GBP/USD explores further upside as market sentiment rebounds after tariff delay

- GBP/USD rose back above 1.2800 on Wednesday as risk appetite roars back.

- The Trump administration delayed its own tariffs once again, sending markets soaring.

- Key US data still remains on the docket this week, with US CPI and PPI inflation, as well as consumer sentiment survey results.

GBP/USD tested higher on Wednesday, climbing back over the 1.2800 handle after broad-market sentiment recovered across the board. The Trump administration has once again pivoted away from its own “no exceptions, no delays” tariff policy, and has again delayed tariffs, this time for 90 days.

Global markets responded by widely surging, though bullish appetite remained limited for Cable, which rose a meager 0.3%. US President Donald Trump still has a 10% “reciprocal” tariff in place as the White House gives most of its trading partners time to negotiate out from tariff levels that were initially calculated by dividing imports by US exports, however the Trump administration has still raised tariffs on Chinese goods to 125% in a retaliatory move following China’s own retaliatory tariff on US goods of 84%, which will impact US agriculture almost exclusively.

Rate markets have been pushed sharply off of their rate-cut perch, with rate swap traders now pricing in 75 bps of interest rate cuts from the Federal Reserve (Fed) through the remainder of the year. Rate markets are still betting that the next quarter-point cut will be delivered in June, however analysts from JPMorgan have warned that it is far more likely the Fed will be stuck in a wait-and-see cycle thanks to tariff uncertainty until at least September.

It’s all about US data for the remainder of the trading week: US Consumer Price Index (CPI) inflation figures are slated for Thursday, with US Producer Price Index (PPI) inflation and University of Michigan (UoM) Consumer Sentiment Index survey results are both set to publish on Friday. This will be the last blast of key US inflation and sentiment figures from the ‘pre-tariff’ phase of 2025, marking a key measurement metric for the remainder of the calendar year.

GBP/USD price forecast

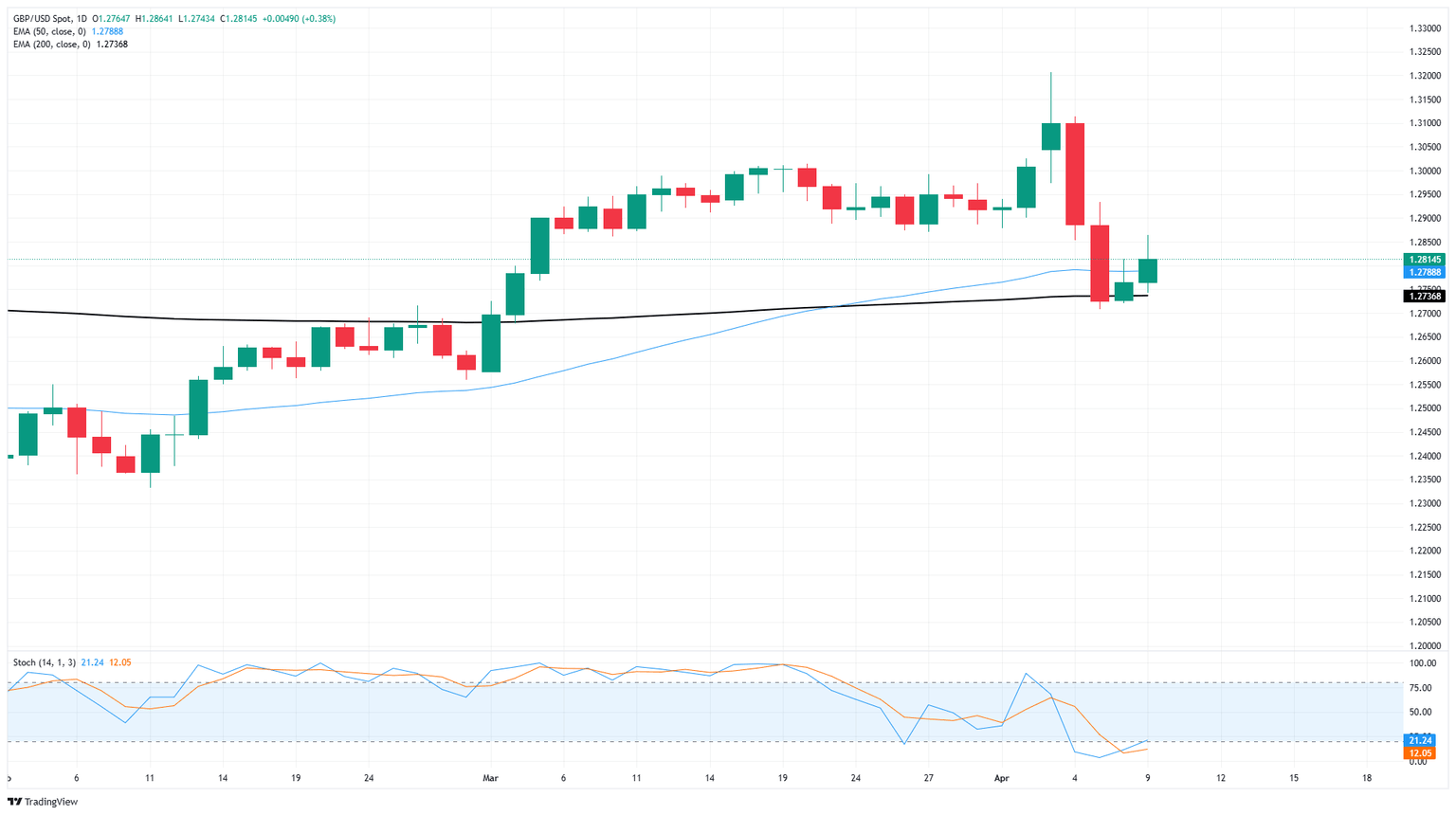

GBP/USD caught another bid on Wednesday, extending a thin bounce from the 200-day EMA just above 1.2700 and grasping for a second straight day of gains. Bullish momentum remains borderline anemic, but bidding pressure was just enough to keep Cable on the high side.

Bidders will still need to extend from the 200-day EMA before confirming a bullish recovery, but short momentum appears to have evaporated too quickly to allow fresh selling positions.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.