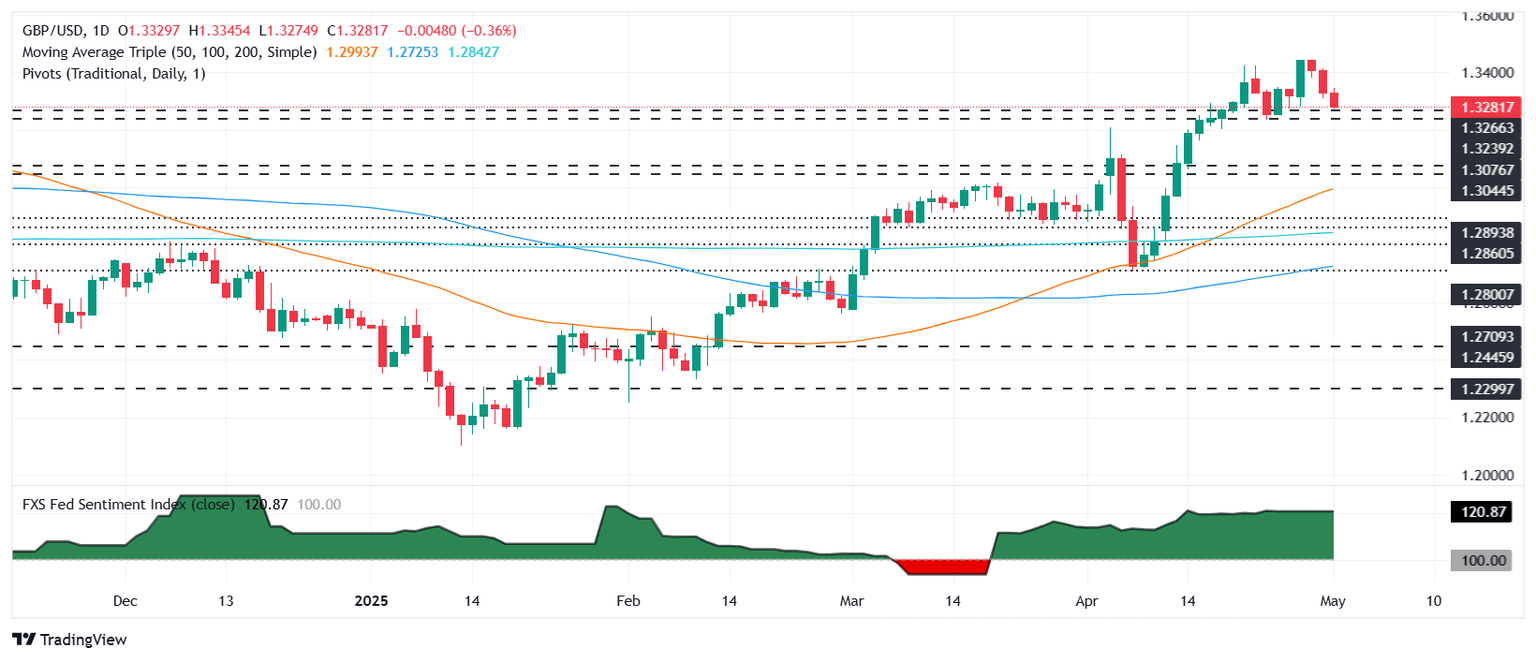

Pound Sterling Price News and Forecast: GBP/USD trades with mild losses around 1.3275

GBP/USD posts modest losses below 1.3300 ahead of US NFP release

The GBP/USD pair drifts lower to near 1.3275 during the Asian trading hours on Friday. The positive developments surrounding US-China trade talks provide some support to the US Dollar (USD). Investors will closely monitor the US April employment report later on Friday, including the Nonfarm Payrolls (NFP), the Unemployment Rate and Average Hourly Earnings.

Early Friday, China said it is assessing the possibility of trade talks with the United States, the first sign since US President Donald Trump raised tariffs in April. The easing of a trade war between the world’s two largest economies and the hope that negotiations could begin between the two sides lift the Greenback and create a headwind for the major pair. Read more...

GBP/USD slips below 1.33 as US and UK manufacturing activity slumps

The Pound Sterling (GBP) edges lower against the US Dollar (USD) on Thursday, with most European markets closed during Labor Day. The release of manufacturing activity data on both sides of the Atlantic and United States (US) trade policies continued to drive the financial markets. At the time of writing, GBP/USD trades at 1.3295, down 0.25%.

The US cash equity markets opened the session in the green. Recently released data by the ISM showed that manufacturing activity in the US deteriorated in April. The ISM Manufacturing PMI rose to 48.7 in April, beating expectations of 48 but still down from March’s 49. Read more...

Author

FXStreet Team

FXStreet