GBP/USD steady near 1.35 as Powell hints at Fed cut

- GBP/USD consolidates as Powell highlights labor market risks, reinforcing September Fed rate cut speculation.

- Market pricing shows 93% probability of a September cut, according to Prime Market Terminal’s Fed tracker tool.

- UK inflation focus ahead with BRC Shop Price Index, while weak US housing adds to growth concerns.

GBP/USD consolidates during the North American session on Monday after last Friday’s dovish tilt by the Federal Reserve Chair Jerome Powell, who said that risks to the labor markets are rising, an indication that monetary policy is cooling the jobs market. At the time of writing, the pair trades at 1.3499, down 0.15%.

Muted trading on UK holiday; dovish Fed tilt and Bailey’s warnings keep focus on growth and inflation

Price action remained muted due to the United Kingdom (UK) summer bank holiday. Despite this, Bank of England (BoE) Governor Andrew Bailey said that the economy faces an “acute challenge” due to the economy's weakness and a reduced labor force participation.

Earlier on Friday, the Fed Chair Jerome Powell flirted with a September interest rate cut as he said “downside risks to the labor market are rising” and that “the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” Additionally, he said that tariffs could create a “one-time” effect on inflation and could dissipate, warranting a less restrictive policy. Nonetheless, Powell said that risks of inflation are tilted to the upside and risks of employment to the downside.

After his speech, market participants had begun to price in an interest rate cut in September, with odds standing at 93% as of writing, as revealed by Prime Market Terminal interest rate probability tool.

On the data front, US New Home Sales fell 0.6% in July from 0.656 million to 0.652 million. Across the pond, the BRC Shop Price Index for August will be revealed on August 26, which will be crucial to dictate inflation’s direction.

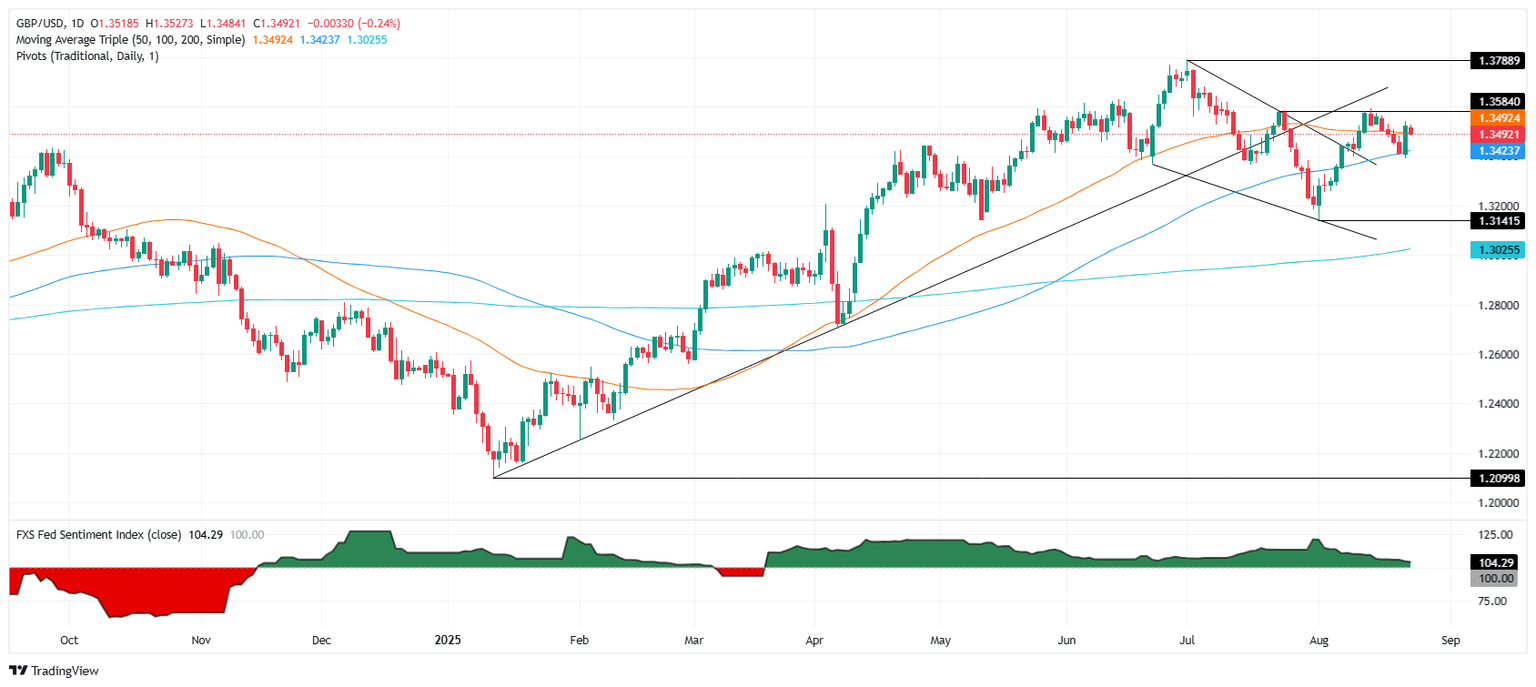

GBP/USD Price Forecast: Technical outlook

GBP/USD paused its rally, following Powell’s dovish lean, but remains hovering around .3500. On the upside, if the pair climbs above last Friday’s high of 1.3544, expect a test of 1.3550 and 1.3600. On the other hand, a drop below the 50-day SMA of 1.3489 paves the way for a pullback to 1.3450 before the uptrend resumes.

Pound Sterling Price This Month

The table below shows the percentage change of British Pound (GBP) against listed major currencies this month. British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -2.16% | -2.13% | -2.05% | -0.12% | -1.02% | 0.61% | -1.09% | |

| EUR | 2.16% | 0.14% | 0.16% | 2.16% | 1.31% | 2.69% | 1.16% | |

| GBP | 2.13% | -0.14% | 0.00% | 2.02% | 1.17% | 2.76% | 1.03% | |

| JPY | 2.05% | -0.16% | 0.00% | 1.97% | 1.06% | 2.60% | 0.98% | |

| CAD | 0.12% | -2.16% | -2.02% | -1.97% | -0.92% | 0.73% | -0.96% | |

| AUD | 1.02% | -1.31% | -1.17% | -1.06% | 0.92% | 1.57% | -0.01% | |

| NZD | -0.61% | -2.69% | -2.76% | -2.60% | -0.73% | -1.57% | -1.58% | |

| CHF | 1.09% | -1.16% | -1.03% | -0.98% | 0.96% | 0.01% | 1.58% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.