Pound Sterling Price News and Forecast: GBP/USD trades near 1.2850 after recovering recent losses

GBP/USD trades near 1.2850 after recovering recent losses, BoE's Breeden speech awaited

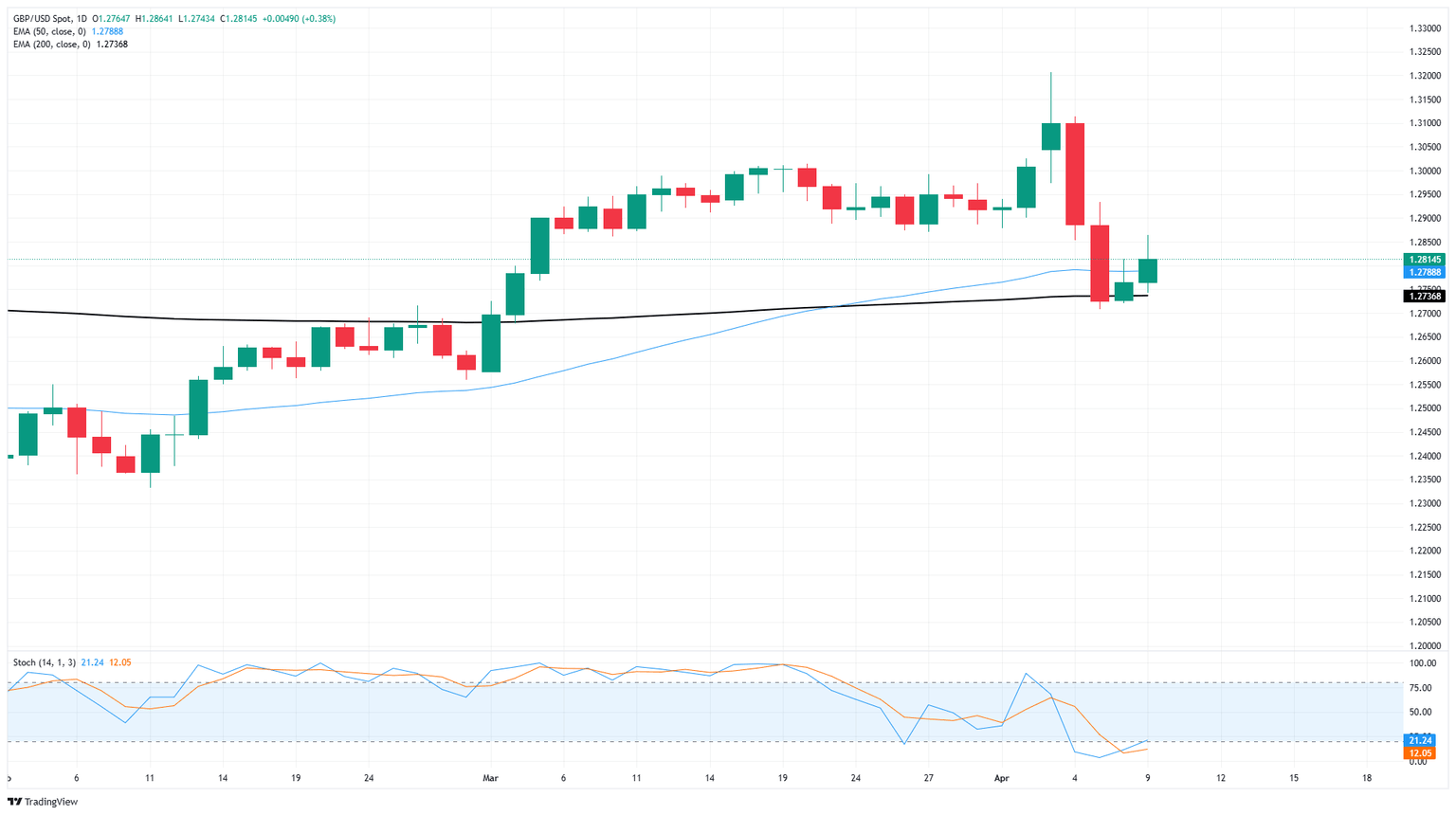

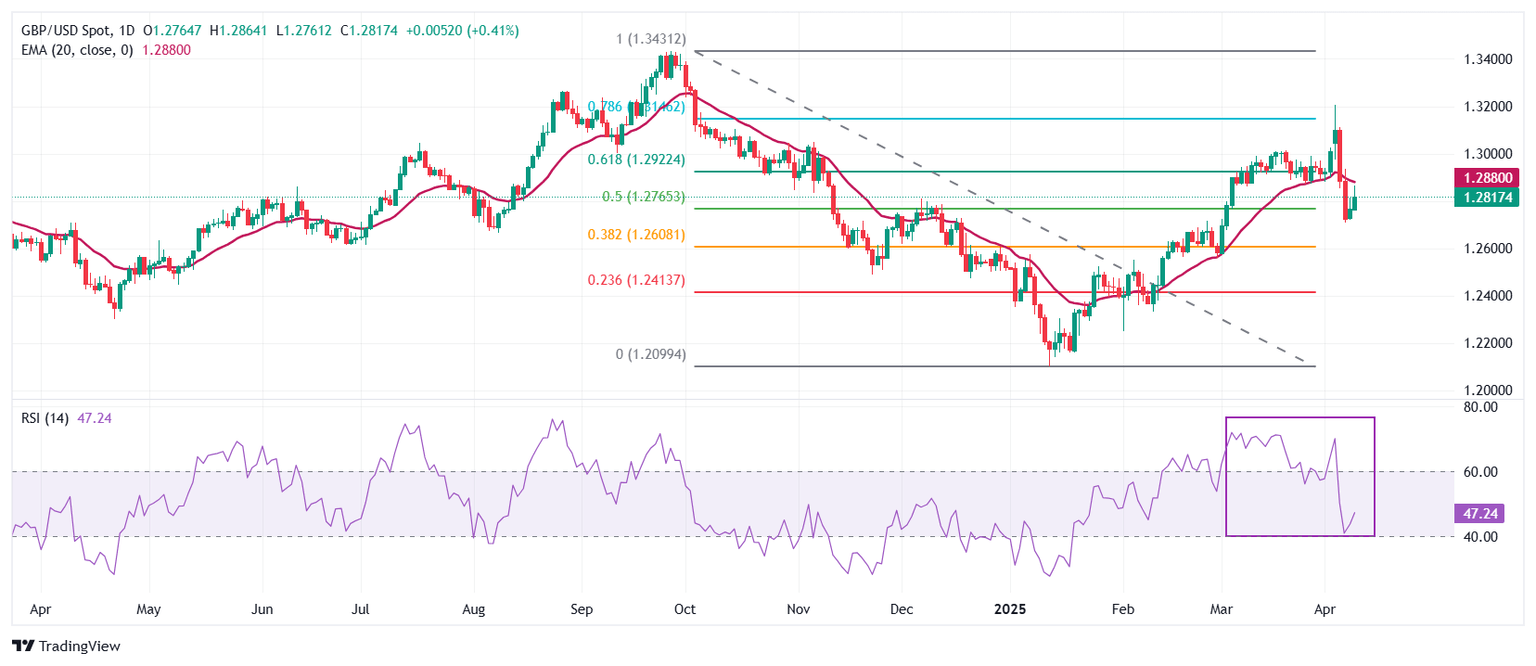

The GBP/USD pair recovers its daily losses and continues its winning streak for the third successive session, hovering around 1.2850 during Asian trading hours on Thursday. The British Pound (GBP) came under pressure following the release of weaker-than-expected data from the RICS Housing Price Balance, which showed just a 2% increase in March. This marked a significant slowdown from the 20% and 11% gains recorded in January and February, respectively, and fell far short of the anticipated 8% rise—highlighting a stagnation in price growth over recent months. Read More...

GBP/USD explores further upside as market sentiment rebounds after tariff delay

GBP/USD tested higher on Wednesday, climbing back over the 1.2800 handle after broad-market sentiment recovered across the board. The Trump administration has once again pivoted away from its own “no exceptions, no delays” tariff policy, and has again delayed tariffs, this time for 90 days. Read More...

Pound Sterling slumps as Trump tariffs prompt global economic risks

The Pound Sterling (GBP) tumbles against its major peers on Wednesday. The British currency faces a sharp selling pressure as the Bank of England's (BoE) Financial Policy Committee (FPC) has warned that a major shift in global trading arrangements could harm "financial stability by depressing growth". Read More...

Author

FXStreet Team

FXStreet