GBP/USD steady near 1.2920 as weak ISM data and tariff fears pressure US Dollar

- GBP/USD holds firm as ISM Manufacturing PMI drops to 49, fueling recession fears, spurred by rising tariffs.

- UK Manufacturing sinks to 17-month low, but GBP remains resilient amid broad Greenback weakness.

- Starmer eyes US-UK trade deal to avoid tariffs; traders now await ISM Services, NFP and Powell’s speech.

The Pound Sterling (GBP) trades with minuscule losses against the US Dollar (USD) following the release of the latest Manufacturing PMI from the Institute for Supply Management (ISM), suggesting that business conditions are deteriorating, with companies feeling the impact of tariffs. At the time of writing, GBP/USD trades at 1.2920, virtually unchanged.

Sterling holds ground despite soft UK PMI as US factory activity slumps and Fed’s Barkin warns of tariff risks

March’s ISM Manufacturing PMI painted a gloomy economic outlook after plunging to 49 from February’s 50.3, below forecasts of 49.5. The index contracted after two straight months of expansion, preceded by 26 consecutive months of contraction. At the same time, JOLTS data reported by the US Department of Labor depicted that vacancies in February decreased but remained at the same level, according to the release. The figures came at 7.568 million, down from 7.762 million and missing estimates of 7.63 million.

Earlier, S&P Global revealed that manufacturing activity expanded, with the PMI rising from 49.8 to 50.2.

Across the pond, manufacturing activity continued its downward trajectory with the S&P Global falling to a 17-month low of 44.9, and still, the GBP/USD pair was unfazed as the Greenback got battered across the board.

In the meantime, United Kingdom (UK) Prime Minister Keir Starmer announced that talks with the US on a trade agreement could help Britain avoid the tariffs imposed by Trump.

The US Dollar Index (DXY), which tracks the performance of the Greenback against a basket of six peers, drops 0.08% to 104.10.

Meanwhile, Richmond Fed President Thomas Barkin stated that the bond market is pricing in more recession risk, noting that he sees challenges to inflation and employment arising from tariffs.

Ahead this week, the US economic docket will feature the ISM Services PMI, Nonfarm Payrolls for March and Fed Chair Jerome Powell's speech on Friday. In the UK, the docket is scarce with traders awaiting the Construction PMI.

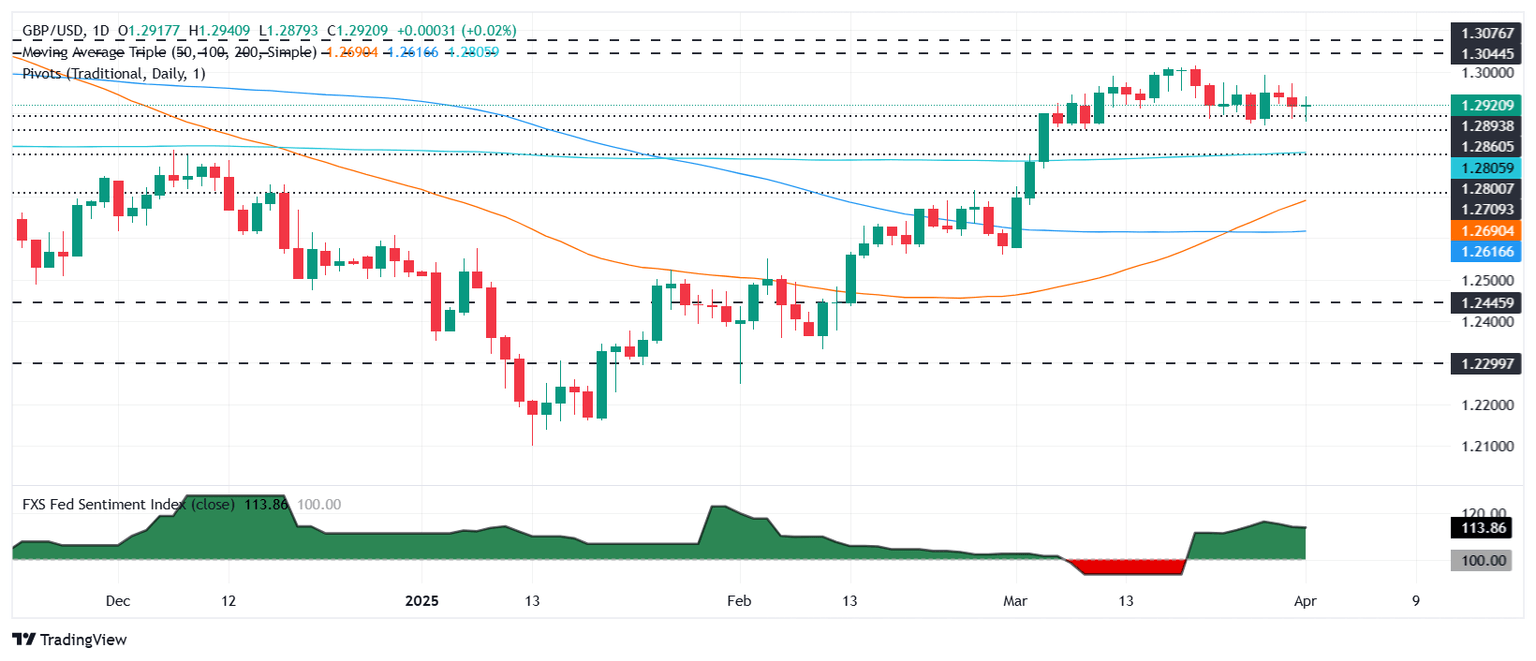

GBP/USD Price Forecast: Technical outlook

GBP/USD uptrend remains in place, though in the short-term the major will consolidate. Buyers need to surpass the March 31 peak of 1.2972 if they want to test their chances to claim 1.30. If cleared, the next stop would be the November 7 high of 1.3047. On the other hand, if sellers push the exchange rate below 1.2900, the next support would be the March 27 low of 1.2865, followed by the 200-day Simple Moving Average (SMA) at 1.2805.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.22% | 0.10% | -0.30% | 0.01% | 0.09% | 0.26% | 0.32% | |

| EUR | -0.22% | -0.02% | -0.45% | -0.17% | -0.04% | 0.08% | 0.15% | |

| GBP | -0.10% | 0.02% | -0.50% | -0.10% | -0.02% | 0.13% | 0.22% | |

| JPY | 0.30% | 0.45% | 0.50% | 0.30% | 0.43% | 0.59% | 0.53% | |

| CAD | -0.01% | 0.17% | 0.10% | -0.30% | 0.11% | 0.25% | 0.32% | |

| AUD | -0.09% | 0.04% | 0.02% | -0.43% | -0.11% | 0.14% | 0.20% | |

| NZD | -0.26% | -0.08% | -0.13% | -0.59% | -0.25% | -0.14% | 0.06% | |

| CHF | -0.32% | -0.15% | -0.22% | -0.53% | -0.32% | -0.20% | -0.06% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.