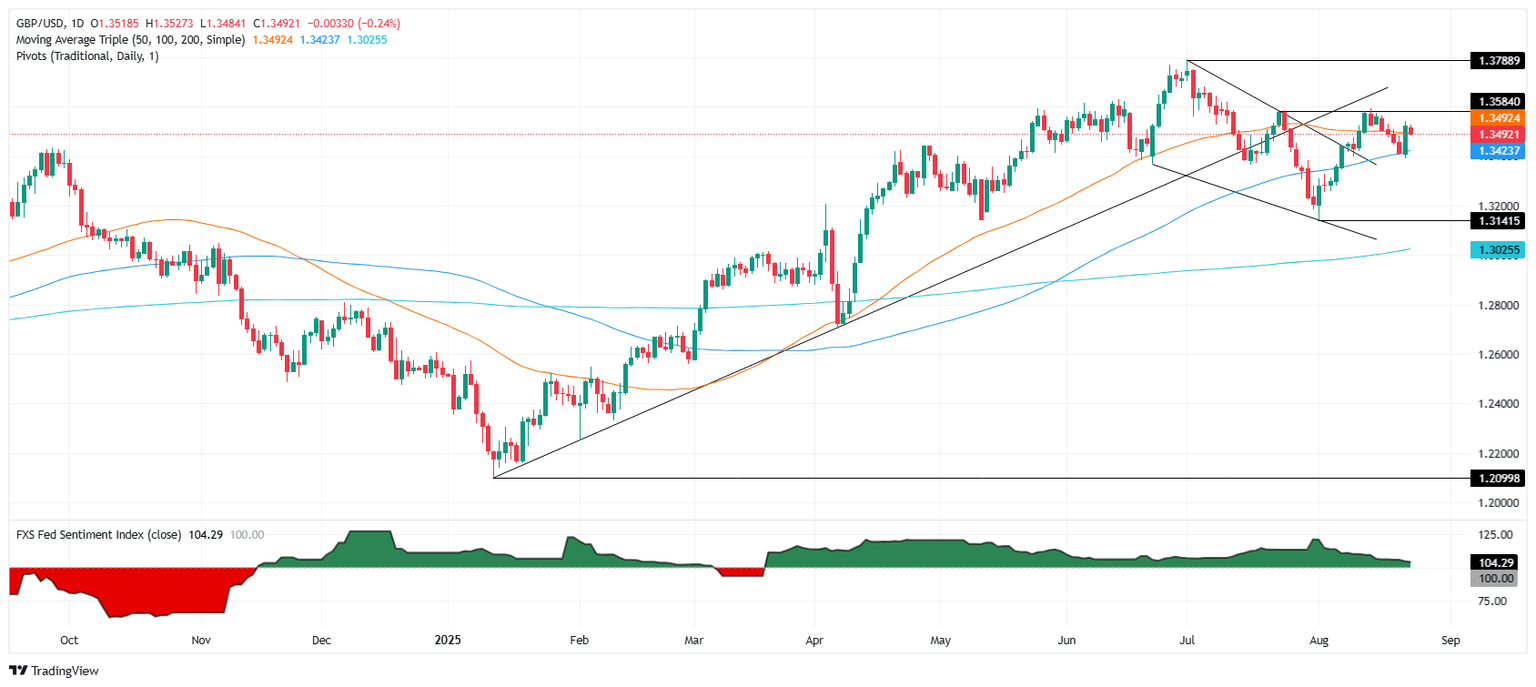

Pound Sterling Price News and Forecast: GBP/USD steady near 1.35 as Powell hints at Fed cut

GBP/USD steady near 1.35 as Powell hints at Fed cut

GBP/USD consolidates during the North American session on Monday after last Friday’s dovish tilt by the Federal Reserve Chair Jerome Powell, who said that risks to the labor markets are rising, an indication that monetary policy is cooling the jobs market. At the time of writing, the pair trades at 1.3499, down 0.15%. Read More...

Pound Sterling corrects against USD, outlook remains firm on Powell's dovish remarks

The Pound Sterling (GBP) corrects to near 1.3480 against the US Dollar (USD) from its Friday's high of 1.3544 during the European trading session on Monday. The GBP/USD pair gained sharply on Friday as comments from Federal Reserve (Fed) Chair Jerome Powell, in his speech at the Jackson Hole Symposium on Friday, signaled that he has turned dovish on the interest rate outlook. Read More...

GBP/USD attracts some sellers below 1.3500 on renewed US Dollar demand

The GBP/USD pair faces some selling pressure around 1.3495 during the Asian session on Monday. The major pair edges lower amid the renewed US Dollar (USD) demand. However, dovish remarks from the Federal Reserve (Fed) Chair Jerome Powell might cap the GBP/USD’s downside. Later on Monday, the US New Home Sales and Chicago Fed National Activity Index data will be published. Read More...

Author

FXStreet Team

FXStreet