Pound Sterling Price News and Forecast: GBP/USD strengthens amid speculation around Trump trade policy with UK

GBP/USD appreciates to near 1.3350, rebounds due to potential US-UK trade deal

The GBP/USD pair rebounds from its recent losses, trading near 1.3340 during the Asian session on Thursday. The Pound Sterling (GBP) gains traction on speculation that the Trump administration may soon announce a trade agreement with the United Kingdom (UK).

According to “The New York Times”, citing three sources familiar with the matter, US President Donald Trump is expected to unveil the trade deal on Thursday. On Wednesday night, Trump hinted at the announcement in a social media post: “Big News Conference tomorrow at 10:00 A.M., The Oval Office, concerning a MAJOR TRADE DEAL WITH REPRESENTATIVES OF A BIG, AND HIGHLY RESPECTED, COUNTRY. THE FIRST OF MANY!!!” Read more...

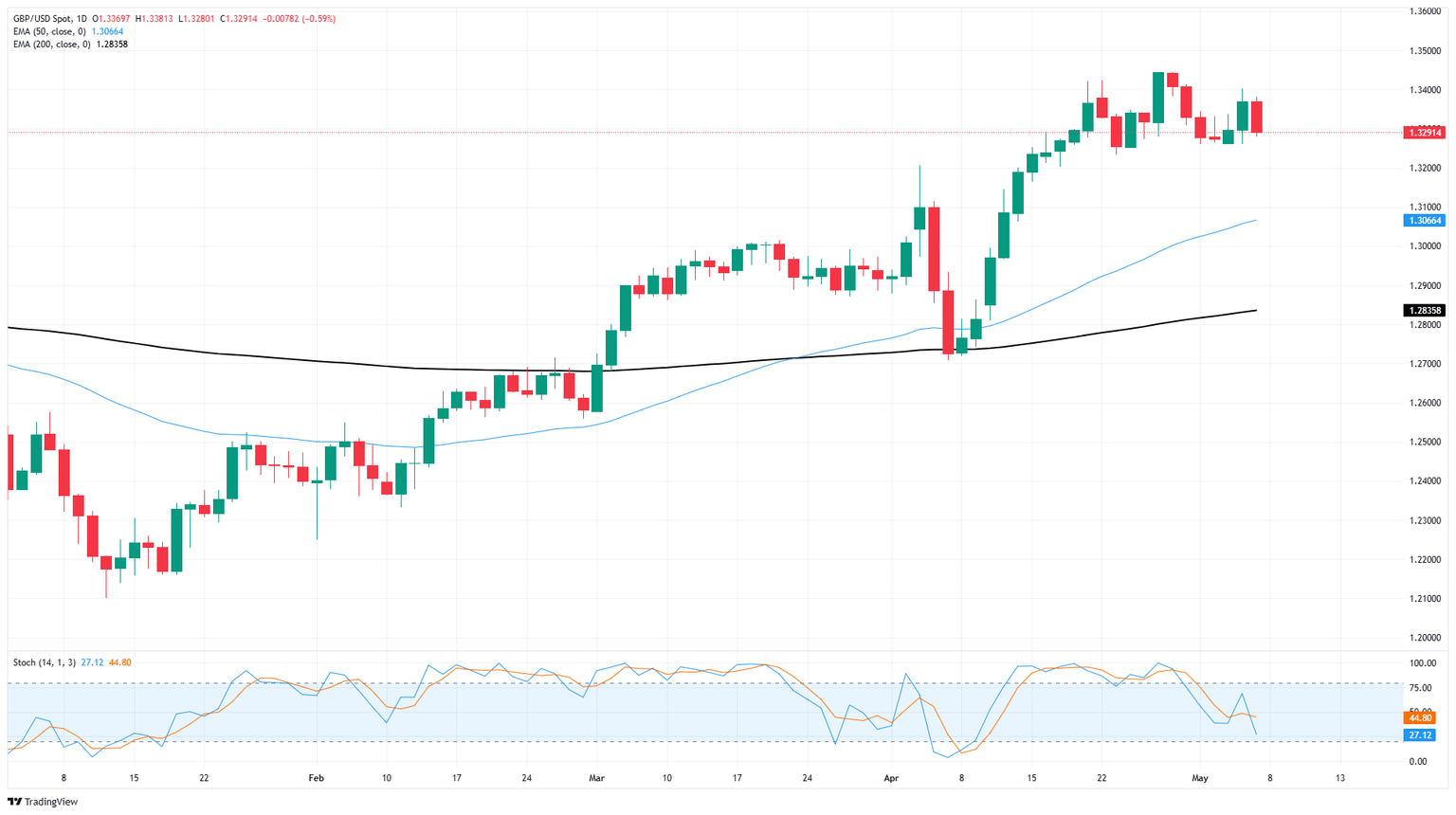

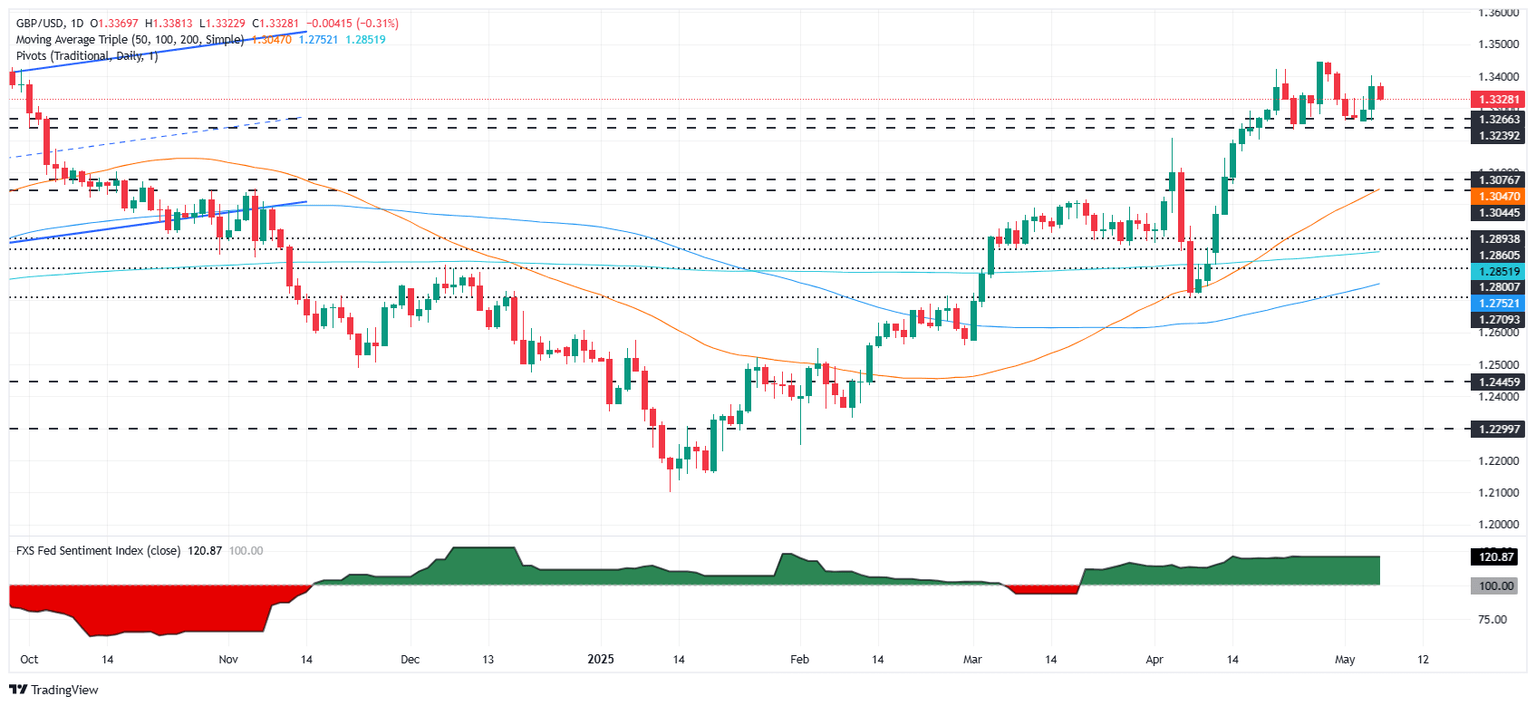

GBP/USD backslides ahead of BoE rate call

GBP/USD fell back on Wednesday, shedding six-tenths of one percent as markets kept one foot firmly planted in the safe haven Greenback. The Federal Reserve (Fed) kept rates on hold, as markets broadly expected, but Fed policymakers remaining firmly stuck in a “wait-and-see” approach hampered risk appetite during the midweek market session. The Bank of England (BoE) is up next with its own rate call on Thursday, and is widely expected to deliver another quarter-point rate trim.

Market sentiment declined after Fed Chair Jerome Powell's press conference. He stated that US trade tariffs could hinder Fed goals for inflation and employment this year. Powell warned that ongoing policy instability may compel the Fed to adopt a 'wait-and-see' approach to interest rates. Although consumer and business sentiment were severely impacted by the Trump administration's tariffs, the lack of significant negative economic data complicates the Fed’s justification for immediate interest rate changes. Read more...

GBP/USD slides as Fed holds rates, flags rising inflation and growth uncertainty

GBP/USD extended its losses on Wednesday after the Federal Reserve (Fed) decided to keep interest rates unchanged as expected, with most eyes set on Fed Chair Jerome Powell's press conference. At the time of writing, the pair trades near 1.3331, down more than 0.20%.

GBP/USD drops over 0.20% to 1.3331 as traders await Powell’s press conference for policy clarity. The Federal Reserve unanimously voted to hold interest rates steady at 4.25%–4.50%, as expected. The central bank noted that economic uncertainty has increased, with heightened risks of both elevated inflation and rising unemployment. Read more...

Author

FXStreet Team

FXStreet