Pound Sterling Price News and Forecast: GBP/USD softens to near 1.3430 during Thursday’s session

GBP/USD weakens below 1.3450, US ISM Services PMI data looms

The GBP/USD pair declines to around 1.3430 during the Asian trading hours on Thursday. The Pound Sterling (GBP) weakens against the US Dollar (USD) amid UK fiscal worries. The US weekly Initial Jobless Claims, the ADP Employment Change and the ISM Services Purchasing Managers Index (PMI) are the highlights later on Thursday.

UK Finance Minister Rachel Reeves said on Wednesday that she would deliver her annual budget on November 26, insisting the economy was not "broken" and that she would keep a grip on spending to help lower inflation and borrowing costs, per Reuters. However, concerns about the UK's ability to keep its finances under control weigh on the sentiment and drag the Cable lower against the USD. Read more...

GBP/USD rebounds ahead of key labor data, but still remains on the low side

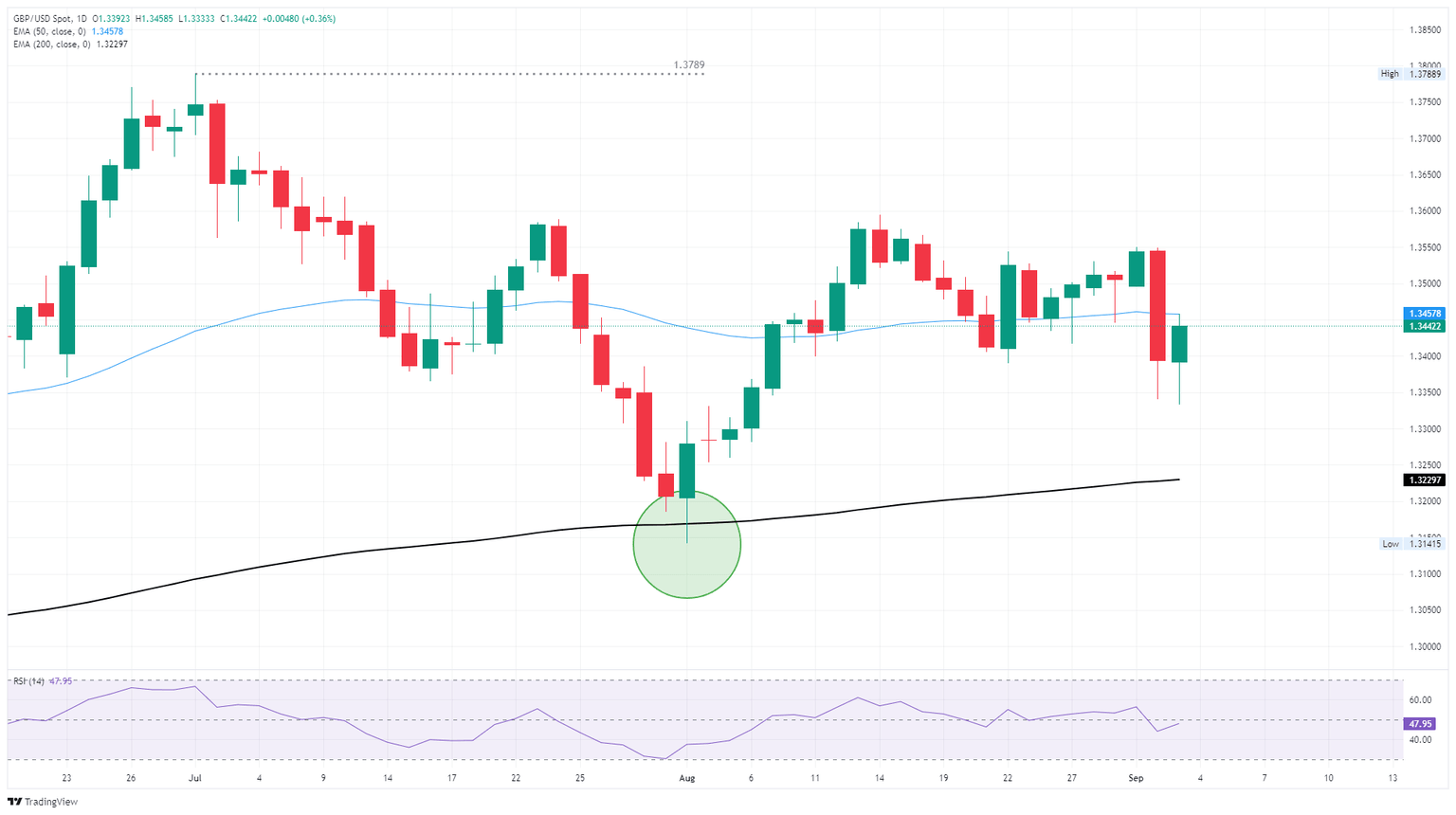

GBP/USD rose off the mats on Wednesday, clawing its way back above the 1.3400 handle after general market sentiment recovered just enough footing to buoy Cable off of four-week lows below 1.3350. Although broad-market investor sentiment is leaning into the risk-on side as traders clamor for an interest rate cut from the Federal Reserve (Fed), a dovish outing from Bank of England (BoE) Governor Andrew Bailey crimped GBP gains.

GBP/USD continues to weave its way around the 50-day Exponential Moving Average (EMA) near 1.3460, though recent price action has exposed potential short pressures cooking behind the pair. Fresh tests below the 1.3400 handle could send the pair heading into a fresh downtrend, while a market-wide resurgence in US Dollar selling could send the pair back into multi-year highs above 1.3600. Read more...

GBP/USD rises to 1.3440 as strong UK data offsets US weakness

The GBP/USD pair advances on Wednesday during the North American session by 0.39% following the release of economic data from the United States (US). Also, fears of the United Kingdom's (UK) government being unable to meet its fiscal requirements eased on signs that the economy continued to fare well. The pair trades at 1.3442 after bouncing off daily lows of 1.3332.

The Greenback is weakening on Wednesday following Tuesday’s rally, which sent the US Dollar higher, past the 98.50 figure during the session, according to the US Dollar Index (DXY). US data revealed that job openings in July fell to 7.181 million, down from 7.357 million (revised from 7.437 million) in June, revealed the Bureau of Labor Statistics (BLS). Read more...

Author

FXStreet Team

FXStreet