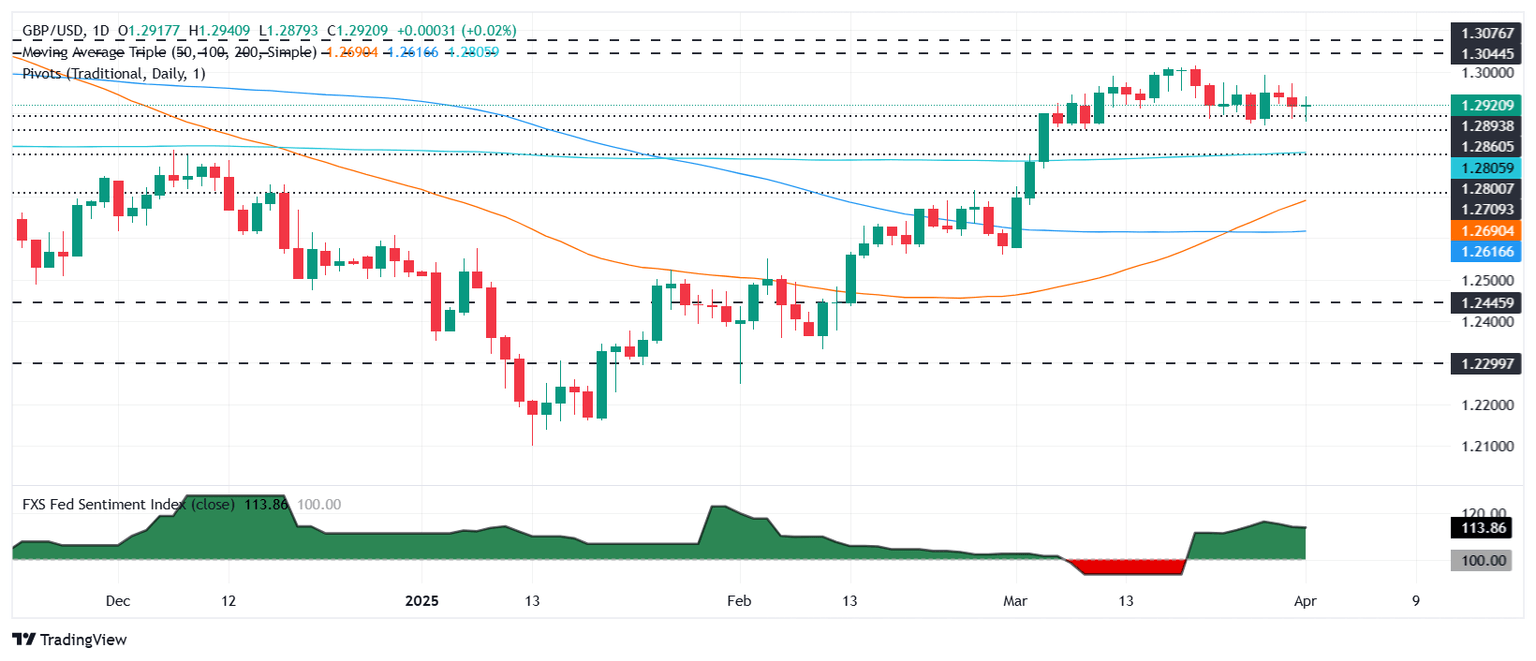

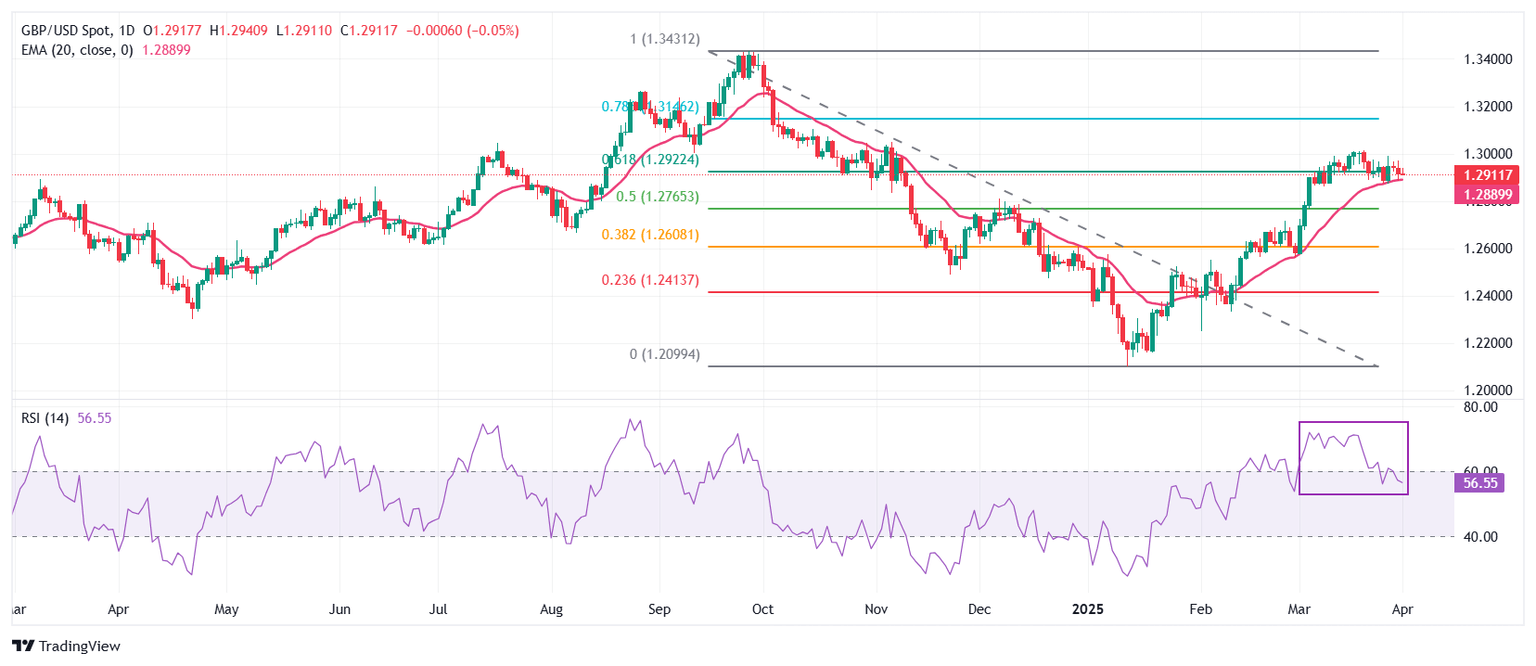

Pound Sterling Price News and Forecast: GBP/USD steady near 1.2920

GBP/USD steady near 1.2920 as weak ISM and tariff fears pressures US Dollar

The Pound Sterling trades with minuscule losses against the US Dollar following the release of the latest Manufacturing PMI from the Institute for Supply Management (ISM), suggesting that business conditions are deteriorating, with companies feeling the impact of tariffs. At the time of writing, the GBP/USD trades at 1.2920, virtually unchanged. Read More...

Pound Sterling underperforms as Trump’s reciprocal tariffs loom large

The Pound Sterling (GBP) weakens against its major peers on Tuesday, with United Kingdom (UK) officials assessing potential economic risks from reciprocal tariffs to be unveiled by United States President Donald Trump on Wednesday. Read More...

GBP/USD treads water as markets await tariff blowback

GBP/USD churned chart paper in familiar territory on Monday, grinding out a familiar congestion zone as investors brace for the latest iteration of US President Donald Trump’s tariff threats. The Trump administration is set to enact a wide catalogue of tariffs on functionally all of the US’s trading partners beginning on April 2. Read More...

Author

FXStreet Team

FXStreet