Tuesday’s early American session as the United States Bureau of Labor Statistics (BLS) has reported a hot

Consumer Price Index (CPI) report for February, and the United Kingdom Office for National Statistics (ONS) has reported soft Employment data.

Read More...

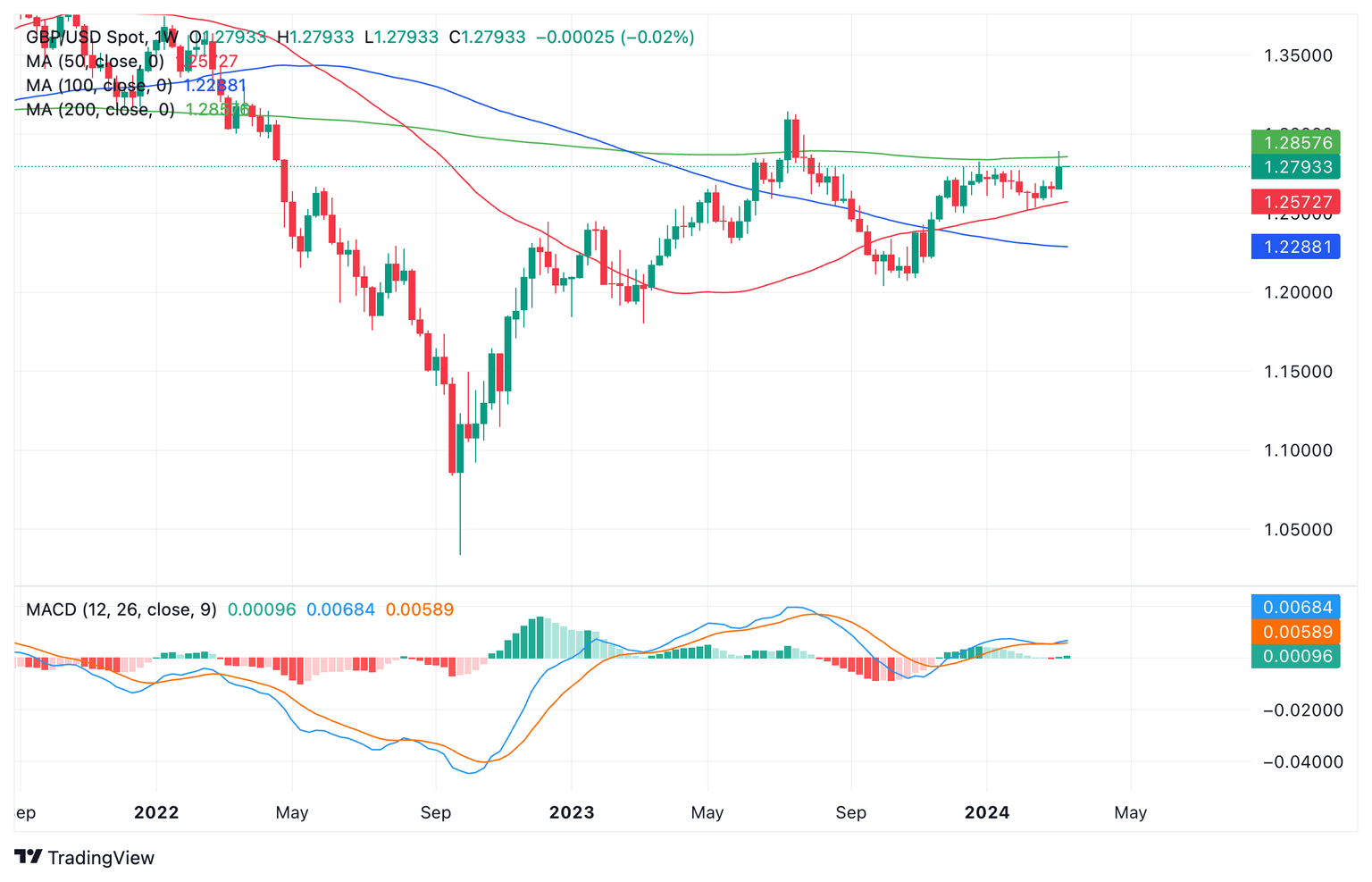

GBP/USD Price Analysis: Rally stalls after touching 200-week SMA

GBP/USD has been rallying higher but it has stalled at the start of the new week after touching resistance at the 200-week Simple Moving Average (SMA). So far, the pullback looks like a correction in an evolving uptrend.

Read More...

GBP/USD holds above the 1.2800 mark, eyes on UK labour market, US CPI data

The GBP/USD pair remains on the defensive above the 1.2800 support during the early Asian trading hours on Tuesday. The lower bets on rate cut expectations from the

Bank of England (BoE) weigh on

the Pound Sterling (GBP). Investors await the UK labour market data and US CPI inflation data on Tuesday for fresh impetus. GBP/USD currently trades near 1.2814, unchanged for the day.

Read More...