GBP/USD Weekly Forecast: Pound Sterling traders eye Fed and BoE decisions

- Pound Sterling retested a stiff resistance near 1.3600 versus the US Dollar.

- GBP/USD braces for a busy week, highlighted by the Fed and BoE policy decisions.

- Technically, the path of least resistance appears to the upside for GBP/USD.

The Pound Sterling (GBP) booked a third consecutive weekly gain against the US Dollar (USD), testing the 1.3600 barrier to reach monthly highs.

Pound Sterling capitalized on USD’s decline

It was all about the increased dovish sentiment surrounding the US Federal Reserve’s (Fed) path forward on interest rates, which smashed the US Dollar to the lowest level in seven weeks across its six major currency rivals.

The USD bearishness helped GBP/USD, while the Pound Sterling benefited from the expectations of policy divergence between the Fed and the Bank of England (BoE).

Weakening labor market conditions in the United States (US) overshadowed sticky consumer inflation, ramping up calls for three rate cuts this year, starting next week.

Bets for a jumbo Fed rate cut this month also gathered strength following the weak US Nonfarm Payrolls (NFP) data for August.

The August US jobs report underscored the fourth consecutive month of weak hiring, cementing a 25 basis points (bps) September Fed rate cut.

The Bureau of Labor Statistics (BLS) showed on September 5 that the headline US NFP increased by 22,000, far below forecasts of 75,000, while the Unemployment Rate climbed to 4.3%, the highest level since late 2021.

Later in the week, the highly anticipated NFP Benchmark Revision report showed downward revisions of nearly a million fewer jobs compared to previous government estimates for the April 2024 to March 2025 period, per Reuters.

Meanwhile, the Producer Price Index (PPI) for final demand dipped 0.1% last month after a downwardly revised 0.7% jump in July. Annually, PPI inflation fell to 2.6% in August versus 3.1% (revised from 3.3%) in July.

The final data releases of the week from the US showed that the University of Michigan's Consumer Sentiment Index dropped to 55.4 in September's preliminary estimate from 58.2 in August. This reading came in worse than the market expectation of 58. Other details of the publication showed that the Consumer Current Conditions Index edged lower to 61.2 from 61.7, while the Consumer Expectations Index declined to 51.8 from 55.9. These readings limited the USD's gains heading into the weekend and helped GBP/USD hold its ground.

Markets continued to price in about a 92% chance of a 25 basis points (bps) rate cut at the Fed's September meeting and an 8% probability of a 50 bps rate cut, according to the CME Group's FedWatch tool.

Growing bets for aggressive Fed easing and global risk rally led by the optimism around Artificial Intelligence (AI) exacerbated USD’s pain, lifting the pair to fresh four-week highs near 1.3600.

However, the upside was capped on several occasions by renewed geopolitical tensions in the Middle East and between Russia and Poland.

Late Monday, Reuters reported suspected Russian drone incursions into Poland’s airspace, putting the Polish air defenses on alert as Russia breached the North Atlantic Treaty Organization (NATO) airspace.

Traders also briefly turned cautious after Israel attacked the Hamas leadership in Doha, Qatar’s capital, restricting the risk-sensitive Pound Sterling.

Friday’s Gross Domestic Product (GDP) and Industrial Production data also helped limit the pair’s bullish momentum.

The UK economy stagnated in July, in line with analysts' expectations, with the GDP arriving at 0%. Meanwhile, monthly Industrial and Manufacturing Production dropped by 0.9% and 1.3%, respectively, in July. Both readings undermined market expectations.

Fed and BoE policy announcements to lead the way

Following a critical week, in terms of US data releases, GBP/USD traders prepare for another intense week, packed with top-tier US and UK statistics and central banks’ policy announcements.

Monday poses for a quiet start to the big week as the UK employment data and US Retail Sales report will make it up on Tuesday.

The UK CPI data for August will garner some attention on Wednesday ahead of the all-important Fed policy showdown.

Traders will quickly move past the Fed aftermath to focus on the Bank of England (BoE) rate decision and the language in the policy statement for fresh signals on the bank’s next move on rates.

The US weekly Unemployment Claims will also offer some trading incentives on Thursday.

On Friday, the UK Retail Sales will be the only relevant data release wrapping up a busy week.

Besides, markets will continue to pay close attention to geopolitical, trade developments and speeches from Fed policymakers for their influence on the performance of the US Dollar and the Pound Sterling.

GBP/USD: Technical Outlook

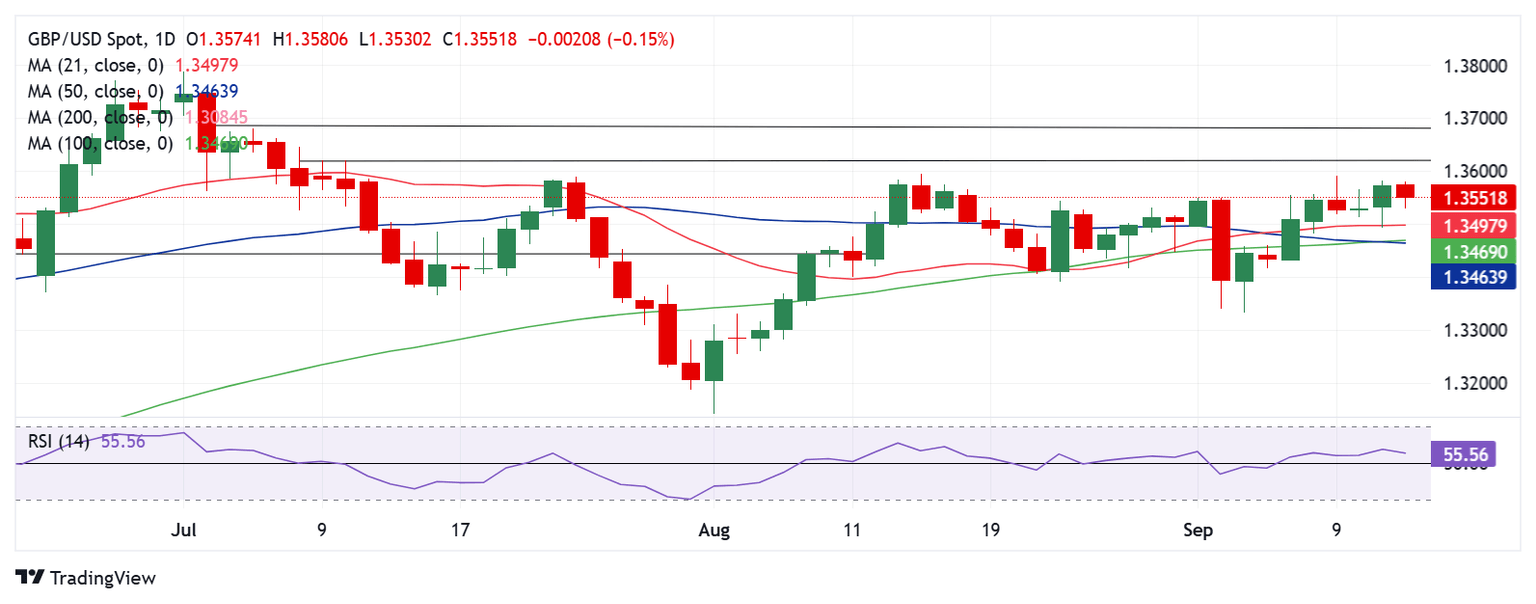

The daily chart shows the GBP/USD pair continues to challenge the 1.3600 stiff resistance, with the 14-day Relative Strength Index (RSI) holding comfortably above the midline.

However, a Bear Cross confirmation raises doubts on further upside. The 50-day Simple Moving Average (SMA) closed below the 100-day SMA on Thursday, validating the bearish crossover.

The immediate support is located at the 21-day SMA at 1.3498, below which the confluence zone of the 50-day SMA and the 100-day SMA near 1.3465 will be put to the test.

A sustained break below the latter will open up a fresh downtrend toward the September low of 1.3333. Additional declines could threaten the August 4 low of 1.3254.

Alternatively, buyers must find acceptance above the 1.3600-1.3620 supply zone on a daily candlestick closing basis.

The July 4 high of 1.3681 will be next on their radars, followed by 1.3788 (July 1 high).

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.