Pound Sterling Price News and Forecast: GBP/USD strengthens near 1.3460 in the Asian session

GBP/USD edges higher above 1.3450 as traders await Fedspeak, key US data

The GBP/USD pair recovers some lost ground to around 1.3460 during the Asian trading hours on Thursday. The US Dollar (USD) weakens against the Pound Sterling (GBP) as traders await more cues from the Fedspeak later on Tuesday. Also, the final print of the US Gross Domestic Product (GDP) growth for the second quarter (Q2), Durable Goods Orders and weekly Initial Jobless Claims will be published.

Traders weighed the prospect of a Federal Reserve (Fed) easing cycle in the wake of a cautious tone from policymakers while awaiting data that may outline the impact of tariffs. Fed’s Powell struck a cautious tone on further easing on Tuesday, saying that the US central bank needs to continue balancing the competing risks of high inflation and a weak job market in coming policy decisions. Read more...

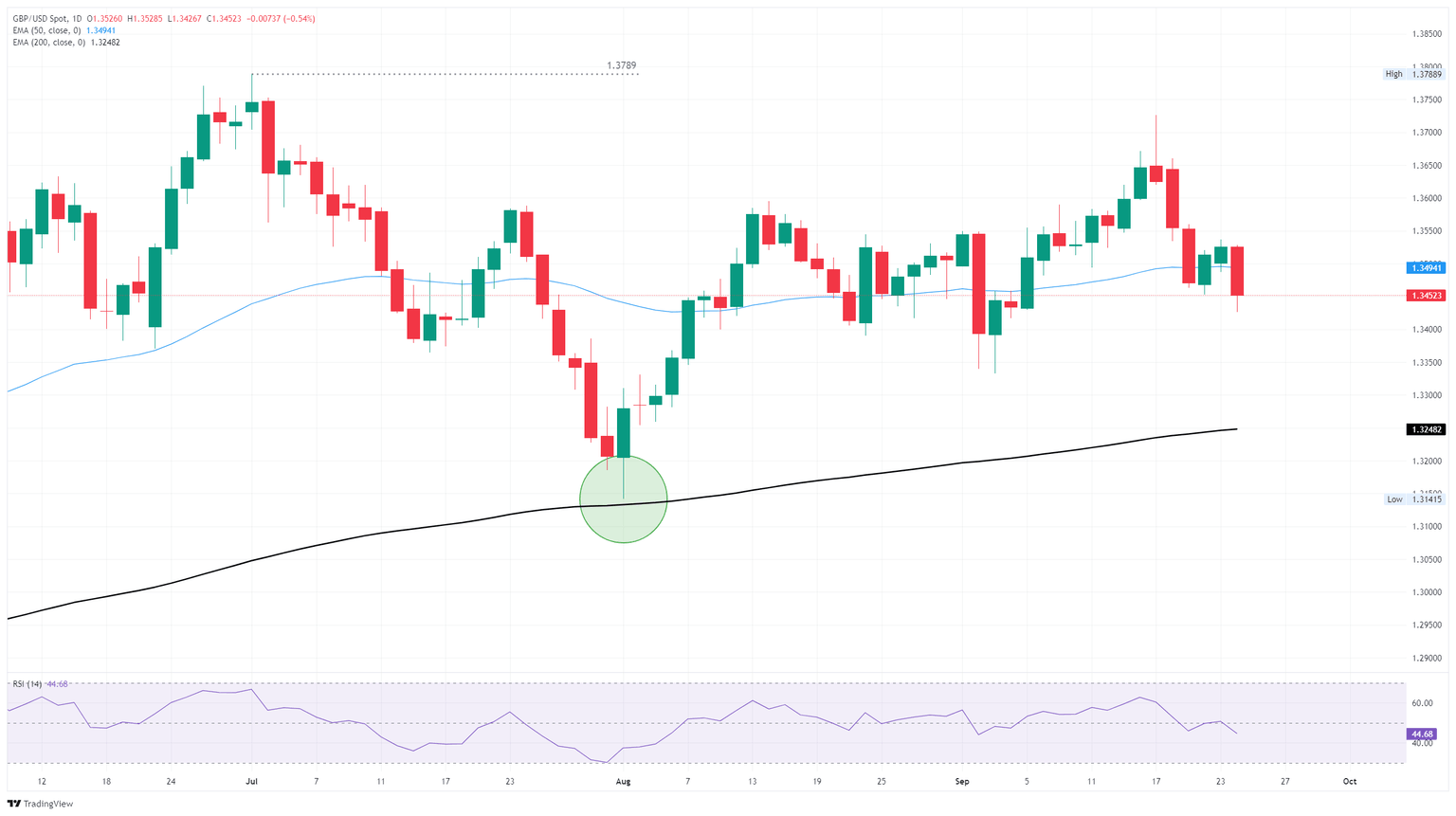

GBP/USD flubs bullish recovery, falls back below key technical levels

GBP/USD fumbled a near-term bullish correction on Wednesday, slipping back below the 50-day Exponential Moving Average (EMA) near 1.3500 and snapping a two-day winning streak. Broad-market risk appetite sharply reversed course heading through the midweek market session as investors weighed a looming US government shutdown and a rapidly approaching round of key US Personal Consumption Expenditure Price Index (PCE) inflation figures.

Cable tested its lowest bids in three weeks on Wednesday, retreating a little over one-half of one percent through the day’s market sessions. GBP/USD has fallen back below the 50-day EMA, but further declines should find a technical floor from the 1.3400 handle. Read more...

Author

FXStreet Team

FXStreet