Pound Sterling Price News and Forecast: GBP/USD steadies as US Dollar weakens

GBP/USD steadies as US Dollar weakens

The British Pound (GBP) is staging a modest rebound against the US Dollar (USD) on Monday, with GBP/USD trading around the 1.3480 mark during the American trading session. The upside in Sterling comes as the Greenback weakens broadly, weighed down by softening US Treasury yields and lingering uncertainty surrounding upcoming trade negotiations and the Federal Reserve’s (Fed) policy path. Read More...

Pound Sterling gains as market experts reassess BoE rate cut projections

The Pound Sterling (GBP) starts the week on a slightly positive note. The British currency ticks up against its major peers, except the Japanese Yen (JPY), as market experts have pared bets supporting a higher number of interest rate cuts by the Bank of England (BoE) for the remainder of the year. Read More...

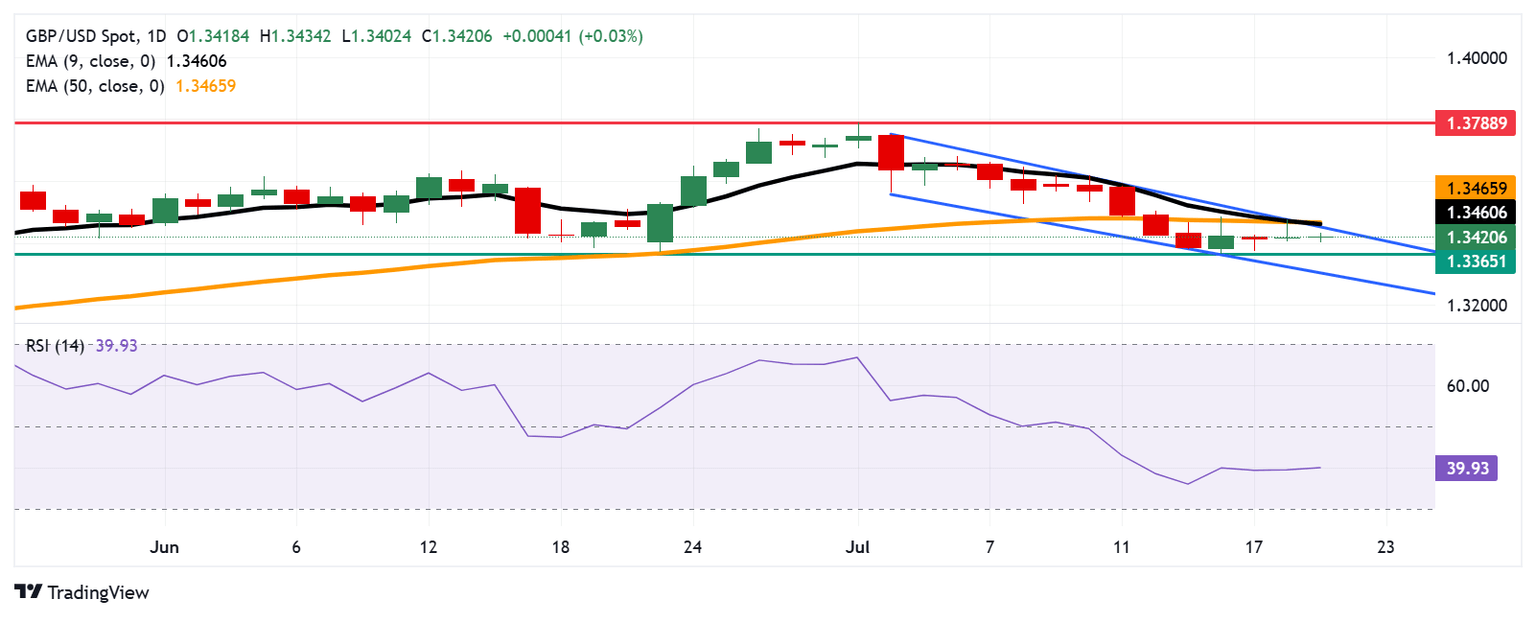

GBP/USD Price Forecast: Hovers above 1.3400 despite a persistent bearish bias

The GBP/USD pair edges higher for the second successive day, trading around 1.3420 during the Asian hours on Monday. However, the bearish bias persists as the daily chart’s technical analysis indicates that the pair remains within the descending channel pattern. Read More...

Author

FXStreet Team

FXStreet