Pound Sterling Price News and Forecast: GBP/USD start the new week on a positive note amid fresh USD selling

GBP/USD Weekly Outlook: Pound Sterling’s upside bias persists as traders brace for US NFP week

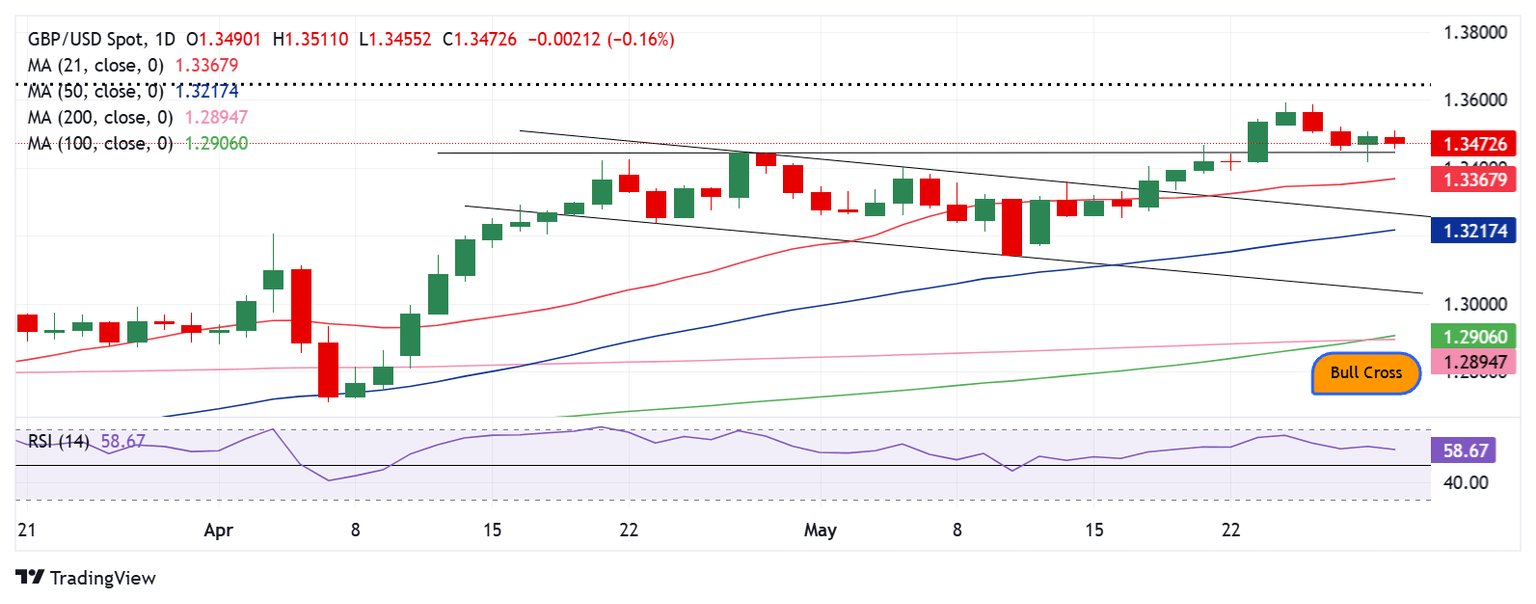

The Pound Sterling (GBP) set out on a corrective downside against the US Dollar (USD) after the GBP/USD pair hit the highest level since February 2022, just shy of the 1.3600 mark. It was all about the US tariff headlines and the resultant USD price action that emerged as underlying factors behind the GBP/USD performance in the past week.

The Greenback kicked off a solid recovery and maintained it almost throughout the week, barring a brief pullback on Thursday. Optimism on the trade front and hawkish US Federal Reserve’s (Fed) policy stance powered the USD turnaround. It started with a positive shift in risk sentiment after US President Donald Trump’s backpedalled on 50% tariffs announced last Friday on European Union (EU) imports from June 1, extending the deadline to July 9. Read more...

GBP/USD moves back closer to 1.3500 mark amid broadly weaker USD

The GBP/USD pair regains positive traction at the start of a new week amid renewed US Dollar (USD) selling though it remains below the 1.3500 psychological mark during the Asian session. The Personal Consumption Expenditures (PCE) Price Index released on Friday pointed to further easing inflationary pressures in the US and bolstered the case for more policy easing by the Federal Reserve (Fed). Adding to this, concerns about the worsening US fiscal condition, fueled by the passage of US President Donald Trump’s “Big Beautiful Bill,” exert fresh downward pressure on the USD.

The British Pound (GBP), on the other hand, continues with its relative outperformance on the back of expectations that the Bank of England (BoE) would pause at its next meeting on June 18 and take its time before lowering borrowing costs further. This, in turn, is seen as another factor lending support to the GBP/USD pair. However, a weaker risk tone limits USD losses and might cap the pair. Read more...

Author

FXStreet Team

FXStreet