Pound Sterling Price News and Forecast GBP/USD: Sterling capped by looming Federal Reserve policy change

GBP/USD Weekly Forecast: Sterling capped by looming Federal Reserve policy change

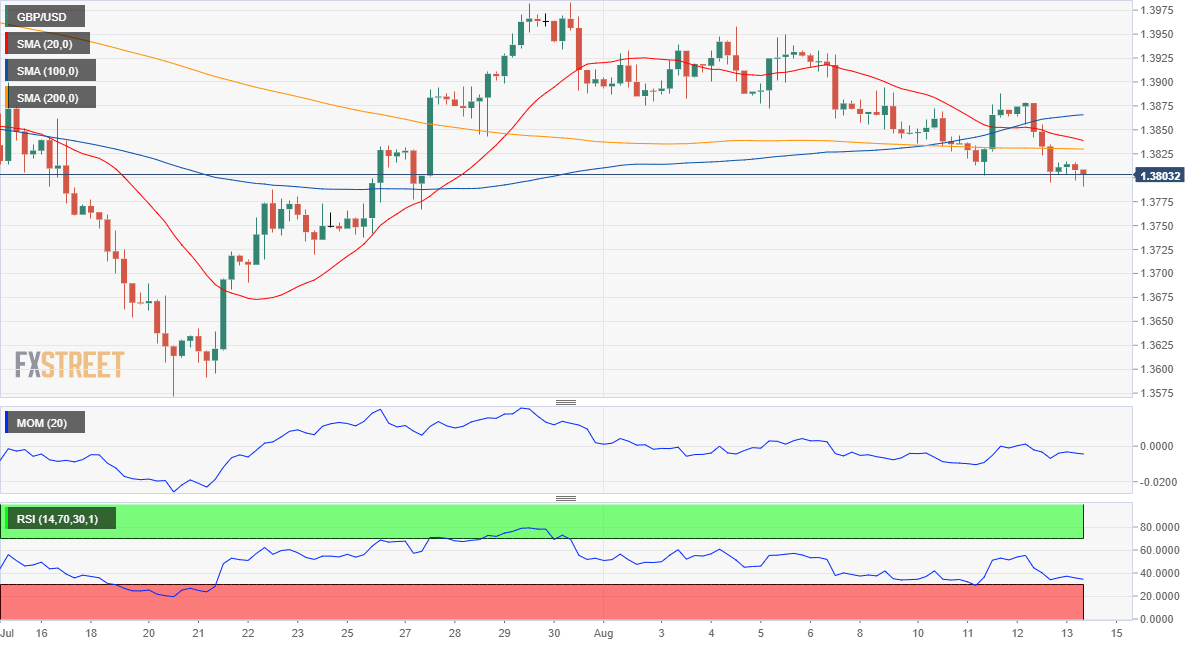

Sterling stalls near the middle of its six-month range. UK economic data improves, promising an advance in the third quarter. Covid cases climb but future direction and impact are uncertain. FXStreet Forecast Poll is bullish but the gains are minor. Sterling declined on the week but the close at 1.3861, just points from the open, gave no indication that the pound was any closer to departing from the ranges of the past six weeks, or in a wider definition, the past six months. Read more...

GBP/USD rises above 1.3850 after disappointing US consumer confidence data

GBP/USD extends daily rebound during the American trading hours. Consumer confidence in US weakened significantly in August. US Dollar Index drops toward 92.50 after disappointing sentiment data. Following a consolidation phase around 1.3800 during the European trading hours on Friday, the GBP/USD pair gained traction and extended its daily rebound in the American session. As of writing, the pair was up 0.35% on the day at 1.3851. Read more...

GBP/USD Forecast: Holding by a thread, bearish

The GBP/USD pair consolidates at the lower end of its weekly range, trading around the 1.3800 level. Major pairs had been lifeless as volatility plummeted following the release of US July inflation, which spur some temporal and limited dollar’s weakness. However, the American currency has recovered most of the ground shed then and trades near weekly highs across the FX board. The pound is its weakest rival, while safe-haven JPY and Gold are the strongest. Read more...

Author

FXStreet Team

FXStreet