Pound Sterling Price News and Forecast: GBP/USD tests immediate barrier at nine-day EMA at 1.2938

GBP/USD Price Forecast: Tests nine-day EMA barrier near 1.2950 amid a bullish bias

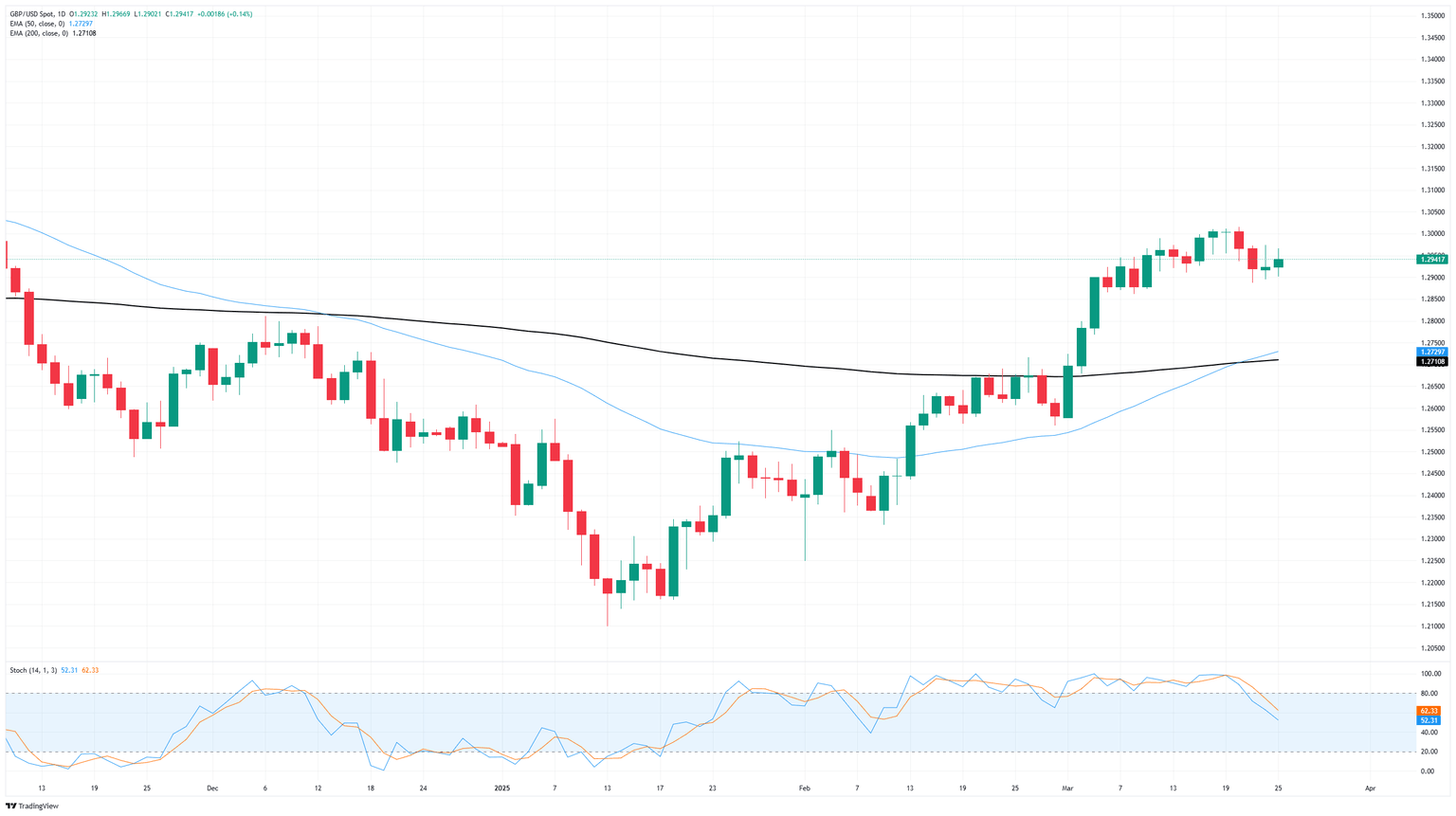

The GBP/USD pair loses ground after registering gains in the previous two sessions, trading around 1.2930 during the Asian hours on Wednesday. The technical analysis of the daily chart indicates a continued bullish bias, with the pair consolidating within an ascending channel pattern.

The 14-day Relative Strength Index (RSI) is positioned above 50, reinforcing strong bullish momentum. However, the GBP/USD pair has broken below the nine-day Exponential Moving Average (EMA), suggesting a bearish shift in the short-term price momentum. Read more...

GBP/USD coils ahead of key UK CPI inflation print

GBP/USD continues to wear worry lines into the charts near the 1.3000 handle as Cable traders draw into the midrange after a near-term bullish recovery lost steam. The pair has yet to draw in a confirmed pullback, as both Pound Sterling and Greenback traders await firmer signs of economic health from either economy.

The US Conference Board (CB) reported a further increase in one-year consumer inflation expectations on Tuesday, now at 6.2% in March compared to 5.8% in February. Consumers continue to express significant concern regarding the persistently high prices of essential household items, such as eggs, along with worries about potential inflation consequences tied to tariffs from the Trump administration. Additionally, the CB’s consumer confidence survey for future economic expectations has dropped to a new 12-year low in March, recording a figure of 65.2, which is substantially below the 80.0 threshold that often indicates a potential recession. Read more...

Author

FXStreet Team

FXStreet