Pound Sterling underperforms as Trump’s reciprocal tariffs loom large

- The Pound Sterling slumps against the US Dollar to near 1.2890 as investors await the release of US President Trump’s reciprocal tariffs.

- Retaliatory tariffs from US trading allies could result in a global trade war.

- The UK fiscal watchdog projects a 1% cut in the size of the economy due to potential risks of Trump’s tariffs.

The Pound Sterling (GBP) weakens against its major peers on Tuesday, with United Kingdom (UK) officials assessing potential economic risks from reciprocal tariffs to be unveiled by United States President Donald Trump on Wednesday.

On Monday, UK Prime Minister Keir Starmer’s spokesman said that the administration has been actively preparing for all “eventualities” ahead of President Trump's announcement of “planned tariffs”, which are expected to impact the “UK alongside other countries”. Starmer added that negotiations between London and Washington on securing an economic deal that would have averted tariffs have been extended beyond Wednesday.

The UK Office for Business Responsibility (OBR) warns that Trump’s policies could wipe out the government fiscal buffer and cut the economy’s size by as much as 1%. Such a scenario could force the Bank of England (BoE) to adopt a swift monetary easing stance to stimulate economic growth. Currently, traders see the BoE reducing interest rates two times this year. The BoE has already cut interest rates once in 2025.

During European trading hours, BoE Monetary Policy Committee (MPC) member Megan Greene commented that wage growth is "still above their models" and rising inflation expectations are a "concern" for the central bank. Such a scenario points to the need to maintain a restrictive monetary policy stance.

On the economic front, revised S&P Global/CIPS Manufacturing PMI data for March comes in higher at 44.9 against the preliminary estimates of 44.6.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.00% | 0.12% | -0.61% | 0.04% | -0.16% | -0.12% | -0.28% | |

| EUR | -0.00% | 0.05% | -0.64% | -0.00% | -0.23% | -0.15% | -0.33% | |

| GBP | -0.12% | -0.05% | -0.71% | -0.07% | -0.29% | -0.23% | -0.39% | |

| JPY | 0.61% | 0.64% | 0.71% | 0.66% | 0.44% | 0.48% | 0.34% | |

| CAD | -0.04% | 0.00% | 0.07% | -0.66% | -0.21% | -0.16% | -0.32% | |

| AUD | 0.16% | 0.23% | 0.29% | -0.44% | 0.21% | 0.05% | -0.11% | |

| NZD | 0.12% | 0.15% | 0.23% | -0.48% | 0.16% | -0.05% | -0.16% | |

| CHF | 0.28% | 0.33% | 0.39% | -0.34% | 0.32% | 0.11% | 0.16% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily digest market movers: Pound Sterling declines against USD amid cautious market mood

- The Pound Sterling declines to near 1.2890 against the US Dollar (USD) in Tuesday’s North American session. The GBP/USD pair weakens as risk-sensitive assets underperform, with investors bracing for reciprocal tariffs from US President Donald Trump, which will be announced on the so-called “Liberation Day” on Wednesday.

- President Trump is expected to impose large tariffs on nations with significantly higher trade surpluses against the US, aiming to fix what he calls “trade imbalances”.

- On Monday, US Treasury Secretary Scott Bessent said in an interview with Fox News that people are going to see “fair trade” that will make the global trading system “fair for American workers” again, and that the US trading allies will have an opportunity to lower their “tariffs and non-tariff barriers”.

- During European trading hours, the Washington Post showed that White House aides have drafted a proposal to impose tariffs of around 20% on most imports to the US.

- Given that higher tariffs from Donald Trump are inevitable, investors will majorly focus on responses from US trading partners. Trump's tariffs are expected to majorly impact China, the Eurozone, Canada, Japan, and Mexico, and any retaliatory measures from them will lead to an all-over global trade war. Such a scenario will be unfavorable for global economic growth, including the US, as US importers will bear the impact of higher tariffs.

- This week, investors will also focus on a slew of US business and labor market data, which will influence market expectations for the Federal Reserve’s (Fed) monetary policy outlook. Meanwhile, Fed officials have been guiding that interest rates should remain in their current range of 4.25%-4.50% as Trump’s economic policies are expected to be inflationary for the economy.

- On the economic data front, weak US ISM Manufacturing Purchasing Managers Index (PMI) data for March, and soft JOLTS Job Openings data for February have exerted slight pressure on the US Dollar. The ISM Manufacturing PMI came in lower at 49.0 against estimates of 49.5 and February's reading of 50.3. A figure below 50.0 suggests that the manufacturing sector activity contracted. US employers posted 7.57 million jobs in February, slightly lower than the expectations of 7.63 million and the prior release of 7.76 million.

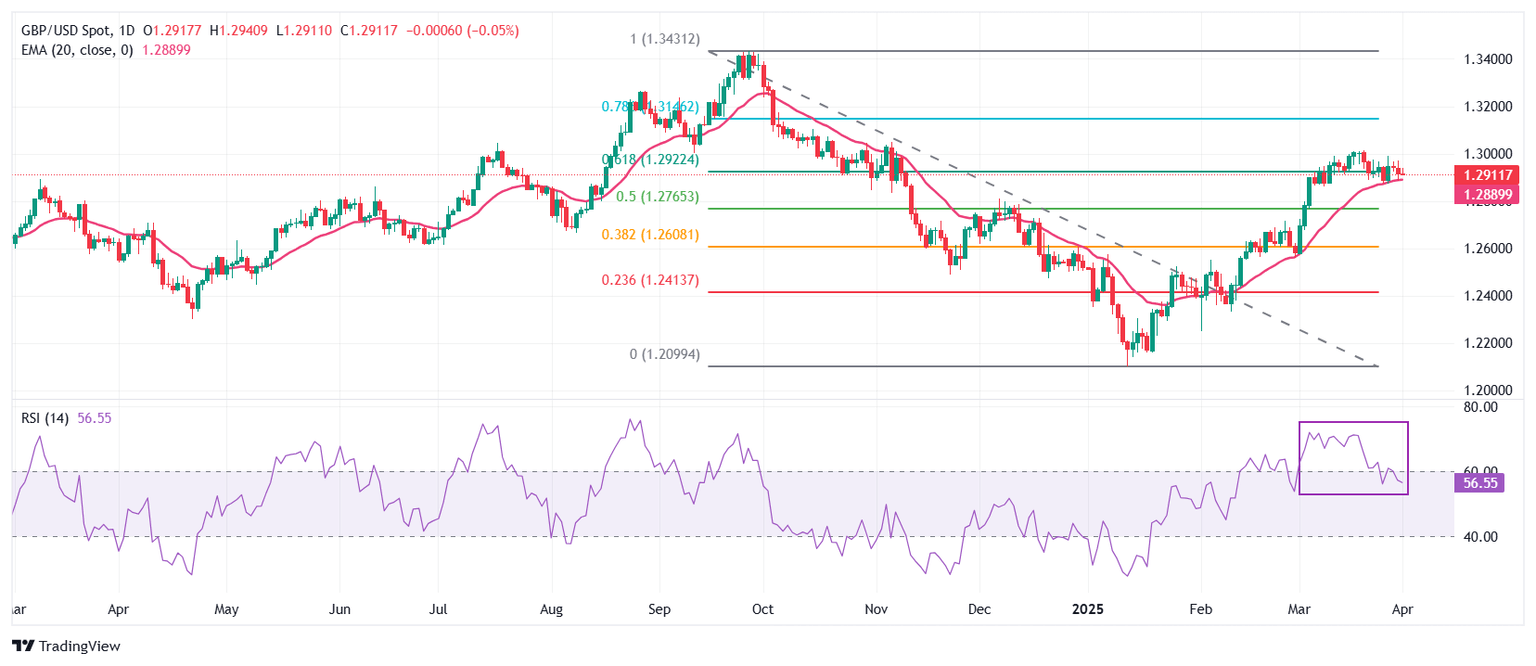

Technical Analysis: Pound Sterling stays around 20-day EMA

The Pound Sterling trades lower against the US Dollar on Tuesday. The GBP/USD pair continues to wobble around the 61.8% Fibonacci retracement, plotted from late-September high to mid-January low, near 1.2930. The 20-day Exponential Moving Average (EMA) provides support to the pair around 1.2890.

The 14-day Relative Strength Index (RSI) cools down to near 60.00 after turning overbought above 70.00. Should a fresh bullish momentum come into action if the RSI resumes the upside journey after holding above the 60.00 level

Looking down, the 50% Fibonacci retracement at 1.2770 and the 38.2% Fibonacci retracement at 1.2615 will act as key support zones for the pair. On the upside, the October 15 high of 1.3100 will act as a key resistance zone.

Economic Indicator

ISM Manufacturing PMI

The Institute for Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US manufacturing sector. The indicator is obtained from a survey of manufacturing supply executives based on information they have collected within their respective organizations. Survey responses reflect the change, if any, in the current month compared to the previous month. A reading above 50 indicates that the manufacturing economy is generally expanding, a bullish sign for the US Dollar (USD). A reading below 50 signals that factory activity is generally declining, which is seen as bearish for USD.

Read more.Last release: Tue Apr 01, 2025 14:00

Frequency: Monthly

Actual: 49

Consensus: 49.5

Previous: 50.3

Source: Institute for Supply Management

The Institute for Supply Management’s (ISM) Manufacturing Purchasing Managers Index (PMI) provides a reliable outlook on the state of the US manufacturing sector. A reading above 50 suggests that the business activity expanded during the survey period and vice versa. PMIs are considered to be leading indicators and could signal a shift in the economic cycle. Stronger-than-expected prints usually have a positive impact on the USD. In addition to the headline PMI, the Employment Index and the Prices Paid Index numbers are watched closely as they shine a light on the labour market and inflation.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.