Pound Sterling Price News and Forecast: GBP/USD trading heavily on Brexit jitters

GBP/USD Forecast: Boris' conditional delay, upbeat vaccine news may help sterling recover

"Now is the time to ease off the accelerator" – Prime Minister Boris Johnson has announced a four-week delay in England's last reopening stage, to the dismay of some of the press. The PM took the decision in response to the rapid spread of the Delta COVID-19 variant, which is already causing an increase in hospitalizations. However, not all the news is bad. Read more...

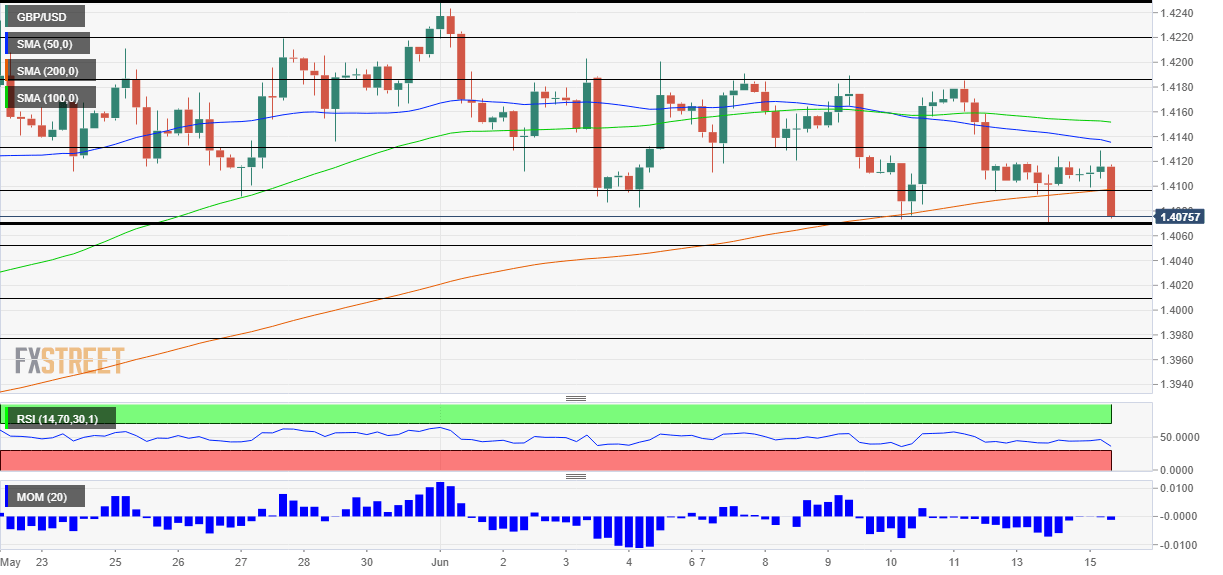

GBP/USD Forecast: Pound trading heavily on Brexit jitters

The GBP/USD pair fell to a fresh two-month low of 1.4033 but managed to recover some ground ahead of the daily close and settled in the 1.4080 region. UK data was mostly upbeat, as the ILO Unemployment Rate contracted to 4.% in the three months to April as expected, while the number of people claiming for unemployment benefits decreased by 92.6K in My, much better than the expected increase and the previous -55.8K. Even further, wages were up by more than anticipated. Read more...

GBP/USD Price Analysis: Bulls target breakout to old hourly support

GBP/USD bulls are taking charge on the shorter-term time frames but bears lurking. The price action is choppy as traders await the Fed, but technicals speak for themselves. The following is a top-down analysis that illustrates the bearish bias for the near/medium term compared to a bullish bias longer term. For the very immediate future, the bulls are taking charge and are on the verge of a breakout to the hourly resistance as shown below. Read more...

Author

FXStreet Team

FXStreet