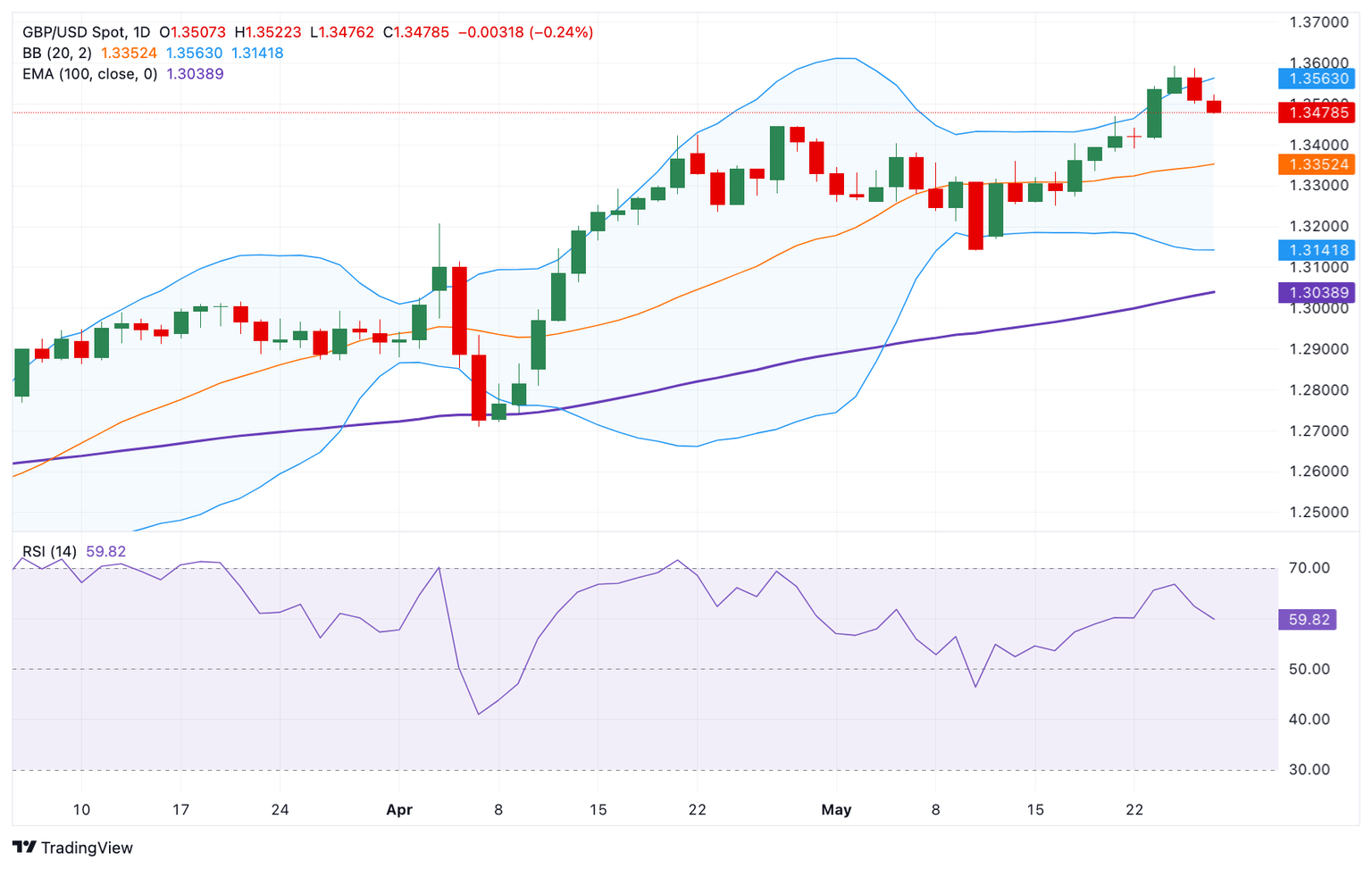

Pound Sterling Price News and Forecast: GBP/USD weakens to near 1.3480 on Wednesday

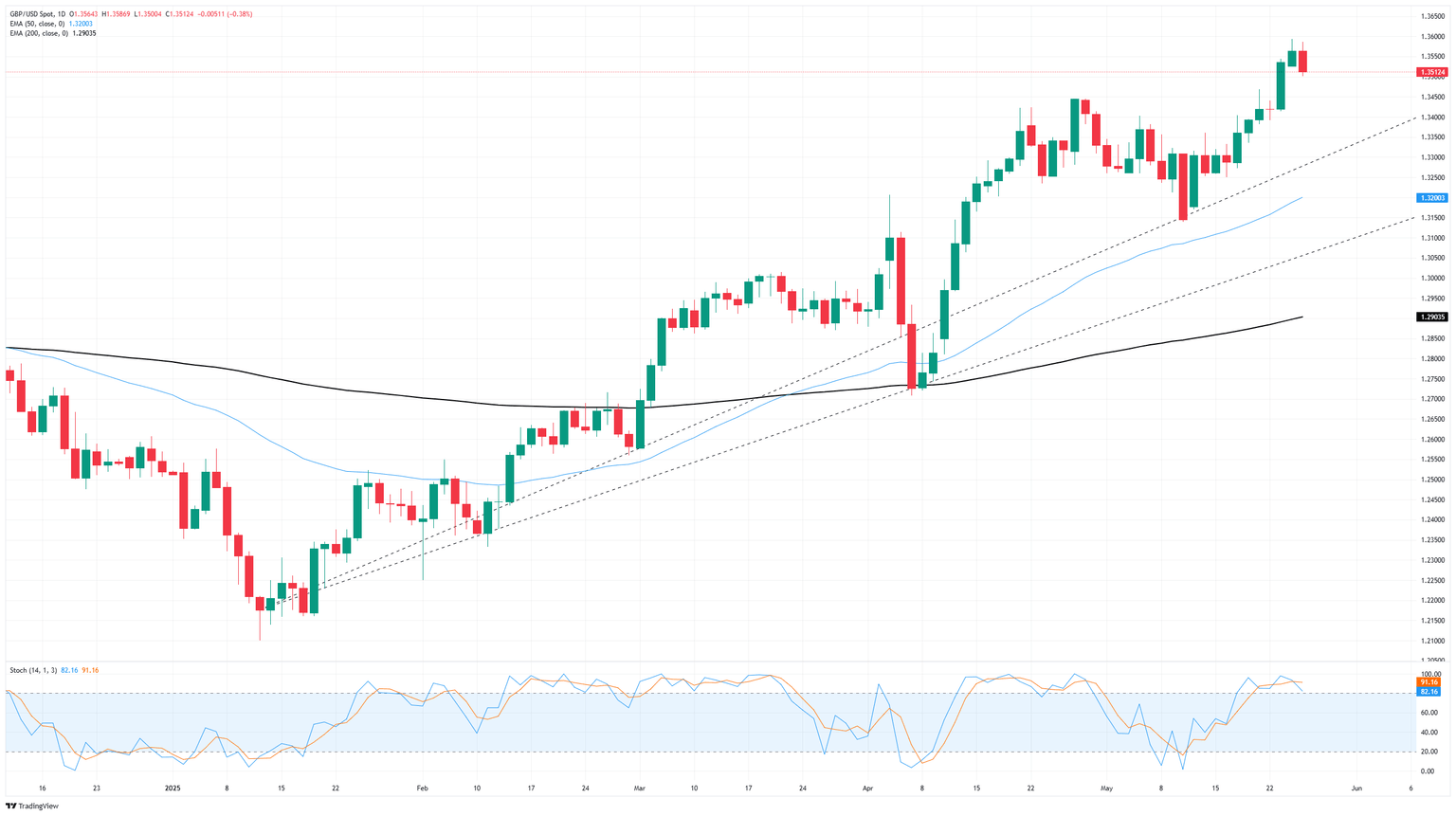

GBP/USD Price Forecast: Keeps bullish vibe, first upside target emerges above 1.3550

The GBP/USD pair attracts some sellers to around 1.3480 during the Asian trading hours on Wednesday. The Greenback strengthens against the Pound Sterling (GBP) on the economic signs in the United States (US).

Data released by the Conference Board on Tuesday showed that the US Consumer Confidence Index rose to 98.0 in May from 86.0 (revised from 85.7). The Minutes of the Federal Open Market Committee (FOMC) will take center stage later on Wednesday. Read more...

GBP/USD: Poised to buckle under the weight of its own success?

GBP/USD pared recent gains on Tuesday, snapping a six-day win streak and knocking price action away from the 1.3600 handle after the pair tapped fresh multi-year highs this week. Another tariff-talk-fueled upswing in broad-market investor sentiment bolstered the US Dollar (USD), sparked by the Trump administration once again stepping back from its own tariff threats.

The Bank of England (BoE) is looking less likely to deliver as many rate cuts as many had expected earlier in the year, helping to bolster the Pound Sterling into its highest prices against the Greenback since early 2022. Further appearances from BoE policymakers are expected over the rest of the week, but the narrative is not expected to change much. Read more...

GBP/USD eases from three-year high as US Dollar steadies on trade hopes

The British Pound (GBP) edges lower against the US Dollar, retreating from a three-year high, with the GBP/USD pair trading around 1.3510 during the American session on Tuesday.

The mild correction in spot prices comes as the US Dollar found footing on renewed trade optimism between the US and the EU. Hopes of a breakthrough in tariff negotiations between Washington and Brussels have lifted risk sentiment, lending modest support to the Greenback after weeks of pressure from fiscal concerns and a cautious Federal Reserve (Fed) stance. Read more...

Author

FXStreet Team

FXStreet