Pound Sterling Price News and Forecast GBP/USD: Why Sterling is set to break higher after weathering negative factors

GBP/USD drops to one-week lows under 1.3875 amid a rally of USD

US dollar extends gains during the American session as US yields soar. Cable fails to hold to weekly gains, drops below 1.3900. The GBP/USD extended the decline to 1.3860, the lowest level in a week, on the back of a stronger US dollar across the board. The greenback started a rally after the release of the US official employment report that continues. NFP numbers came in above expectations and triggered a sell-off in Treasuries. Read more...

GBP/USD Weekly Forecast: Why Sterling is set to break higher after weathering negative factors

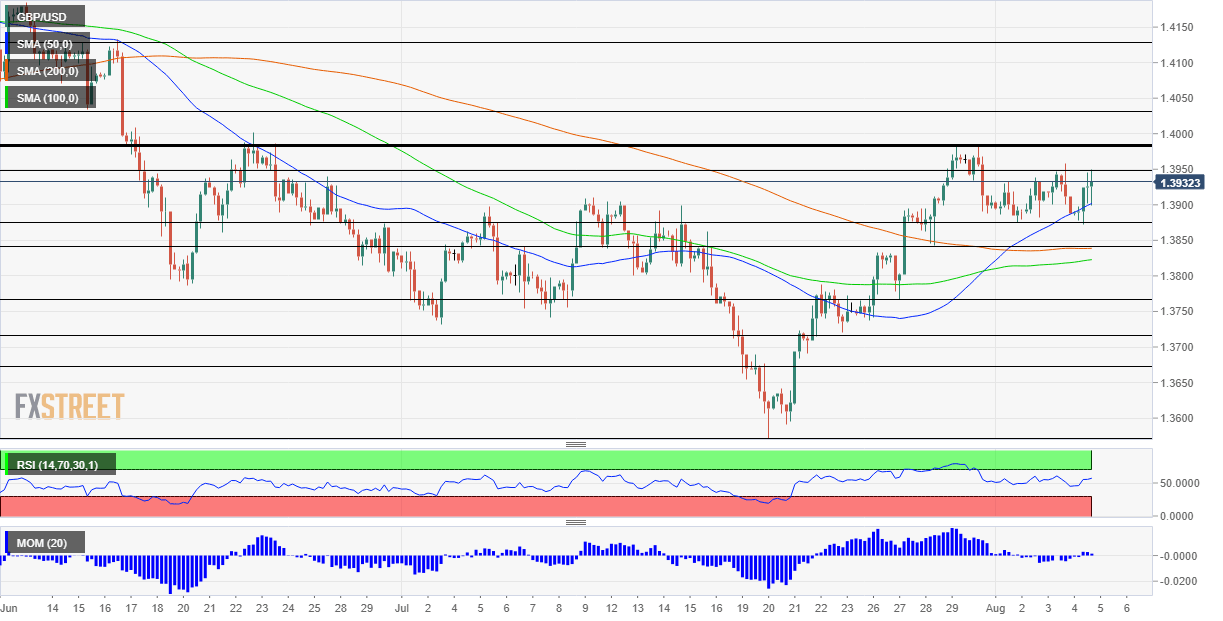

GBP/USD has rocked and rolled in response to the BOE and Nonfarm Payrolls. UK GDP, US inflation and covid headlines are set to shake cable in the upcoming week. Early August´s daily chart is painting a mixed picture. The FX Poll is showing a bullish trend on all timeframes. Resisting gravity and set to skyrocket? GBP/USD has weathered hawkish tunes from the Fed, strong US jobs and BOE caution. Can it move higher now? The next moves hinge on critical US inflation figures, Britain's covid advantage and UK growth data. Read more...

GBP/USD Forecast: Bailey bails sterling out, Nonfarm Payrolls may test critical support

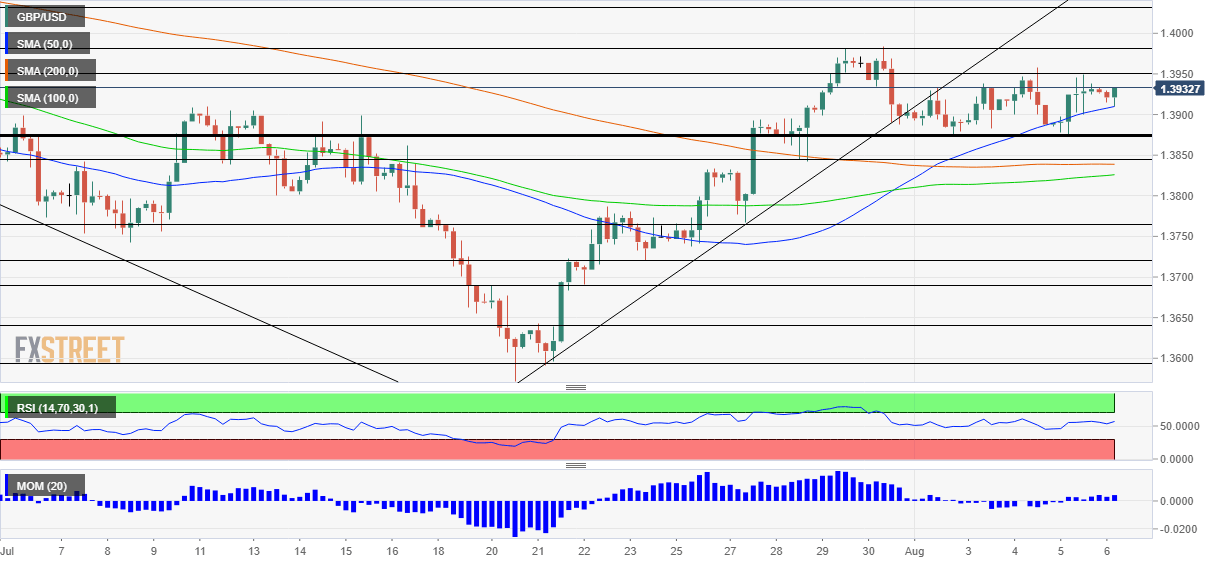

GBP/USD has weathered dollar strength after the BOE took a hawkish step. US Nonfarm Payrolls are left, right and center for markets. Friday's four-hour chart is showing bulls are in control, and where critical support awaits. Tip-toeing toward tightening – the Bank of England has indicated it is ready to "modestly" change its monetary policy, and that has eventually proved to be positive for the pound. A bigger test is due now. Read more...

Author

FXStreet Team

FXStreet