GBP/USD rebounds ahead of key labor data, but still remains on the low side

- GBP/USD rebounded back above 1.3400 on Wednesday after testing below 1.3350.

- Cable markets are geared for dueling central bank outings from both the Fed and BoE this month.

- US ADP jobs preview in the barrel for Thursday as market sentiment remains tied closely to Fed rate cut hopes.

GBP/USD rose off the mats on Wednesday, clawing its way back above the 1.3400 handle after general market sentiment recovered just enough footing to buoy Cable off of four-week lows below 1.3350. Although broad-market investor sentiment is leaning into the risk-on side as traders clamor for an interest rate cut from the Federal Reserve (Fed), a dovish outing from Bank of England (BoE) Governor Andrew Bailey crimped GBP gains.

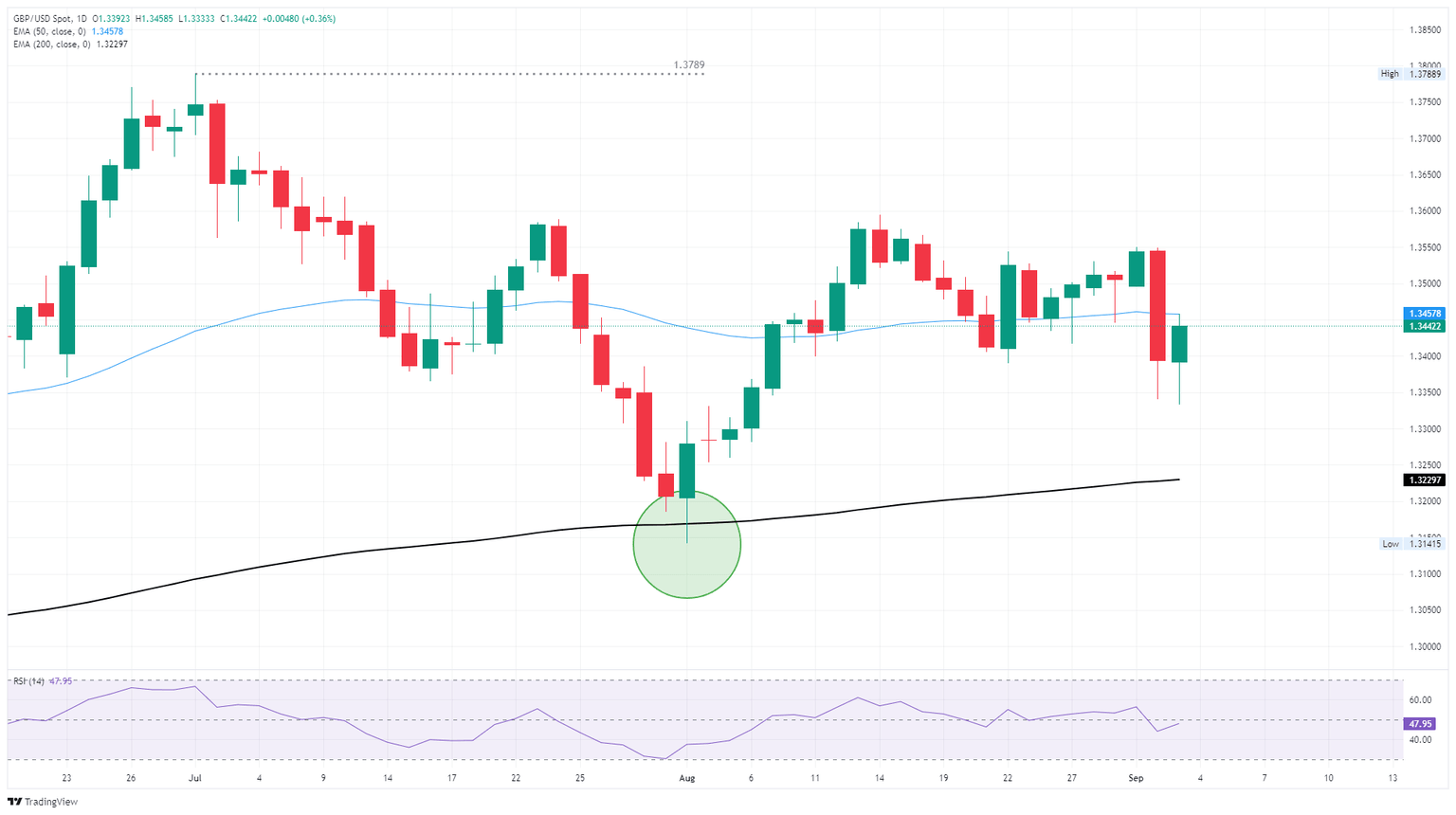

GBP/USD continues to weave its way around the 50-day Exponential Moving Average (EMA) near 1.3460, though recent price action has exposed potential short pressures cooking behind the pair. Fresh tests below the 1.3400 handle could send the pair heading into a fresh downtrend, while a market-wide resurgence in US Dollar selling could send the pair back into multi-year highs above 1.3600.

Dovish Bailey soothes QE tightening expectations

BoE Governor Bailey cautioned that the BoE is still very much in the “discussion” phase of making changes to its Quantitative Easing (QE) programs. The BoE makes one adjustment to its QE spending habits every year, at its September interest rate call meeting. UK lawmakers have been clamoring for the BoE to tamp down on its purchases of government debt instruments in an effort to appear less spendthrift than government ledgers have been recently. However, that may not be as convenient a decision as perceptions allow: BoE face value losses on UK debt are already estimated to be in the ballpark of £100B, and the UK’s economy may not be strong enough to withstand more than a slight adjustment to the BoE’s bond buying plans.

US ADP Employment Change figures from August and the latest ISM Purchasing Managers Index (PMI) are in focus. ADP Employment Change data will be released to markets on Thursday. While ADP data has a weak connection to Friday’s upcoming official NFP jobs report and often performs poorly as a predictor, investors still watch ADP's initial numbers for any major developments. The ISM Services PMI is expected to show signs of improvement in business outlooks as firms head into the fourth quarter.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.