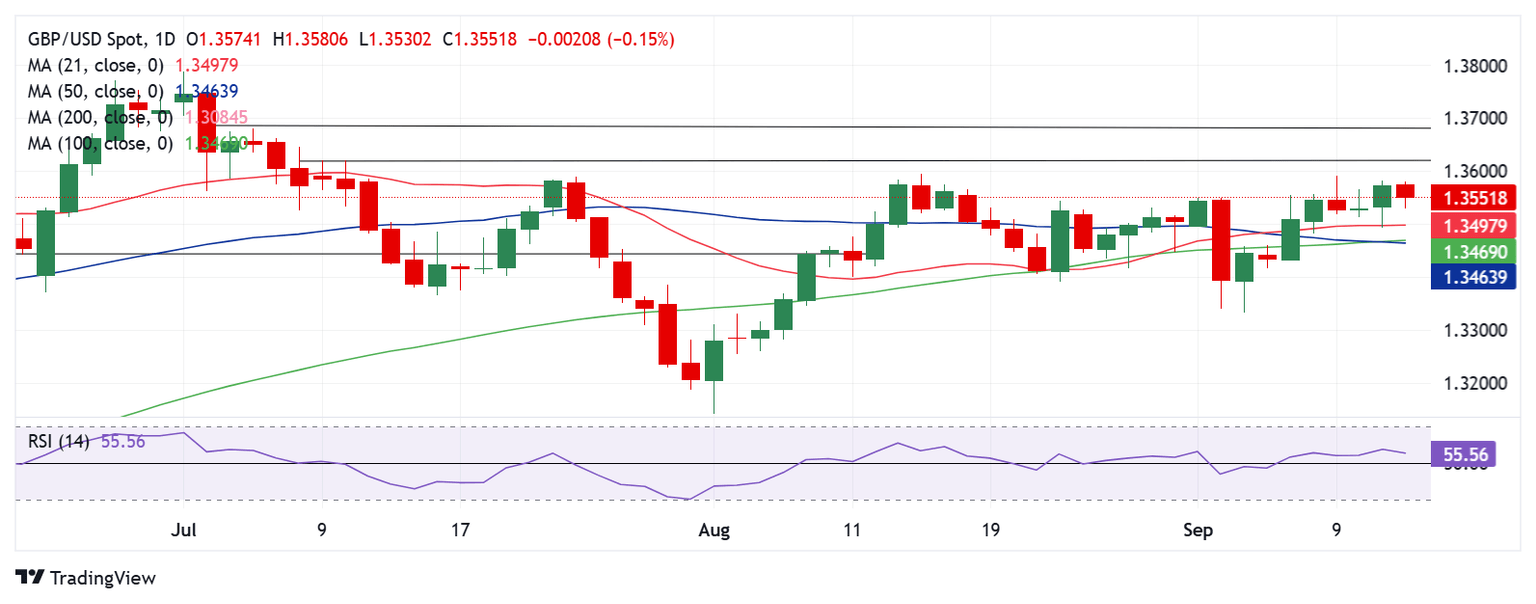

Pound Sterling Price News and Forecast: GBP/USD trades with mild gains around 1.3555 on Monday

GBP/USD holds positive ground above 1.3550 as potential Fed rate cut looms

The GBP/USD pair posts modest gains near 1.3555 during the early Asian session on Monday. Traders expect the US Federal Reserve (Fed) to deliver its first rate cut of the year at its policy meeting on Wednesday, which might weigh on the US Dollar (USD). Later on Monday, the New York Empire State Manufacturing Index for September will be released.

Bets are strongly in favor of a Fed rate reduction at the September meeting on Wednesday, fueled by recent evidence of a weakening labor market. According to the CME FedWatch tool, traders are now pricing in a near 100% probability of a quarter-point rate cut at the upcoming meeting. A small minority even sees a possibility of a jumbo rate cut. Read more...

GBP/USD Weekly Forecast: Pound Sterling traders eye Fed and BoE decisions

The Pound Sterling (GBP) booked a third consecutive weekly gain against the US Dollar (USD), testing the 1.3600 barrier to reach monthly highs. It was all about the increased dovish sentiment surrounding the US Federal Reserve’s (Fed) path forward on interest rates, which smashed the US Dollar to the lowest level in seven weeks across its six major currency rivals.

The USD bearishness helped GBP/USD, while the Pound Sterling benefited from the expectations of policy divergence between the Fed and the Bank of England (BoE). Weakening labor market conditions in the United States (US) overshadowed sticky consumer inflation, ramping up calls for three rate cuts this year, starting next week. Read more...

Author

FXStreet Team

FXStreet